Fool me once, shame on you; fool me twice, shame on me

24 May 2018

Hyflux, the former investor’s darling, has been plagued with cashflow problems. This brings back memories of 2016, when more than S$1.1Bn worth of bonds from companies such as Trikomsel, Pacific Andes Resources Development, Swiber, Perisai Petroleum Teknologi, Swissco, Nam Cheong and Rickmers Maritime all defaulted, leaving many affluent investors in the lurch with little hope of recovering their full investment.

Recent Headlines About Hyflux’s Debt and Cash Flow Woes

Why does this keep happening? Many high-yield bonds are sold primarily to individual private and priority banking clients. Many of these investors are driven purely by return without any thought of risk, and buy products based only on their headline yields – the higher, the better! Yet they overlook the risk they would be undertaking. Secondly, the vast majority of financial intermediaries in Singapore have commission and remuneration structures that provide no incentive for their representatives to give proper fiduciary advice which puts the client first. When coupled with companies hungry for capital, we get a less than ideal outcome. Ironically, most of these investors put money in bonds thinking that they are much safer than stocks, only to learn the hard way that they were wrong.

Investors suffering higher-than-expected losses in the markets is a phenomenon that will continue for a long time to come. To beat this pattern, investors need to come to terms with investing misconceptions, educate themselves appropriately, and not blindly follow poor investment “recommendations”.

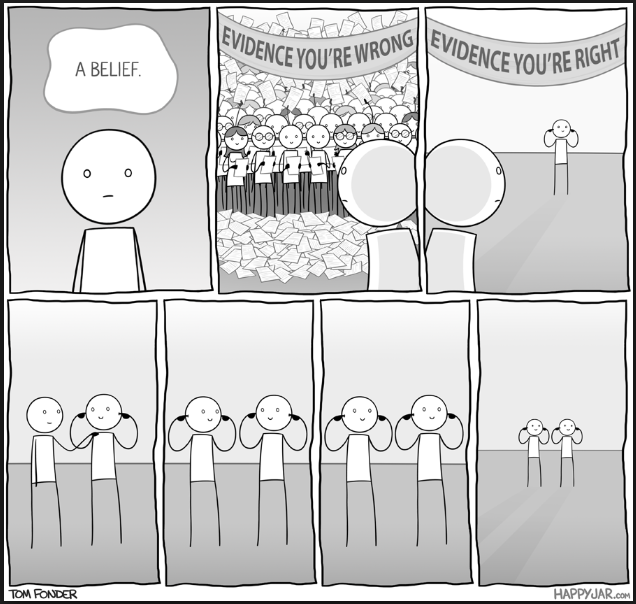

A philosopher once said that nothing is as difficult for people as not deceiving themselves. But while most self-delusions are relatively costless, those relating to investments come with a hefty price tag. We delude ourselves for a number of reasons. One main reason is a need to protect our egos. That’s why we look for evidence that supports our existing beliefs and dismiss those facts that might prove us wrong. Psychologists call this “confirmation bias“. A related tendency, “hindsight bias,” involves seeing something as obvious and predictable only after it has happened.

Here are seven common ways that investors fool themselves:

- “Everyone could see that market crash coming.” – Have you noticed how people become experts after the fact? But if everyone could see a correction coming, why wasn’t everyone trying to profit from it? Or why did they still end up losing money?

- “I only invest in blue-chip companies.” – People often gravitate to the familiar names in stocks or investments they think are ‘solid’. But a strong public profile does not necessarily make a company a good investment. Hyflux, Enron, Worldcom, Kodak, Polaroid and a multitude of other examples are cases in point. As it is sometimes difficult to see past the corporate veil, it is much better to diversify your bets.

- “I’m waiting for more certainty.” – It’s understandable to feel uneasy in the midst of volatility. But acting on those fears can be counter-productive and leads one to act on herd mentality. Uncertainty is part and parcel of investing, and discipline is rewarded in the long term.

- “I know this industry, so I am going to invest in it.” – People often assume that success in investment requires specialist knowledge of a sector. And investors who pride themselves on doing their homework on a particular sector eg. real estate, often think they are then expert investors for that sector. But can you really know everything? What about sudden regulation and policy changes? Furthermore, it is important to know that any available information about any stock is usually reflected in the price. Hence it makes more sense to trust the market instead. To think you know more about the market is foolish thinking.

- “It was still a good call, but no one saw this coming.” – Isn’t that the point? You can rationalise such a bet as much as you like, but events or external influences can conspire against you. Spread your risk instead.

- “I’m going to restrict my portfolio to the strongest economies.” – Prospects for a country’s economy are already reflected in market prices. You also do not want to be overly-exposed to a single country or economy. Yes, Singapore may be a well-run country with a strong economy, but it is also subjected to ups and downs and is affected by what happens elsewhere in the world. News moves prices, and the nature of news is that it is often unpredictable (after all, who wants to read what they already know?). So, again, work with the market.

- “Ok, it was a bad idea but I don’t want to sell at a loss.” – We can put too much faith in our individual choices or “bets”. Holding on to that loser means missing opportunities elsewhere. In the end, it is portfolio structure and asset allocation that determines performance. (see here and here for the research proof).

This is by no means an exhaustive list. In fact, our capacity for deluding ourselves in investments is greater than you think. But overcoming self-deception is not impossible. It begins with recognising that humans are not wired for disciplined investing, and will always find one way or another to rationalise an emotional reaction to market events.

That is why even experienced investors engage advisors who know them, and who understand their circumstances, risk appetites and long-term goals. The role of the advisor is to listen to and acknowledge our very human fears, while steering investors to stick with the plans they had committed to while at their most lucid and logical state of mind.

We may always try to fool ourselves. But, to quote another great philosopher, “the essence of self-discipline is to do the important thing, rather than the urgent thing.”

(Excerpts of this article were taken from “Seven Ways to Fool Yourself” in Outside the Flags 5 (2017) by Jim Parker, Dimensional Fund Advisors.)

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.