Halfway Through a Crazy Year

25 June 2020

“If stock market experts were so expert, they would be buying stock not selling advice.” – Norman Ralph Augustine

We’re only halfway through 2020. It has definitely been a one-of-a-kind year. It has also been a one-of-a-kind market, and anyone who tells you that they think they know what’s coming next is either full of themselves or delusional.

Here is a quick stock-take of what has happened so far.

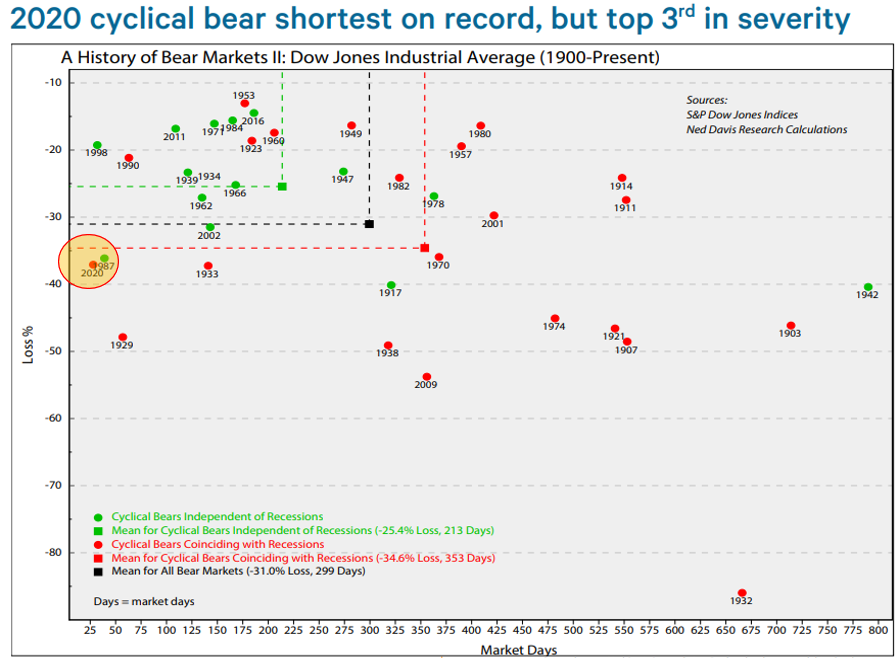

1. The Shortest Bear Market in History

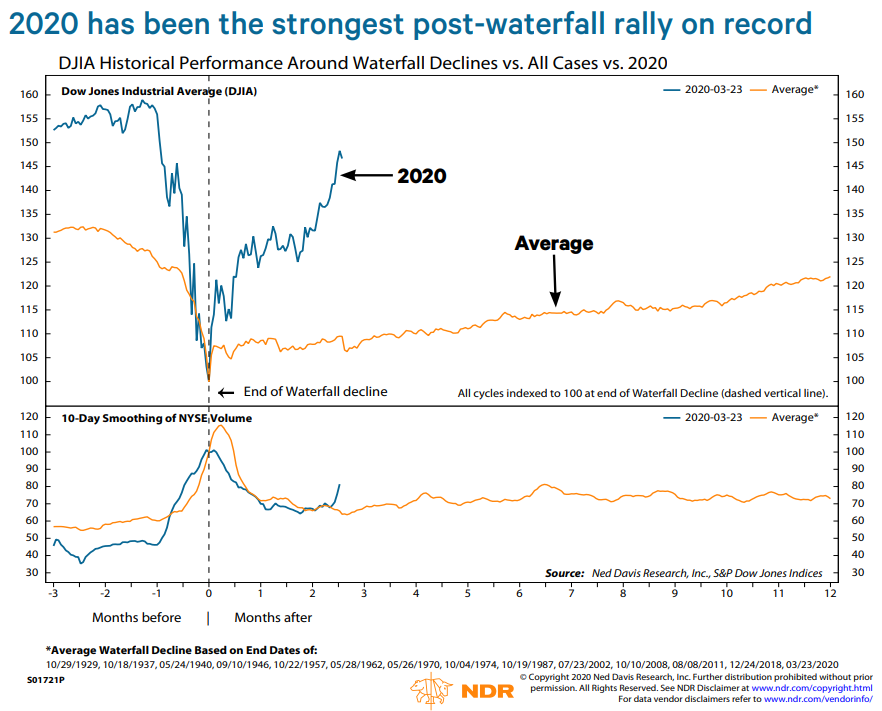

This bear market lasted 40 calendar days, making it the briefest of the 37 cyclical bear markets since 1900. On record, it is also the most severe waterfall decline that the market has experienced. A waterfall decline (as the name suggests) is a condition where stocks drop extremely quickly, just like a waterfall.

2. A Slew of Negative Predictions and Economic Reports

