Should you buy an annuity? What are the alternatives?

24 January 2020

“An important key to investing is to remember that stocks are not lottery tickets.”

—Peter Lynch

Sales of annuities rose by a staggering 48% in 2018, according to the Life Insurance Association of Singapore’s 2019 report. (2019’s results should be out next month.) With our ageing population worrying about retirement, it is no wonder that banks and financial advisers have their annuity products selling like hotcakes!

First, what are annuities? When you buy an annuity, you give money to an insurance company in return for receiving future payouts. These usually last the rest of your life, similar to receiving a pension. If you die before you get back what you invested, the insurer usually keeps the rest. There are annuity-like products that allow your beneficiaries to receive some amount of bequest in those situations, but they are likely to cost more.

All this is very attractive to risk-averse investors. Annuities promise a guaranteed – if small – retirement income. It can certainly be comforting to know that you won’t run out of savings even if you live to see 100. It is also appealing how the payouts will arrive automatically without you having to take any action, especially when cognitive decline or even dementia beset you in your later years.

But are annuities really as good a deal as they’re made to seem? Let’s take a closer look.

The Good

- Payouts – Annuities provide a regular payout once you reach the qualifying date. These funds can supplement your retirement savings and can be planned to cover your essential expenses.

- Guarantee – These returns are guaranteed. Every annuity product guarantees that you will make a certain percentage of your principal investment, even though this percentage is low – typically ranging from 1.5% to 2.6%. Of course, this is contingent on the insurance company still being around in the future.

The Bad

- High Fees – Annuities come with high embedded fees that may not be visible to the customer. We checked out 3 popular retirement annuity products from large insurance companies, and found:

- Total expense ratios of underlying investments ranging from 2.68% to 3.30%. That’s higher than nearly all retail equity unit trusts or mutual funds! These expenses directly affect the level of return that the product can generate.

- Commissions. An old saying goes, “Annuities are sold, not bought”. Every time a client purchases an annuity, the insurance agent can be compensated up to around 9.5%. However, if they have done their work and incorporated this as part of a proper financial plan, then that compensation for their time and effort is deserved.

- Growth – Stock markets are positive almost 70% of the time and produce significant gains in the long run. When you give money to an insurance company for an annuity and they invest that money in the stock market, you won’t benefit from all of those gains. If stocks produce over 20% returns, as they did in 2019, someone with an annuity would only receive the maximum cap of perhaps 4% or 5%. In contrast, long-term stock returns are in the vicinity of 7% per year.

- Liquidity – Once you’ve purchased an annuity, it can be very difficult to get out of it. Due to the high upfront fees, surrendering the policy early could mean forfeiting a large amount of what you had paid. Among two of the three annuity products we looked at, breaking even on your investment could mean waiting 15 years before surrendering the policy. For the third product, you would need to wait 24 years.

It is thus important that you properly weigh the advantages and drawbacks before deciding to purchase an annuity. Most of us are already auto-enrolled in CPF LIFE (a life-annuity scheme), so consider if you would still need additional annuities from private insurers.

Are there better options? Investing in the stock market might be one of them.

Unfortunately, a lot of investors are afraid of the stock market. One reason is that they see the stock market like a lottery or casino, a place to gamble in hopes of making a quick buck rather than to invest in a proper way. This has naturally led to a lot of poor outcomes, which has caused investors to shy away from taking risks. Hence the allure of low-risk products like annuities.

But what if you want the low risk and security of annuities along with the high returns and liquidity of the stock market?

Well, one option is to simulate your own annuity programme – one with no lock-in period (so you can access the balance in an emergency), and where you get to keep a much larger portion of the returns and final balance.

Simulating an Annuity with Simple Investments

In 2018, Nobel laureate Eugene Fama and Professor Kenneth French published their research on long-horizon returns. Building upon research that had been done since the 1960s, they found that certain conditions have to be met in order for investors to have a high probability of achieving a certain level of return.

These conditions are:

- Invest in the whole market, preferably the value-weighted market. Investors cannot simply hold a handful of stocks or active funds. They need to buy asset-class investments with thousands of securities. Why? The broad diversification offered by the entire market lowers Value at Risk, lowers standard deviation, and provides a more certain return outcome. In comparison, holding just a few favourite stocks comes with the high risk of some of them going bankrupt and disappearing in the future.

