Should you be worried over low interest rates?

11 September 2020

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

— Albert Einstein

You might remember a time when saving money in the bank was enough to net you a decent profit. Long before internet banking and digital tokens, the humble passbook recorded all your financial transactions. It was always a joy to update it and see the interest credited into your account. Back then, $1,000 of savings could get you over $40 in interest!

Fast forward to today, and things could not be more different. With yields at all time lows and even negative in some countries, investors may actually need to pay banks to keep their money.

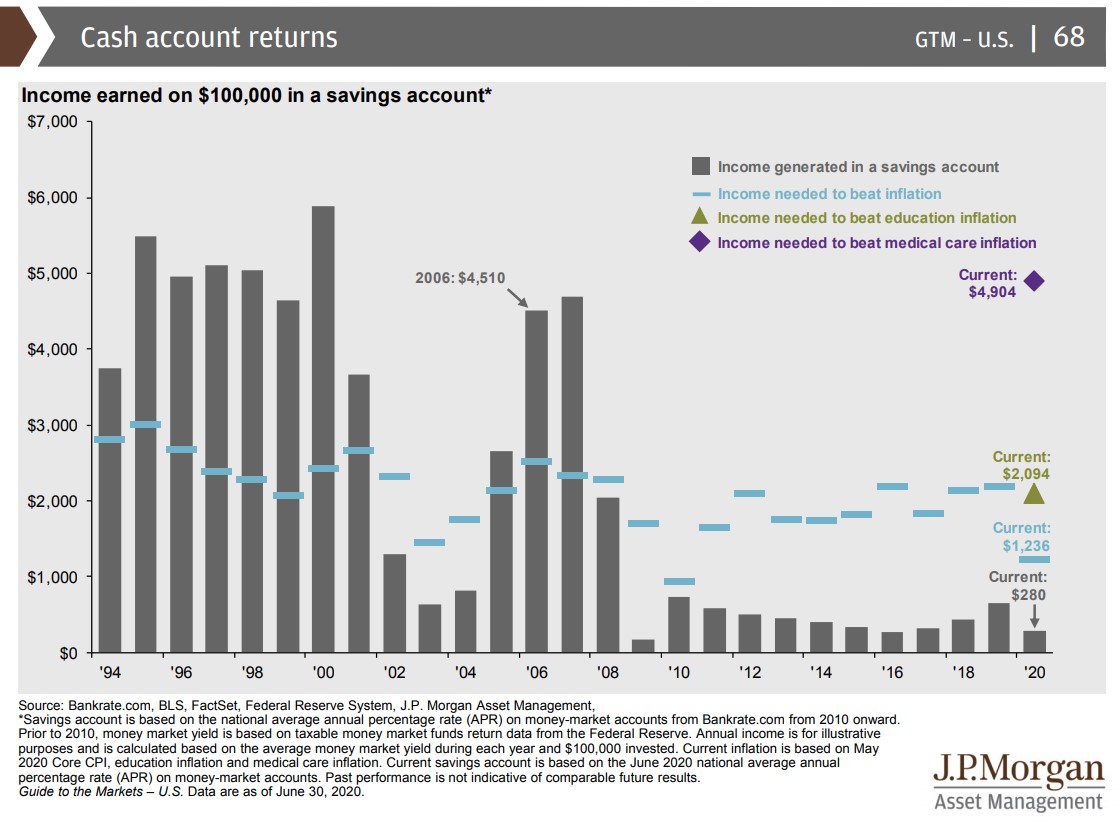

JP Morgan’s recent investment update shows how income from US savings accounts fell off a cliff in 2009. They have yet to recover, producing three worrying trends:

- Savings rates are too low to beat inflation;

- Savings rates are far too low to beat education inflation;

- Savings rates are far, far too low to beat medical inflation.