Coupled with the stock market decline over the past 3 months, economic reports, data and investor sentiment have been extremely negative. There is news of rampant unemployment, businesses closing down and how a vaccine could be years away in the making.

The big names and well-known banks have come out with their dire forecasts for the economy and the market. Here is a list of their predictions.

Goldman Sachs: “Downturn will be 4 times worse than housing crisis”, “stocks will tumble 18% in the next 3 months”

Deutsche Bank: “The worst global recession since World War II”

JPMorgan: “Recession will rock the US and Europe by July”

PIMCO: “Inevitable recession could turn into depression”

3. What is Happening Now?

Contrary to expectations and the negative data, the market rally since the March 23 bottom has been the strongest of any post-waterfall rebound. Since then, a globally-diversified basket of stocks is up more then +30%, replacing the bear market with a new bull market.

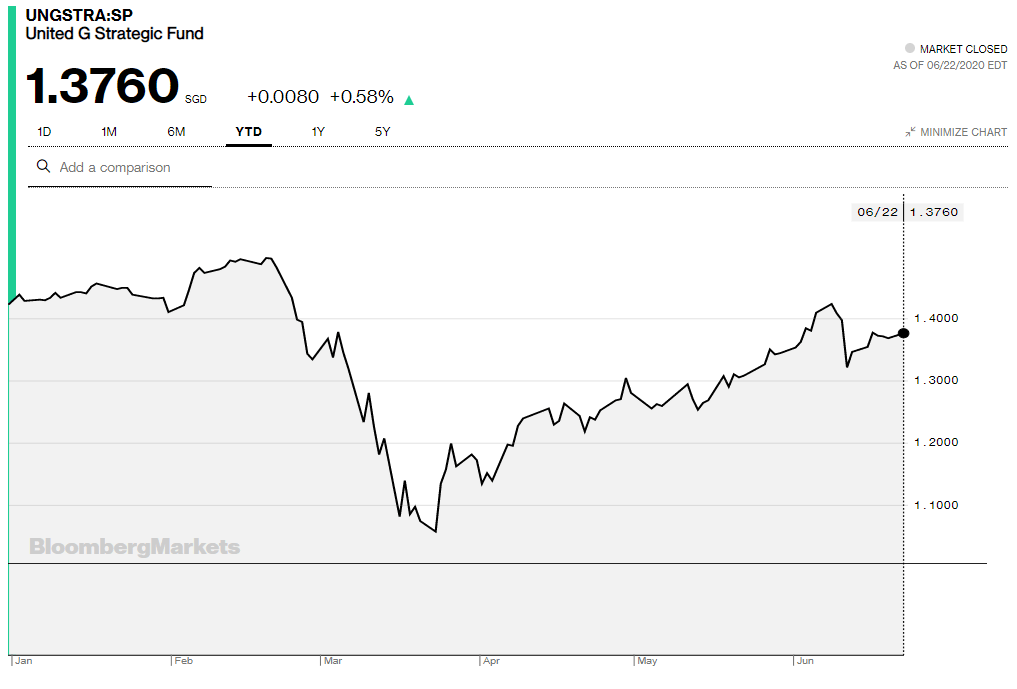

A sample core globally-diversified equity fund that we use for some portfolios (the United G Strategic Fund) is close to erasing its loss for the year.

