Driving Forward Whilst Looking Back

10 January 2020

“Market Forecasting: The attempt to predict the unknowable by measuring the irrelevant; a task that, in one way or another, employs most people on Wall Street.”

—Jason Zweig

As we head into the new year, financial institutions and experts are once more offering their analyses and opinions on where markets are headed, what central banks are likely to do, and what asset classes investors should buy.

However, if investors are to learn anything new this year, it’s that markets are almost impossible to forecast. 2019 served up many good examples on how unpredictable they can be.

Market watchers expected interest rates controlled by the Fed to rise. Instead, they fell. Consumer confidence weakened as the year began, and news headlines broadcast fears of an economic slowdown, but global stocks were up by more than 20% by the end of the year—on course for the best showing since 2013.

Investors who had moved onto the sidelines in early to mid-2019, perhaps after the trade war took a turn for the worse, would have missed out on those unexpected gains in November and December.

One of the culprits of the European debt crisis, Greece—the site of an economic crisis so dire that some expected them to abandon the euro earlier this decade, and a country whose equity market lost more than a third of its value in 2018—ended up having one of the most robust stock market performances among emerging economies in 2019. On top of that, Greece issued bonds at a negative nominal yield, which means investors paid for the privilege of lending the government cash. Sounds unbelievable?

Taken as a whole, all that is a reminder that the prediction game is a losing one for investors.

Where Are Interest Rates Going?

The answer is that nobody really knows. A closer look at interest rates and the bond market shows just how unpredictable asset performance can be.

Going into 2019, Federal Reserve officials expected economic conditions to support raising a key interest rate benchmark two times, since the hikes in 2018 had caused capital losses for bondholders as the asset class sold off. In the end, however, policy makers lowered it three times in 2019.

In the market for US Treasuries—where market participants set interest rates—the yield curve that tracks Treasuries inverted for the first time in more than 10 years, as seen in the chart below.

Some long-term yields fell below some short-term yields over the summer. What’s more, yields on medium- and long-term bonds were at historically low levels at the start of the year, but they had fallen even lower by the end of October. Investors who made moves based on the expectation that yields would rise in 2019 may have been disappointed at how events ultimately transpired.

Which Country’s Stock Market Should I Invest In?

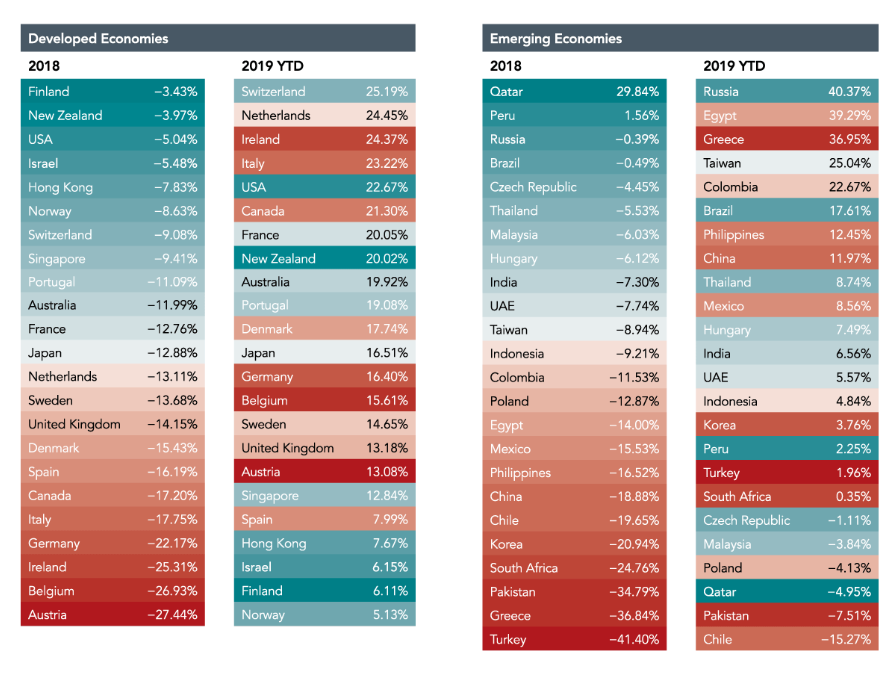

Events weren’t any easier to anticipate in the global equity markets, where no evident link appears between markets that performed well in 2018 and those that excelled in 2019, as the diagram below shows.

Among the 23 developed market countries, only one country was a Top 5 performer for 2018 and 2019: the US.

2018’s strongest performing market—Finland—ranked 22nd last year through the end of October. Among emerging markets, Greece swung from a 37% decline in 2018 to a 37% advance in 2019 through the end of October. And what about our home country, Singapore? It continues to languish as one of the laggards.

Learning Lessons

History has shown there’s no compelling or dependable way to forecast stock and bond movements, and 2019 was a case in point. Neither the mainstream prognostications nor the hindsight of recent strong performance predicted outcomes in 2019.

Rather than basing investment decisions on predictions of which way debt or equity markets are headed, a wiser strategy may thus be to hold a range of investments that focus on systematic and robust drivers of potential returns. Investors who were broadly diversified across asset classes and around the globe were in a position to potentially enjoy the returns that the markets delivered in 2019.

Be it last year, this year, or next year, that approach is a timeless one.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.