5 Useless Things to Do in a Market Correction

06 March 2020

“Risk is what’s left when you think you’ve thought of everything.”

— Carl Richards

February markets ended with a clunk – like the sound your car makes when you hit the curb. In its wake, strategists, economists and journalists have been scrambling to blame “the fastest market sell-off” in stock market history on the coronavirus and Bernie Sanders’ rise in the US Democratic primaries.

You shouldn’t worry about the reason for the sell-off. The only thing you should worry about is your reaction to the news.

Here are some other things that you should NOT do at all:

#1. Don’t look back in regret

Warren Buffet was famously quoted saying, “In the business world, the rear-view mirror is always clearer than the windshield.”

This also applies to markets. It is not helpful to beat yourself up, lamenting that you should have sold earlier / seen it coming / taken less risk. These thoughts are useless. It’s over, and there is nothing you can do about it. What’s more important is making sure your investment plan and objectives are still sound.

#2. Don’t listen to what some billionaire or hedge fund manager is doing

Rich and famous investors have many thoughts on the market that the financial media is eager to draw out and broadcast. However, unless you are a billionaire or hedge fund manager yourself, you have nothing in common with them.

Unlike them, you probably won’t be able to lose millions of dollars on a whim after a risky bet or out of simple pride. This important fact makes following their advice deeply dangerous. Their investment objectives and risk profiles are wildly different from yours. Ignore what they say or do, and what they are investing in. Focus instead on your own needs and personal financial circumstances.

#3. Don’t react to the headlines

When something is reported in the news, it is already old news, and you can be sure it has already been priced into the market.

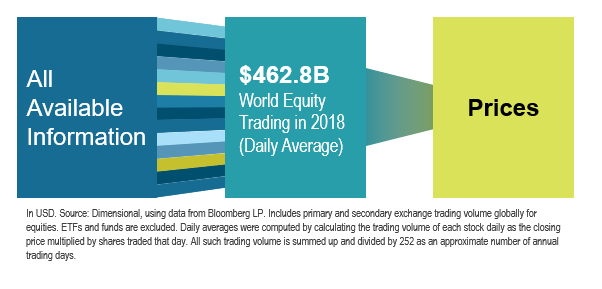

Every day, over $400 billion in trades are executed in the market. If there’s the slightest hint of a groundbreaking development, some computer trading algorithm out there will have already bought or sold in response to it. Professional investors will have assimilated the data and acted upon it long before a reporter first pitched the news. Then take into account the time needed for additional drafts, revisions and editing before the final report is published or broadcast into the public space.

All this means that financial headlines are outdated by the time they hit the press. No matter how fast you are, you will therefore be doing yourself a huge disservice if you did something to your portfolio just because of some news you had just read.

And always watch out for fake news circulating online, such as those touting some new secret development that few people know about.

#4. Don’t listen to advice from anyone other than your fiduciary adviser

Your financial adviser is the person who knows your finances best, and thus the only one with the ability to provide proper advice that’s actually relevant to your individual situation.

Working with a fiduciary ensures that your financial foundation is rock solid. Your adviser should have gone through a proper discovery meeting with you and developed a comprehensive investment plan that captures all your needs, wants and objectives. Your adviser would then have had solutions customised specifically to meeting those objectives while taking into account all the unique factors in your life.

The worst thing you could do to yourself now would be to chuck all that away by listening to the advice from friends or relatives. Their personalities, financial circumstances and goals are different from yours. Don’t mix up your risk tolerance and time horizon with someone else’s.

#5. Don’t sell

One of the worst things to do would be to succumb to fear and sell, afraid that there are more losses on the horizon. Another portfolio-destroying action would be to reduce your risk within your portfolio – for that would mean reducing equities just as the prices of stocks are declining.

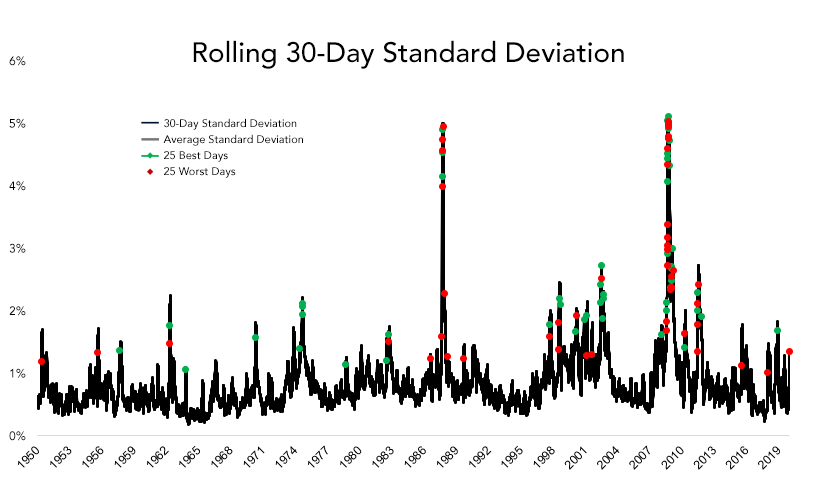

Instead, take heart in knowing that when market volatility is high, the best days of the market tend to arrive together with the worst ones. (See diagram below.)

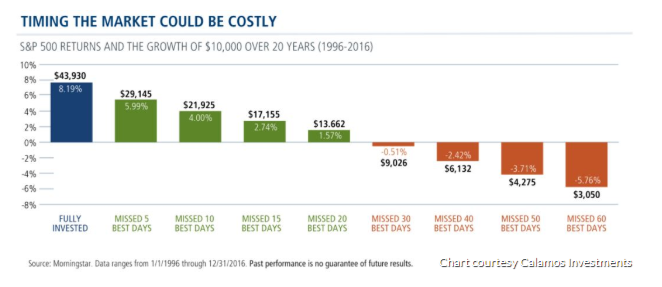

Selling or reducing your equity allocation after a few bad days would thus only ensure that you miss out on the best days of the market.

You may not think it is much, but missing just a few good days of returns will permanently harm the ability of your investments to generate long-term returns. See the charts below for both SGD and USD representations.

So, with these 5 points in mind, it’s time to turn off your financial news alerts and notifications. Take a deep breath. Head to the pub for a drink, or schedule a nice relaxing massage, and let us worry about the markets for you. There’s no need to make your life more stressful than it is!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.