4. Why is This Happening?

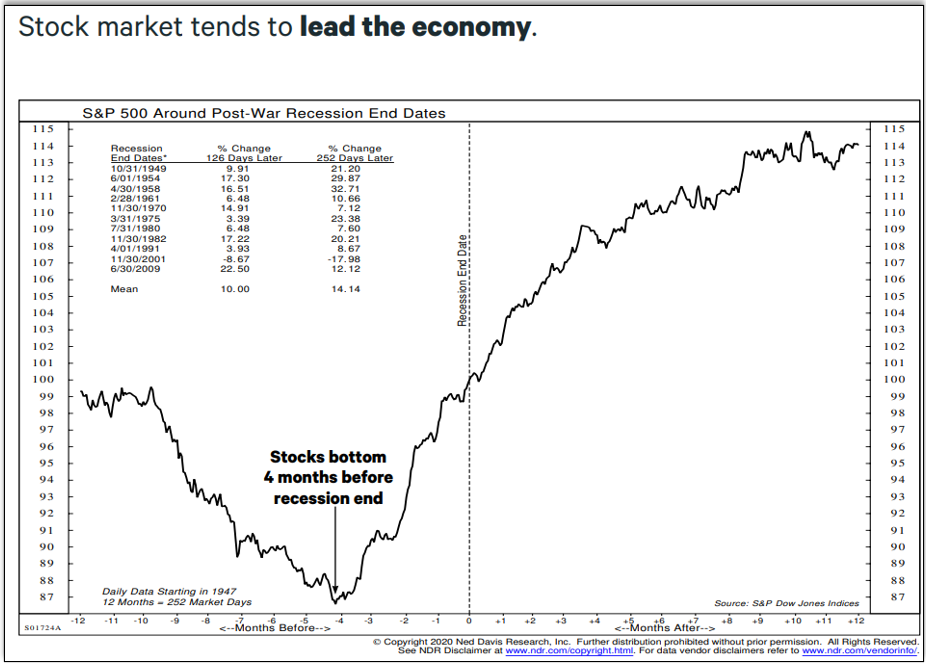

Doesn’t that all sound surprising? Investors always forget that reported data is lagging (reflecting events that happened days or weeks ago). Markets look into the future.

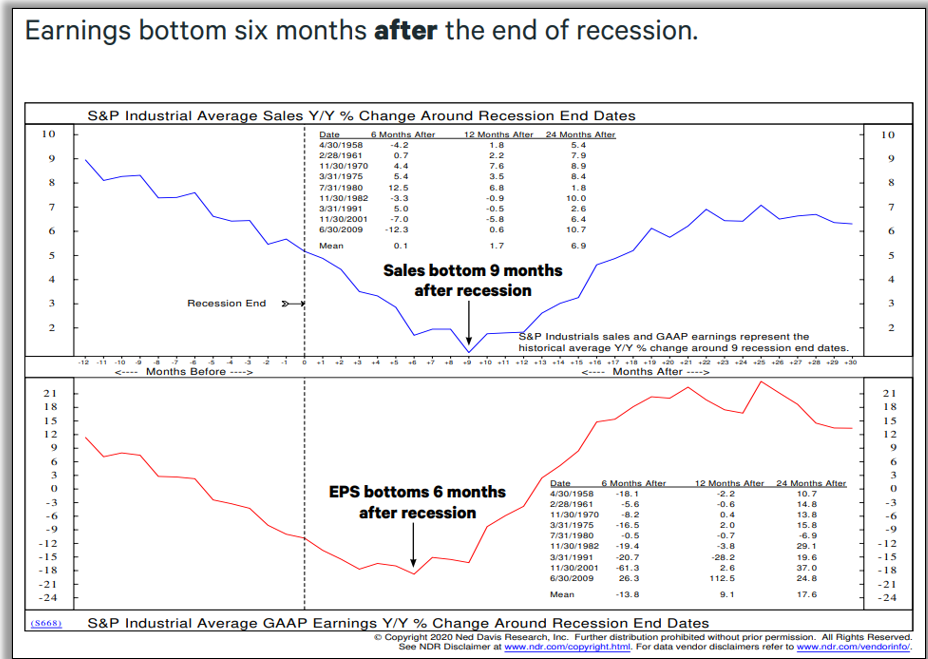

The data shows that markets bottom around 4 months BEFORE the end of the recession on average. In comparison, corporate earnings bottom 6 months AFTER the end of a recession!

