The Financial Cost of Following Wrong Advice

17 January 2020

“The stock market is a device for transferring money from the impatient to the patient.”

—Warren Buffett

Looking at the financial news, it would seem that markets are definitely going to keep rising and also definitely going to collapse soon. Did you catch that contradiction? Such wildly contradictory views have always been a mainstay of the financial media, but in recent years we have seen an increasing number of bleaker outlooks from market commentators.

You can blame 2008 for this. It was a severe financial crisis that rocked global markets, and yet completely (and shamefully!) escaped the notice of all those market ‘experts’. The European debt crisis then followed swiftly on its heels, compounding the devastation and causing a major depression in asset prices (at least on paper) that would take nearly a decade to return to par.

Controversial news and shocking opinions appeal to our human negativity bias — a concept researched at length by Nobel laureate Daniel Kahneman. Simply put: BAD NEWS SELLS! Economists and market watchers who give outrageous doomsday predictions stand a much better chance at being featured in the press over any of their peers who calmly state that everything looks fine. Investment professionals prefer to err on the side of caution, as their jobs are on the line. They would rather advise investors to lean towards ‘safer’ products, like bonds and fixed return products, than advise them to invest in the market and risk their anger should a crisis decimate their portfolios.

Yet what this negatively-skewed media coverage does is feed a perpetual state of economic panic amongst investors. Many people are so afraid of a market collapse that they simply stop investing altogether, preferring to store all their money in cash or real assets such as property.

However, there are many problems with doing so. Sometimes, it can actually be the more dangerous option.

For starters, many investors use leverage (borrowing money from banks) to gain a huge exposure to an illiquid asset class, such as property, without being fully aware of the huge risks involved. But leverage always cuts both ways, amplifying gains as well as losses. Many investors have forgotten the pain suffered by property investors during the 1997 Asian financial crisis when the word ‘negative equity’ was first coined. The huge drops in property prices meant that many property investors owed more to the bank than their outstanding mortgage. Banks thus made investors either top up the difference in cash or face a forced sale of their property by the bank at fire sale prices. As this was a time when many were being retrenched or had business failures, those options sent many of them into into financial ruin or bankruptcy.

Secondly, many bankers advise risk-averse customers to buy bonds. This has been driving up bond valuations to record levels, creating a big risk to investors who assume that they are in something that is safe and shouldn’t lose its value. Bonds have been in a 30-year bull market. Many investors have forgotten a time when interest rates were at double digits. Even if present rates do not reach those levels, any small increase will still create capital losses for investors with large holdings in bonds.

You should get the drift by now. Supposedly safer assets like bonds and property also have a dark side and the potential to devastate wealth.

Here is a non-exhaustive list of some popular forecasts since 2010 from well-known financial personalities, a few of whom are on record as having anticipated a prior bear market and recession:

20 May 2010

“There are some parts of the global economy that are now at the risk of a double-dip recession. From here on I see things getting worse.” (CBS)

—Nouriel Roubini, Roubini Macro Associates LLC, NYU Stern School of Business4 Jun 2011

“Another recession is coming, and soon. So says Gluskin Sheff economist David Rosenberg. Rosenberg, a longtime bear on the economy and the stock market, now says he is 99% sure we will have another recession by the end of next year.” (Fortune)

—David Rosenberg, Economist, Gluskin Sheff9 Aug 2011

“It seems suicidal to buy a broad-based basket of stocks or economically sensitive commodities or emerging markets stocks – all of which are very leveraged to economic growth” (Kiplinger); and “Sell everything, nothing looks good” in July 2016 (Reuters)

—Jeff Gundlach, CEO, DoubleLine Capital LP24 Feb 2012

“Lakshman Achuthan, co-founder of the Economic Cycle Research Institute, said on Friday that his research firm is sticking with the forecast it made in September: A new recession is inevitable, despite improvement in high-profile economic indicators, such as job creation and unemployment, and a stock market rally. Achuthan said data gathered since his September forecast only confirms his view that economic growth has slowed to such a degree that a downturn is now unavoidable, likely by late summer.” (CNN)

