What’s In Store For the Next 10 Years?

27 February 2020

“The desire to perform all the time is usually a barrier to performing over time.”

—Robert Olstein

Just imagine for a moment that you’re back in January 2010. It’s the start of the new year, and you’re reading a review of the financial markets. Investors have been on a roller-coaster ride for the past three years. First, there was the stress of the Great Financial Crisis from late 2008 to early 2009, and then came the relief and excitement of recovery in March 2009 – a recovery that’s still going strong.

Investors who rode out the market slide are finally beginning to be rewarded! But the rebound has been going on for 10 months now, and markets still have a long way to go to reach their previous highs.

Opinions are mixed on what might unfold in the coming year. “Bull Market Shows Signs of Aging,” declared the Wall Street Journal in December 2009, underscoring the sense of prevailing uncertainty. Although stocks have rallied and indices are on the rise, they pointed out the mounting worries in some quarters that the market is running out of steam.

From your vantage point in early 2010, you may be wondering whether to stick with your investment plan. There’s so much uncertainty going on. Perhaps it might be better for you to move into cash while you wait for more evidence that the markets have recovered.

Now, fast forward to today, and consider what the global equity markets delivered to investors who stayed the course.

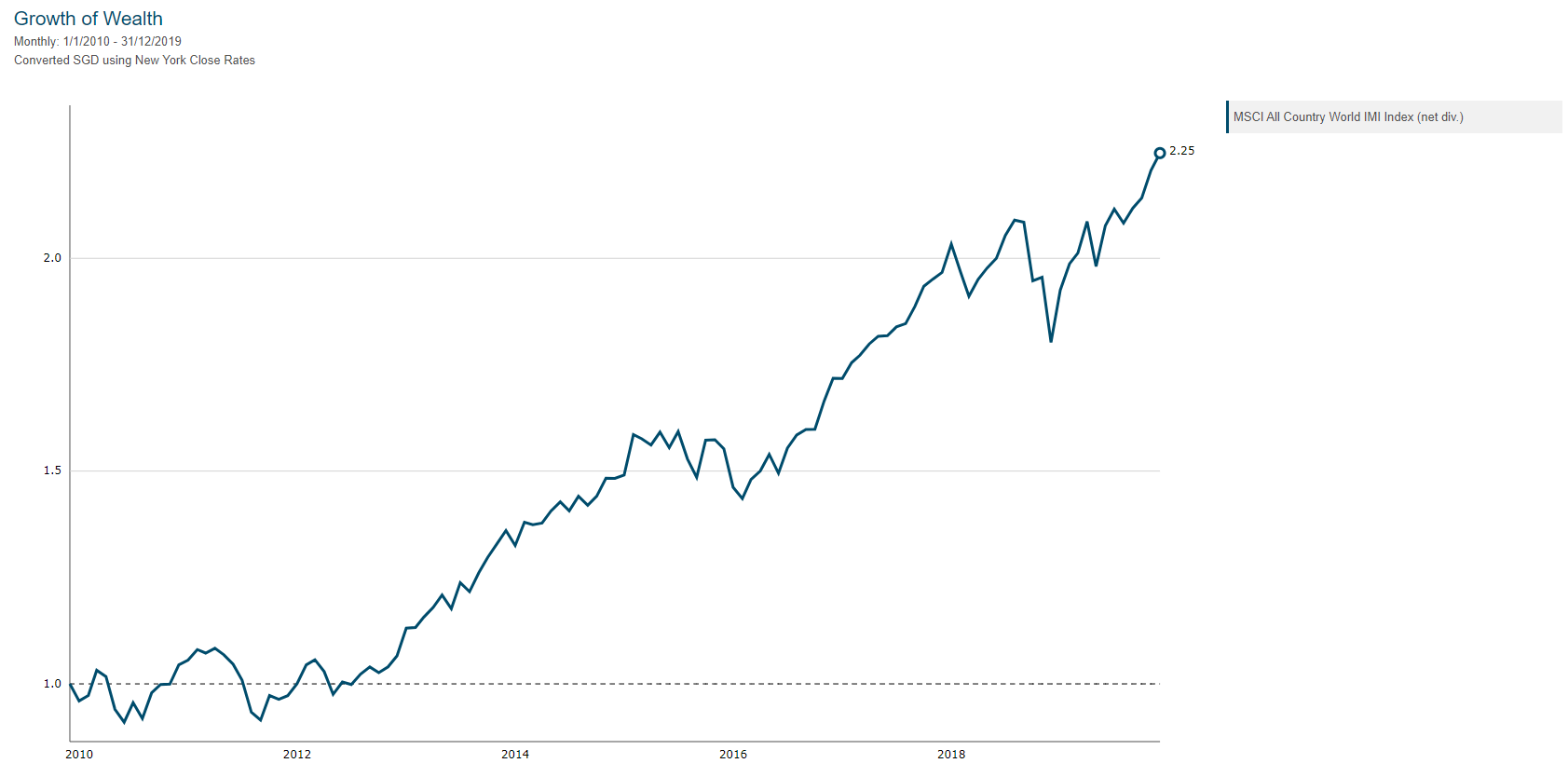