This means that the market would already have a nearly 1-year head-start on you if you decide to invest based on earnings reports and other investment strategies based on economic data. You would, unfortunately, have missed extremely good gains on your money.

The unprecedented rally has caused a few strategists to embarrassingly rollback their dire predictions for the stock market.

5. What Will Happen?

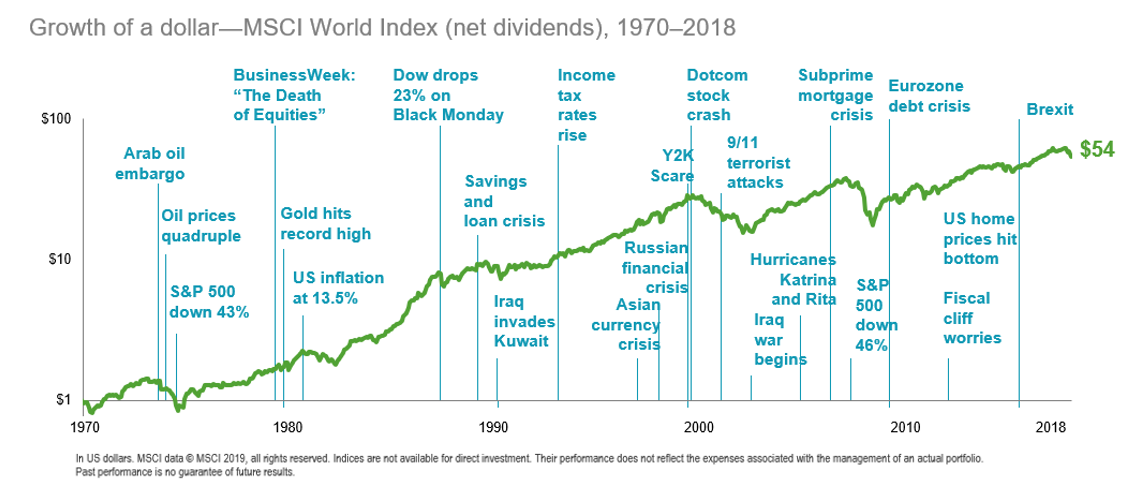

Markets will continue to function normally despite whatever crisis may appear. It has done so for decades and will continue to do so for decades to come. Disciplined investors should not get distracted by the noise, news and what others are doing. Focus on your goals, and look beyond the concerns of today to the long-term growth potential of markets.

The diagram below shows the growth of wealth for $1 invested in globally diversified stocks from 1970 to the present. We have lurched from one crisis to another and yet always emerged stronger.

6. What We Will Continue to Do for Your Portfolios

- We will keep you invested in the best assets for your portfolios. We always emphasise extreme diversification with specific tilts to academically proven drivers of return (smaller, cheaper and more profitable companies).This keeps you safe from risks associated with single companies, industries or countries, and gives you the best chance for long-term out-performance.

- We continuously monitor for signs of financial stress – as financial stress typically leads to longer-lasting damage. We run monthly risk assessments on your individual portfolios to ensure that they are acting within the guidelines we have designed for them. We also make daily risk readings from a quantitative model that tells us whether the market is investible or not. This guides our investment decisions on whether we should really go to cash or buy more equities when prices decline.

- We will rebalance when necessary, as we did for you in March. This will help you greatly in terms of ensuring a quick recovery and managing risk within your portfolio. As markets recover and your equity positions rise, we will trim profits as necessary.

The investment climate right now is highly dynamic. Things may get better or they may get worse, but as long as we continue to manage your portfolio based on evidence-based strategies and stick to our philosophy, we will ultimately be in a good state.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.