—Lakshman Achuthan, Co-founder, ECRI25 May 2012

“I think we could have a global recession either in Q4 or early 2013. That’s a distinct possibility.” When asked what were the odds, Faber replied, “100%” (CNBC)

—Marc Faber, Author, Advisor, Marc Faber Ltd12 Nov 2012

“The data is clear, 50% unemployment, a 90% stock market drop, and 100% annual inflation starting in 2013.” (Newsmax)

—Robert Wiedemer, Author31 Mar 2013

“When the latest bubble pops, there will be nothing to stop the collapse. If this sounds like advice to get out of the markets and hide out in cash, it is.” (Business Insider)

—David Stockman, Fmr Director of the Office of Management and Budget25 Apr 2013

“We repeat our key forecasts of the S&P Composite to bottom around 450 (-70%), accompanied by sub 1% US ten year yields” (CNBC, following on Edwards’ “ultimate death cross” in July 2012)

—Albert Edwards, Global Strategist, Société Générale30 May 2013

“We’ve got a much bigger collapse coming…I am 100% confident the crisis that we’re going to have will be much worse than the one we had in 2008” – Marketwatch, and “The crisis is imminent. I don’t think Obama is going to finish his second term without the bottom dropping out. And stock market investors are oblivious to the problems.” (Money Morning)

—Peter Schiff, CEO, Chief Strategist, Euro Pacific Capital Inc15 Oct 2013

“DeMark’s Dow Jones Index chart covering the period from May 2012 to the present seems to be tracking, almost precisely, the months leading up to the 1929 stock market crash.” “The market’s going to have one more rally, then once we get above that high, I think it’s going to be more treacherous… I think it’s all preordained right now.” (Bloomberg)

—Tom DeMark, CEO, DeMark Analytics LLC6 Nov 2013

“We see a significant risk-on top before giving way, over the last three quarters of 2014 through 2015, to what could be a 25%-50% sell-off in global stock markets.” (Marketwatch)

—Bob Janjuah, Client Advisor, Nomura24 Jul 2014

“David Levy says the United States is likely to fall into a recession next year, triggered by downturns in other countries, for the first time in modern history. “The recession for the rest of the world … will be worse than the last one,” says Mr. Levy, whose grandfather called the 1929 stock crash. Mr. Levy predicts a US recession will throw its housing recovery in reverse, and push home prices below the low in the last recession. He says panicked investors are likely to dump stocks and flood into US Treasuries, a haven in troubled times, like never before.” (The Independent)

—David Levy, Chairman, Jerome Levy Forecasting Center29 Sep 2015

“I see real tremendous problems ahead and I don’t think we are handling it right and nobody really wants to talk [it] out… We are headed toward a strong correction and possibly a complete meltdown but not systemic like 2008. It won’t threaten the system, it’s just going to threaten your livelihood and net worth…. I do think you are in a very massive bubble and when it bursts it isn’t going to be pretty, it could be a blood bath.” (Forbes)

—Carl Icahn, Founder, Icahn Enterprises7 Jan 2016

“Global markets are facing a crisis and investors need to be very cautious, billionaire George Soros told an economic forum in Sri Lanka on Thursday…” China has a major adjustment problem,” Soros said. “I would say it amounts to a crisis. When I look at the financial markets there is a serious challenge which reminds me of the crisis we had in 2008.” (Bloomberg)

—George Soros, Founder, Soros Fund Management, Quantum Fund18 Jan 2016

“A broad range of other leading measures, joined by deterioration in market action, point to the same conclusion that recession is now the dominant likelihood.” (Hussman Funds)

—John Hussman, Founder, Hussman Strategic Advisors31 Oct 2016

“Mr. Trump’s presidency would likely cause the stock market to crash and plunge the world into recession…anti-trade policies would cause a sharp slowdown, much like the British are experiencing after their vote to exit the European Union.” (New York Times)

