Waiting With Cash is Not an Investment Strategy

14 October 2020

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

— Peter Lynch

Coronavirus resurgence in many countries around the world. Vaccine trials delayed. Resumption of US-China tensions. Rise in jobless numbers. US presidential elections. Collapse of the oil and gas sector. There is no shortage of reasons for why you should hold off putting your money into the market. 2020 was a year of many firsts, but every other year has had its fair share of problems.

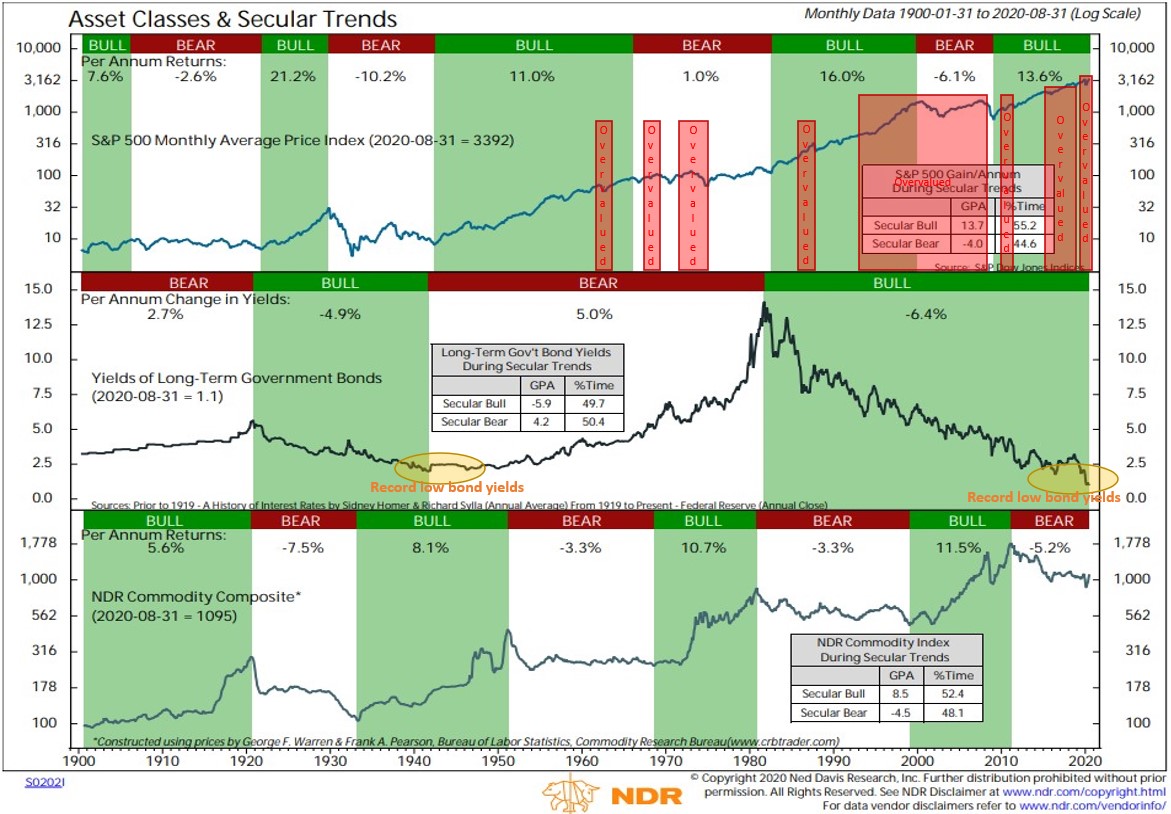

You could lament that it is very difficult to get a return these days. After all, we are living in a world of low bond yields and high equity valuations. However, investors may have forgotten that we have experienced extremely low bond yields in the past – the prior bond market peak was in the 1940s, which led to a 30 year bond bear market. We have also experienced long periods of high equity valuations in the past, so nothing is new. (see chart below).

The world has gone through many variations of the same theme before. However, choosing to bury your cash (or gold) in the ground whilst waiting for the uncertainty to pass is not a viable investment strategy. Neither is complaining about the lack of further help from the government or wishing you had put in money when markets had started to collapse in March. You need a actionable investment plan with clear goals.

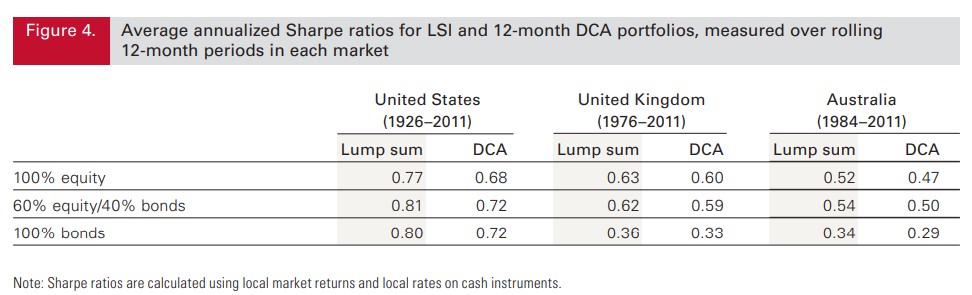

In Vanguard’s study comparing investing immediately versus phasing it in over a period of time (in essence holding on to cash longer) showed that returns are almost always higher in the long-term, independent of whether an investor was risk-loving or risk-averse. The comparison of Sharpe ratios – which are returns adjusted for risk – also shows that immediate investing is the better solution.