On a total return basis, global stocks more than doubled in value from 2010–2019. The MSCI All Country World IMI Index, which includes large and small cap stocks in developed and emerging markets, produced an 10-year annualized return of 8.43% (in SGD terms).

If you had invested $1 into stocks in the index at the beginning of 2010, it would have grown to $2.25 by the end of 2019. (Which meant that if you had invested $100,000, it would have grown to $225,000. Not too bad, right?)

But despite those positive annual market returns across most of the decade, investors also had to deal with a lot of market uncertainty. These stemmed from events including an unprecedented US credit rating downgrade, sovereign debt problems in Europe, negative interest rates, flattening yield curves, the Brexit vote, the 2016 US presidential election, recessions in Europe and Japan, slowing growth in China, trade wars, and geopolitical turmoil in the Middle East, to name a few.

The decade also brought technological advances in electronic commerce and cloud computing, the global embrace of the smartphone and social media, increased automation and enhanced artificial intelligence, and new products like electric cars and early iterations of self‑driving ones.

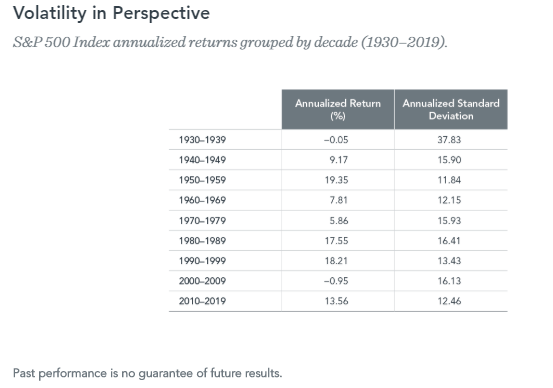

Looking back, you could conclude that the 2010s had its share of uncertainty – just like the decades before. From US stock market data (which we use as reference due to its long historical record), we see that the US equity market experienced moderate volatility compared with previous decades.

The table below shows the US stock market’s returns and standard deviation across the decades. A higher standard deviation reflects wider market swings during that decade.