—Simon Johnson, Economist, MIT Sloan School of Management9 Nov 2016

“It really does look like President Donald J. Trump, and markets are plunging….So we are very probably looking at a global recession, with no end in sight. I suppose we could get lucky somehow. But on economics, as on everything else, a terrible thing has just happened.” (New York Times)

—Paul Krugman, Author, Economist, Graduate Center of the City University of New York

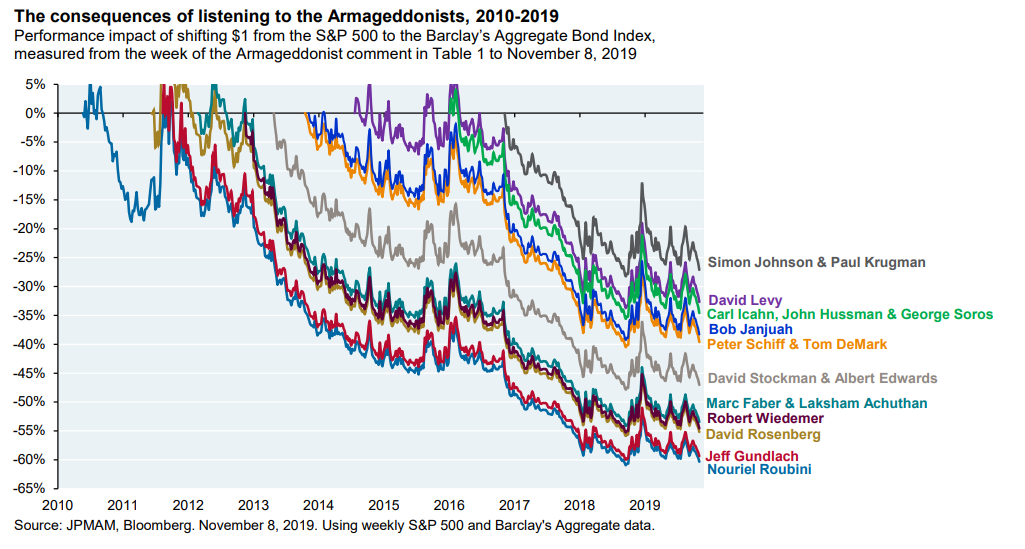

So, what would have happened if you had followed the advice of all those market experts and luminaries? The chart below shows the opportunity loss you would have suffered if you had taken out $1 from stocks (using the S&P 500 index) to buy $1 of bonds at the point of those predictions. The results make clear how significant the impact is, and you would have fallen very far behind in achieving your financial goals.

Being bearish might sound a little more intelligent, because being contrarian is an ‘in’ thing. After all, nobody gets praised for predicting if and when markets go up; that’s what markets are supposed to do and do in fact do, most of the time.

The recent US attack on Iran’s top general caused some slight market corrections and brought out calls for a flight to safe haven assets. Such talk was quite rare back in December 2019.

The markets will eventually crash, because markets don’t keep going up forever in a straight line. When that happens, these bearish forecasters would feel vindicated. Investors who stayed on the sidelines and missed the carnage might say, “I told you so!”

However, the bigger and much more important issue to consider is: Will the next recession and bear market be severe enough to justify your fears of a market collapse?

A simple calculation of the numbers on the previous chart shows that markets need to experience losses of 40 to 50% in order for those opportunity losses to be reversed. But looking at market losses over the past 93 years (since 1926), we find that there were only 5 times when markets had losses greater than 30%! (on average, once every 19 years.)

In that light, how should one deal with market corrections, bear markets and market crashes? Here are some suggestions:

- If you are investing for long-term goals and already have a plan with long-term returns expectations, stick to it. Such plans have already accounted for the probability of market corrections along the way.

- Markets go up most of the time. Time spent worrying about crashes is time spent worrying about something that doesn’t happen very often.

- Build your portfolio with the appropriate asset allocation that will meet your goals while still giving you peace of mind.

- Consult a fiduciary adviser for behavioural coaching in times of market turmoil so as to avoid making financially destructive decisions.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.