In the latest edition of Burton Malkiel’s famous book, “A Random Walk Down Wall Street“, the author has updated figures on what an investor would have reaped if he or she had started investing in 1969 and held till 2018.

He wrote, “An investor with $10,000 at the start of 1969 who invested in a Standard & Poor’s 500-Stock Index Fund would have had a portfolio worth $1,092,489 by April 2018, assuming that all dividends were reinvested. A second investor who instead purchased shares in the average actively managed fund would have seen his investment grow to $817,741.”

Whilst he was trying to make a point that index investing would have beaten an active fund manager substantially over the long run, the other important point to note is that putting your money to work in the market – active or otherwise – would have provided a return of over 9% p.a. Now, compare this to sitting in cash, perhaps reaping the returns of a bank deposit rate of 2%. You would have made 30x less!

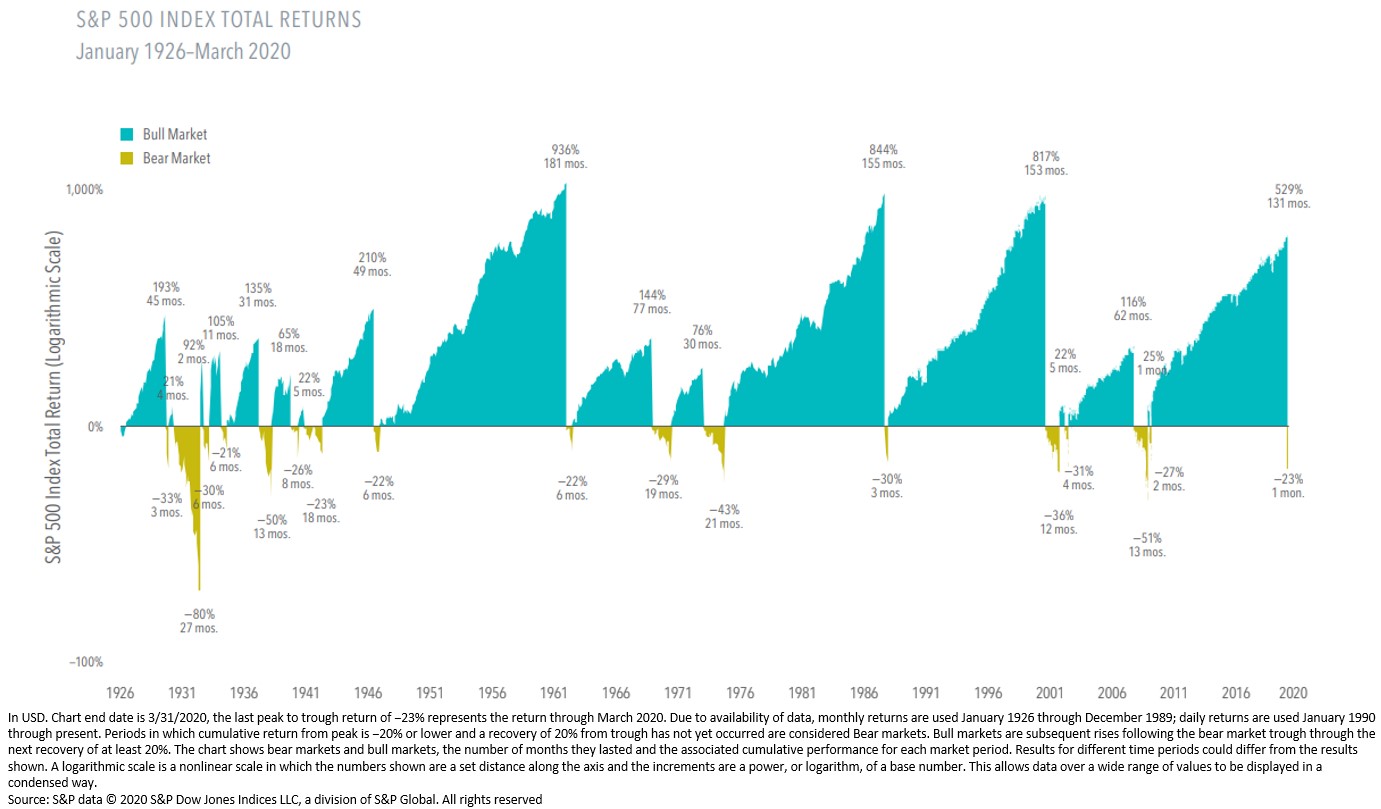

Remember that markets have gone through numerous cycles and many different bull and bear markets (see chart below). We have gone through oil crises, world wars, economic troughs, financial crises, bankruptcies. There will always be some worry or another. If you wait for the coast to be clear you would be missing out a lot. Yes, returns are volatile but the good always outshines the bad. When viewing both bull and bear markets side by side, it is clear that investing in markets has rewarded investors. It also shows that bad periods are only temporary.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.