- Stay invested for a very long time – more than 20 years, ideally at least 30 years. Why? Fama and French highlighted how stock market returns converge around a normal distribution. In other words, the longer you wait, the more certain you can be about what return you will eventually receive.

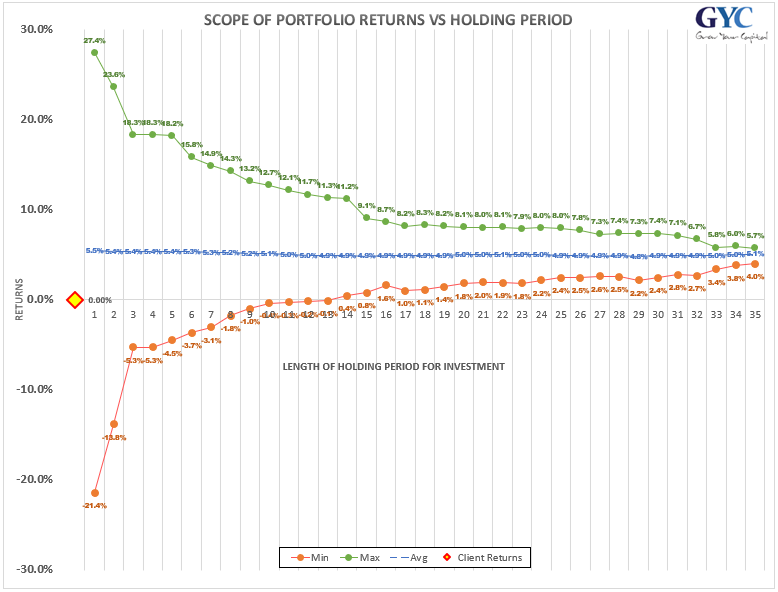

This is best illustrated with the chart below. It uses long-term rolling period market data to simulate a sample 50/50 portfolio (50% equities and 50% bonds) over a period of 35 years. (Note: this is a representation of one of our actual portfolios, and shows the nett return that investors receive after advisory fees and fund expense ratios).

In the chart, the green line denotes the returns you can expect in a best-case scenario, and the orange line the worst-case scenario. The blue line shows an average-case scenario. You can see how wildly uncertain returns can be for someone who invests for just one year. The returns could be anything from a loss of 21.4% to a gain of 27.4%.

Conversely, as time goes on, the range of expected returns steadily narrows. After 35 years, an investor can expect a positive gain of 4.0% to 5.7% in the worst and best case scenarios respectively. This holds true even if the initial investment was done at a ‘bad’ time. An investor who suffered through the dot-com collapse, the 2008 Great Financial Crisis, the 2011 Euro crisis and every single other crisis along the way would have simply experienced returns along the orange line. All those drastic losses would have flattened out over time and ultimately become a steady positive return.

So, what does this mean if you’re an investor who wants to create your own annuity?

- Invest in a stable, balanced portfolio. Its returns will be far higher than anything an annuity will get you.

- If you withdraw the average return from your portfolio every year, your portfolio can theoretically last forever. This will also allow your beneficiaries to continue receiving the payout or withdraw the whole lump sum once you no longer need it.

- If you hit an unlucky stretch, you can still continue receiving a payout. This would mean the portfolio slowly reducing in value, but as long as you keep on holding it for the long-term, the risk of it falling to $0 is very small.

If you find the above too difficult to manage on your own, you can consult a fiduciary financial adviser to construct a proper retirement plan for you that takes into account your personal situation. This would allow them to make personalised recommendations on annuities as well as how an investment-type annuity could help with your overall retirement income. They can then handle the implementation of any plans on your behalf.

For far too long, investors have been investing in the wrong way. Professional investment advice is often poor, misguided and self-serving, and has given many investors the impression that investing in stocks could mean losing everything. But that is true only if you are highly concentrated in a few stocks, are leveraged, or are constantly chasing after the hottest themes and trading too often.

As we have shown, investing doesn’t need to be that way. A disciplined, evidence-based approach provides a way for investors to receive guaranteed returns and payouts from the market. This way, you can secure your retirement and have peace of mind, without the conditions and restrictions that come with an annuity plan.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.