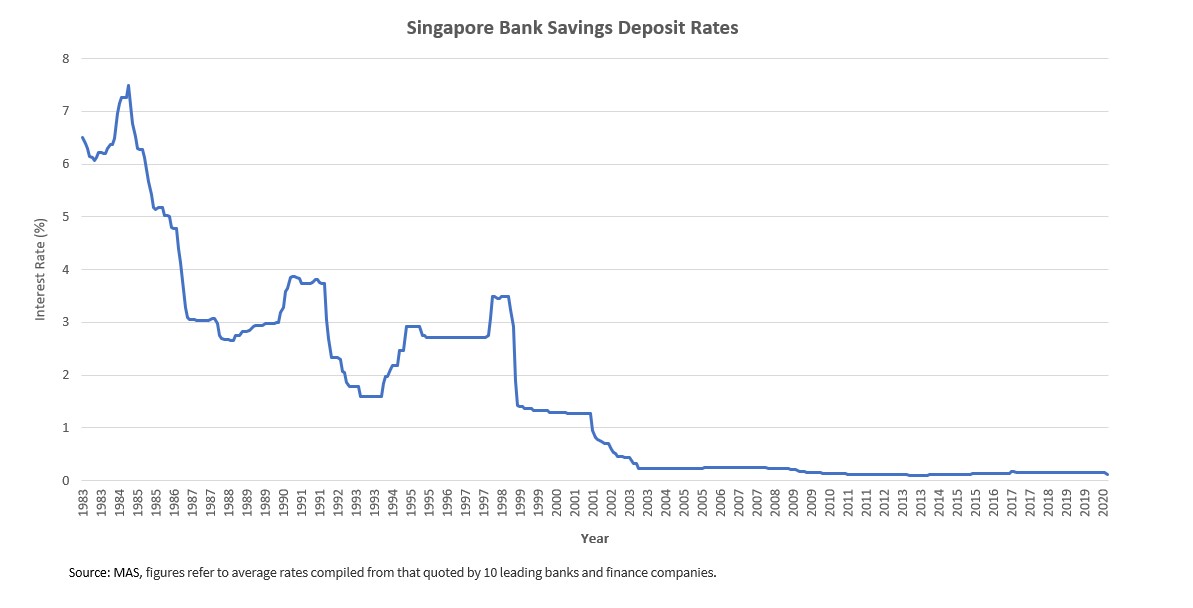

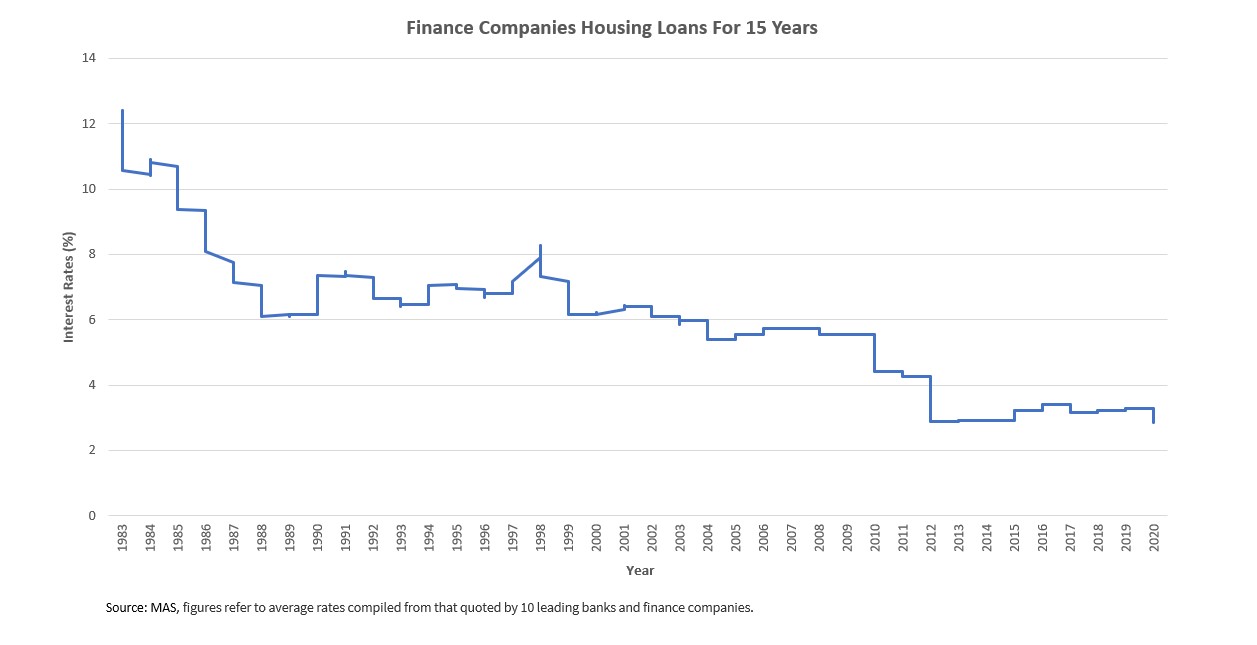

Singapore’s interest rates move in lockstep with the US, due to our close interlinks within the global financial system. The diagram below shows how our own bank deposit rates also fell off a cliff.

