Can COVID-19 cause the markets to catch the flu?

31 January 2020

“The four most dangerous words in investing are: ‘this time it’s different.” – Sir John Templeton

Investors and markets have been on edge following reports of thousands of cases of a new SARS-like coronavirus (2019-nCoV) originating in Wuhan, China. As of this week, over seven thousand people worldwide have been confirmed with the illness, with over 100 dead.

This has brought back scary memories of SARS – another acute respiratory illness from China that infected over 8,000 and killed almost 800 people in 2002-2003 (mostly in China and Hong Kong).

The financial media has been speculating about the effects of the virus on markets, with headlines reporting the rise in safe haven assets. While some postulation on the impact on tourism and travel-related sectors may sound logical, do such health emergencies really affect markets? Let’s look at the evidence.

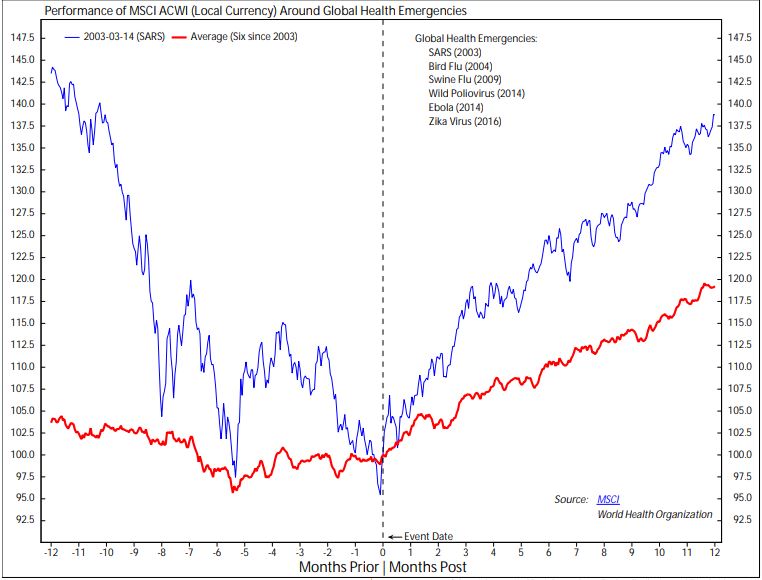

Over the past two decades (20 years), we have experienced a total of 6 other global health emergencies. The chart below shows how the markets reacted (red line) before and after the crisis was announced by the World Health Organization (WHO). The blue line represents the most recent SARS epidemic.

As we can see, the announcements are usually a lagging indicator. On average, the bad news had already been priced into the market months before the WHO announcement was actually made. However, instead of falling further, markets actually rose over the following year.

Notably, that rise happened despite detrimental market events coinciding with those health emergencies. For example, the overall average was brought down by the instance of swine flu in 2009, which coincided with the Great Financial Crisis. Likewise, the SARS outbreak overlapped with the bursting of the dot-com bubble, which exaggerated the overall decline in equities.

This diagram below charts the SARS period from end-2002 till end-2003. You’ll find that global stocks actually rose 30% during this time!

Asian markets took slightly longer to rally after the dot-com bust, but also experienced a gain of 40% during the SARS period.

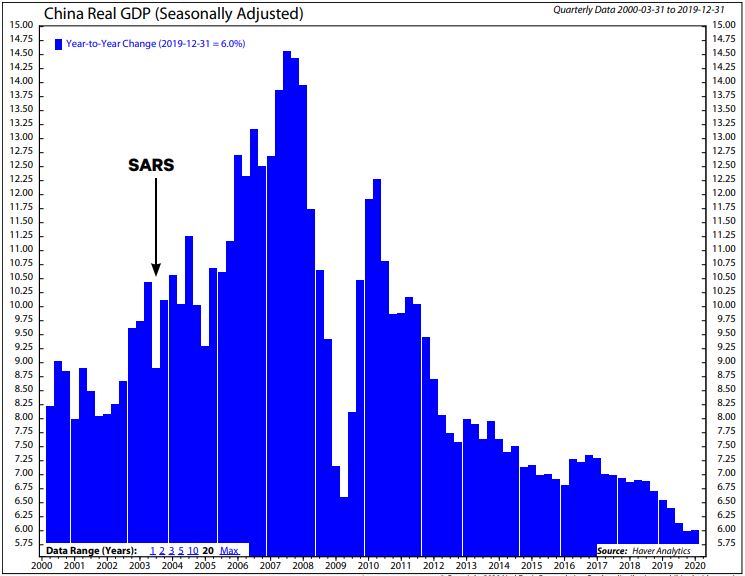

SARS did cause the Chinese GDP to drop slightly, as seen in the chart below. However, that drop was not significant, nor does it look out of place compared to preceding or following years. The more severe impact was the 2008 Global Financial Crisis and its accompanying recession.

One concern today is that China’s economy is now so much bigger. As such, a potential slowdown in its growth could have broad implications for the global economy (which has been showing green shoots). During the SARS period, China’s economy encompassed just 4.4% of global GDP. As of 2018, that share has soared to 17.2%, making it the world’s second largest after the United States.

However, China’s response to health crises has also improved. Chinese officials have been swift to respond to the illness in hopes of preventing a larger epidemic. While China kept SARS a secret for several months, officials were quick to announce the existence of the new coronavirus. Genomic data has come a long way in the 17 years since 2003 and allowed scientists to rapidly sequence the viral sample and start work on a vaccine.

In the meantime, China put a lockdown on the most affected cities – constituting about 40 million people – to help contain the illness. The Chinese government seems ready to add more major cities to the lockdown should the situation worsen. Many Asian countries that were impacted by SARS are likewise much better prepared this time.

All this means that China’s larger economy alone will not necessarily make this worse on markets compared to SARS.

The evidence shows that markets only take longer to recover in a financial crisis or economic recession. Even then, they still do recover, and go on to make new highs. Other events such as wars, political turbulence, scandals, health epidemics and terrorism cause only minor bumps in the market.

If your portfolio is properly diversified with thousands of securities and is not overly concentrated in one sector (such as technology or FAANG only) or region (such as Asian or Emerging markets only), you should not be overly worried about the impact on your investments.

Going by what history has shown of past health crises, the latest virus is unlikely to make the market catch a cold, and any short-term volatility presents an excellent buying opportunity for long-term investors.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.