Benefits of Diversification

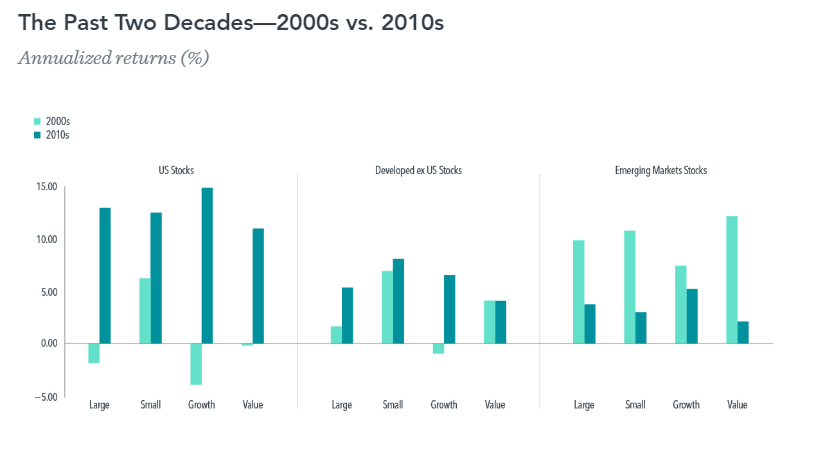

The past decade was quite challenging for investors who committed to good practices like global diversification and investing in areas of the market associated with higher returns, namely small cap stocks and value stocks. (Value stocks are stocks trading at low relative prices, unlike growth stocks, which trade at high relative prices due to the expectation of growth.)

As shown in the chart below, investors in the 2000s had been generally rewarded for holding stocks from emerging markets and developed ex-US markets. In the 2010s, however, the US market outperformed both of them.

Similarly, value vs. growth and small vs. large cap performance varied between the two decades. While small cap and value stocks in the 2000s outperformed large cap and growth stocks across the board, the 2010s produced mixed outcomes. Small caps underperformed large caps in the US and emerging markets, but outperformed in the developed ex-US market. Value underperformed growth in all three market regions.

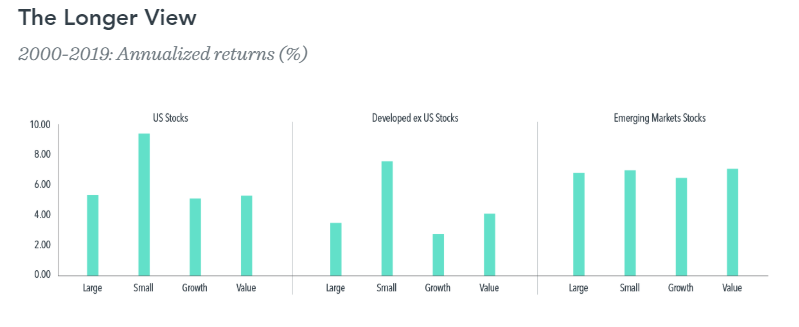

However, if you look at the cumulative performance over both decades, you’ll find that small cap and value stocks both outperformed large cap and growth stocks respectively across all three markets. Within the 2010s, small cap and value still delivered a respectable 12.44% and 10.88% (in USD) respectively despite their US underperformance.

Their annualized 20-year returns illustrate how diversification can help investors ride out the extremes for a positive longer-term outcome.

From 2010-2019, the returns from global fixed income may have surprised some investors. In 2010, interest rates were at a historic low. Investors looking at that may have expected those rates to rise as financial markets and economies recovered from the crisis.

But over the decade, long-term rates decreased even though short-term rates increased. As a result, long-term bonds generally outperformed shorter-term bonds, such that realized term premiums were positive. Lower-quality bonds also generally outperformed higher‑quality bonds.

Enduring Principles

So, the question on all investors’ minds is: what will this new decade bring?

The answer is that only time will tell.

Stocks and bonds both produced strong returns in 2019. But the global stock bull market is already 10 years old. Current headlines can give investors other reasons to worry about the future – for example, coronavirus fears, a pushback on globalization, the effects of climate change, the limits of monetary policy, the fate of Brexit, and the vagaries of the 2020 US presidential race.

Those are merely the known unknowns. Looking ahead, the only certainty is that nothing will be certain.

But here’s what we can learn from the past decade, and the ones that came before it. Despite all the change and uncertainty, the fundamentals of successful investing endured.

What are these fundamentals? We list them as follows:

- Diversify across markets and asset groups to manage risks and pursue higher expected returns;

- Stay disciplined and maintain a long-term perspective;

- Take the daily news with a grain of salt and avoid making reactive investment decisions based on fear or anxiety;

- Don’t try to predict future performance or time the markets. Instead, develop a sensible investment plan based on a strong philosophy, and stick with it.

By following these principles, you can expect a better investment journey – regardless of which decade you’re in!

#

(Adapted from an article by Dimensional Fund Advisors.)

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.