This brings about some pressing questions:

- How might retirees or the risk-averse generate enough income on their savings in order to live comfortably?

- How might anyone planning for the future ensure that they can generate sustainable returns without overly exposing themselves to unknown risks?

- Will interest rates ever go up again, and what are the implications for markets?

The unfortunate reality is that many people seeking higher returns have been pressured into dumping their money into seemingly “safe” investments that often turn out to be anything but. The collapse of Hyflux, oil and gas sector companies like Swiber, and the default of the Noble Group are all examples of investors losing their hard-earned savings with what they thought were ‘safe’ bonds.

These bond defaults primarily affected private banking customers who had snapped up huge amounts of high yield debt from those companies. Unfortunately, many mom and pop investors were also badly hit.

Likewise, investors seeking higher interest rates crowded into high dividend-yielding stocks and funds. Those who only cared about the natural yield of those instruments (coupons and dividends) were pushed into overpaying for them.

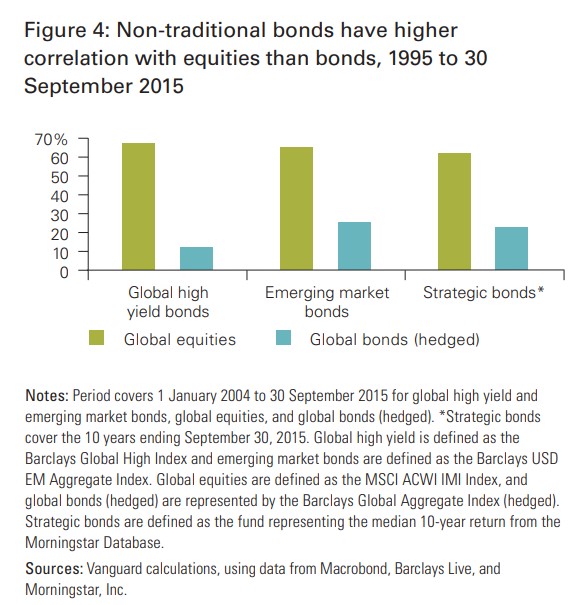

High yield bonds, emerging market bonds, strategic bond investments with fixed maturity dates, property investments… all of these have been riding the same trend into popularity. The problem is that investors who go into such non-traditional investments seeking a higher yield invariably expose themselves to new and unknown risks.

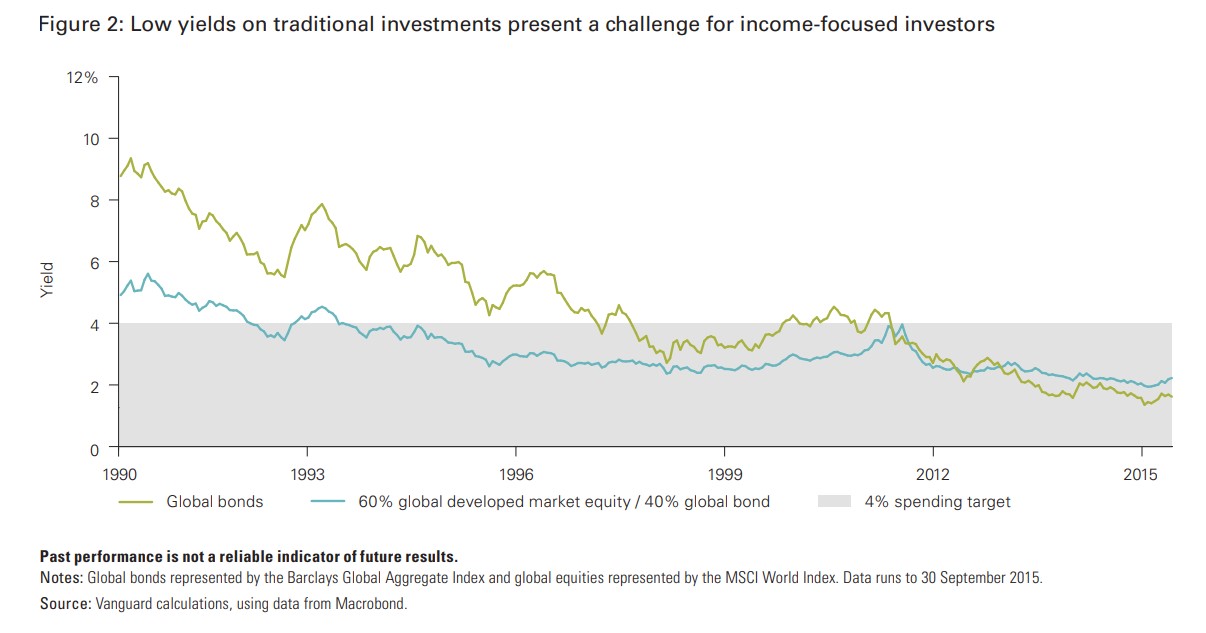

A big issue that many investors fail to consider is the role of bonds in their investments. Traditional bonds provide some yield but were used primarily as a buffer against volatility. However, investors are now channelling more money into non-traditional bonds, which means taking on higher risk.

These “new” bond vehicles correlate closely to equities. This means that they follow stocks very closely, and during a market drawdown, they go down in value together. Listed property investments also have similar volatility and drawdowns to their equity counterparts. Meanwhile, physical property investments are illiquid and come with high costs when an investor needs to sell quickly to raise money.

Vanguard’s research shows that focusing on higher-yielding sectors results in a less diversified portfolio, higher levels of risk, decreased tax-efficiency (for taxable investors) and an increased chance of falling short of long-term financial goals.

Instead, a better way to invest for income is a total-return approach. Investors should consider not just the regular income payout but the return from capital gains. Such an approach is more holistic and offers a number of portfolio benefits, including maintaining diversification, enhancing the portfolio’s tax-efficiency, allowing greater focus on the size of the portfolio, and increasing the portfolio’s longevity. The Value at Risk (VaR) is also lower, ensuring that potential losses on your portfolios are kept within a tolerable range. All these are reasons why we take a total-return approach to your investments.

So, should you be angry about low interest rates? Not necessarily. The upside to this is that borrowing costs are as low as they have ever been. This benefits everyone, as it enables individuals to more easily obtain leverage for purchasing big ticket items such as housing.

If and when interest rates go up, would it really affect the value of your investment portfolio? Many financial commentators seem to think so. They explain that companies will find it more costly to borrow money. This will affect their revenue and therefore affect their share price.

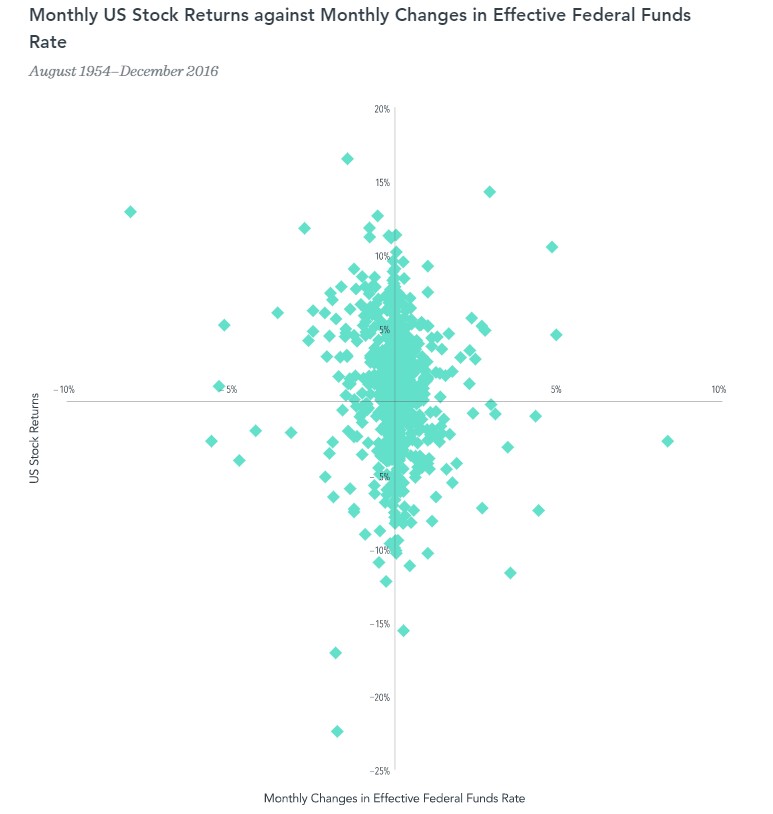

Interestingly, the historical data on such past scenarios may surprise you. From the diagram below, there is no clear relationship showing that stock returns are negative when interest rates rise, or vice versa.

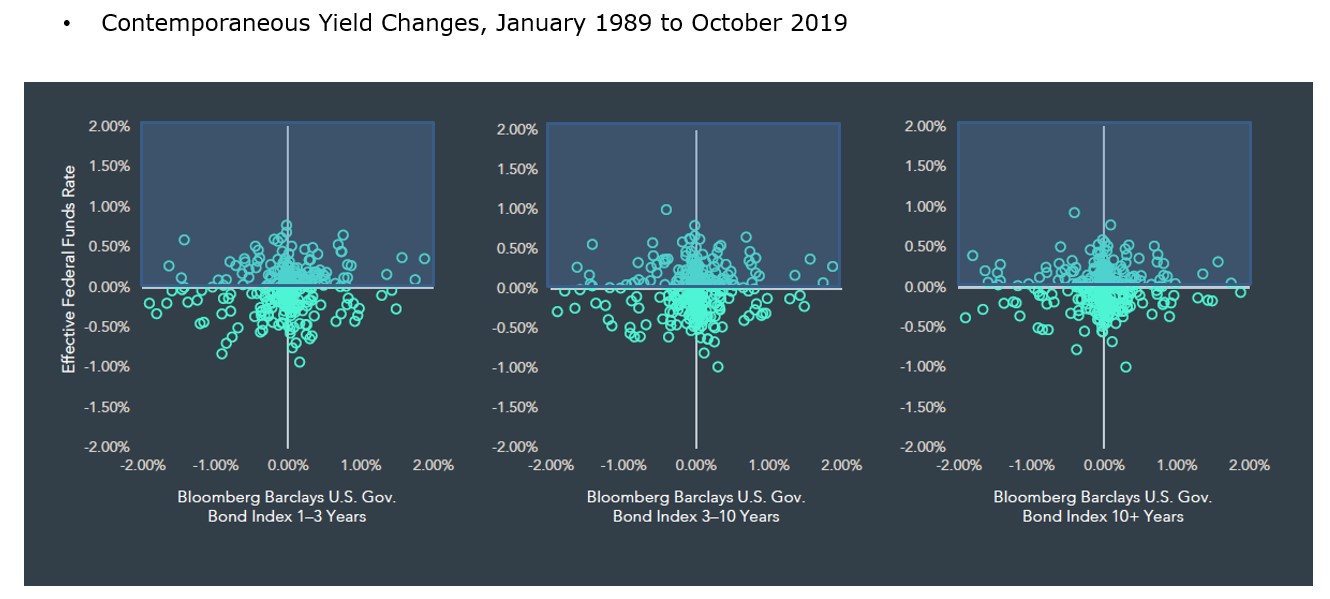

The logic for bonds was supposedly clearer. When interest rates rise, bond yields naturally follow – affecting the capital value of bonds. Investors thus stood to lose money when interest rates rose. Surprisingly, the diagram of historical data below also shows no relationship between bond returns and changes in interest rates.

In the end, how you feel about the current low interest rate situation likely has a lot to do with your current stage in life. If you are a retiree depending on your cash and bond savings for income, you naturally won’t be too pleased. Whereas if you’re a young person borrowing money to buy a home, you should be happy with the low borrowing costs at present. What you could save over the lifetime of the loan could possibly more than make up for lost interest income.

As an investor, as long as you are invested into a globally diversified portfolio of stocks and bonds, you don’t have to worry about the direction of interest rates affecting your long term returns.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.