Investing With a Conscience

03 July 2020

“You can’t make a good deal with a bad person.”

—Warren Buffett

Investors sometimes worry that their investments might be funding activities that go against their values. Someone who lost a loved one to a drunk driver may refuse to invest in alcohol. A pacifist may balk at the thought of their funds going towards weapons of war.

Such concerns are what led to ESG Investing: the process of considering environmental, social and governance factors alongside financial factors in the investment decision-making process.

ESG was first described as socially-responsible investing in the 1960s. It allowed investors to exclude stocks or entire industries from their portfolios based on specific business activities, such as tobacco production or involvement in the South African apartheid regime.

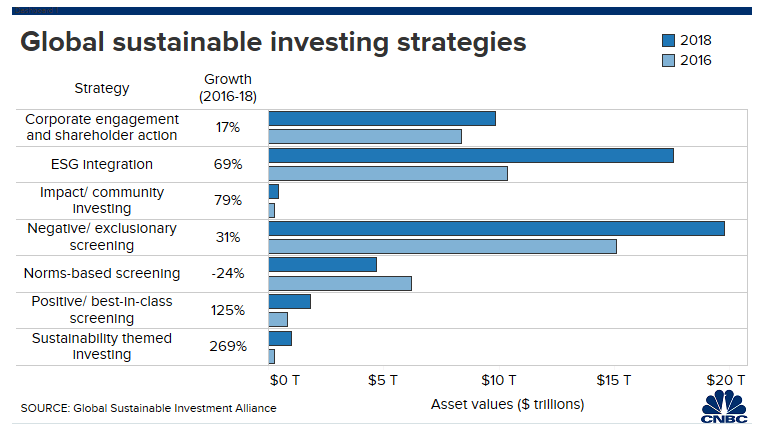

While such ethical considerations have long been common motivations of ESG investors, the field has been rapidly growing and evolving beyond that.

Nowadays, ESG investing involves not just ethical and moral beliefs but environmental and other sustainability concerns as well. How good a company is at worker welfare, water management, accident prevention, safety policies, supply chains and resource management also impacts their cash flow and profitability.

ESG investing started gaining ground in January 2004, when then- UN Secretary General Kofi Annan wrote to over 50 CEOs of major financial institutions. He invited them to participate in a joint initiative to find ways to integrate ESG investing principles into capital markets. The result of this was the landmark study, “Who Cares Wins“.

Today, ESG investing has an estimated AUM of over $30 trillion – forming more than a quarter of all invested assets. This is expected to double over the next decade.

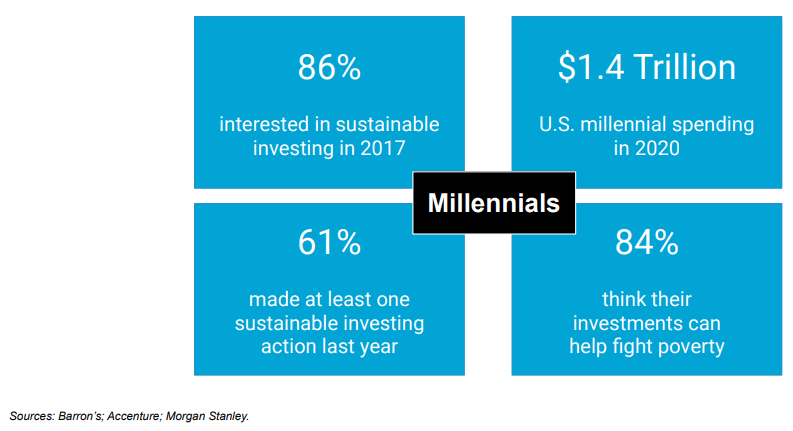

A large factor behind the rise of ESG investing is the growing influence of younger investors in investment decisions. We are in the midst of the wealth transfer from baby boomers to millennials as they gradually take over their parents’ portfolios.

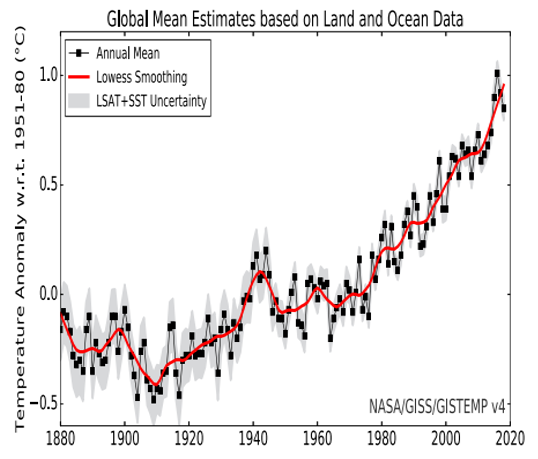

When we couple this with the increasing awareness and urgency around global warming, climate change and social inequalities, ESG is likely to continue gaining ground. More and more, investors see their investments as one avenue to make a positive difference in the world.

Of course, ESG is not without its critics. One early pushback was the claim that cutting out entire industries from the market would mean compromising on returns.

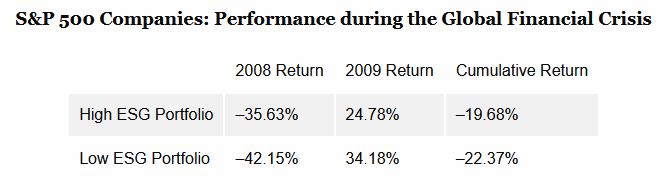

However, this assumption is unsupported by reality. In fact, there’s evidence that ESG investments can expect superior returns. The CFA Institute analysed annual returns from 2008 to 2018 and found that high ESG portfolios saw an average annual return of 7.34%, compared to 7.18% for low ESG portfolios.

High ESG portfolios also experienced lower volatility, at 14.91% vs 16.38%. They did especially well during stock market declines, such as the Great Financial Crisis of 2008.

Why is this so? There are several explanations. More sustainable companies use fewer resources and use them more effectively, which improves productivity and helps their bottom line. Companies that prioritise quality and refuse to cut corners – which often goes hand-in-hand with unethical work environments – generate better customer feedback and loyalty, as well as attract better talent.

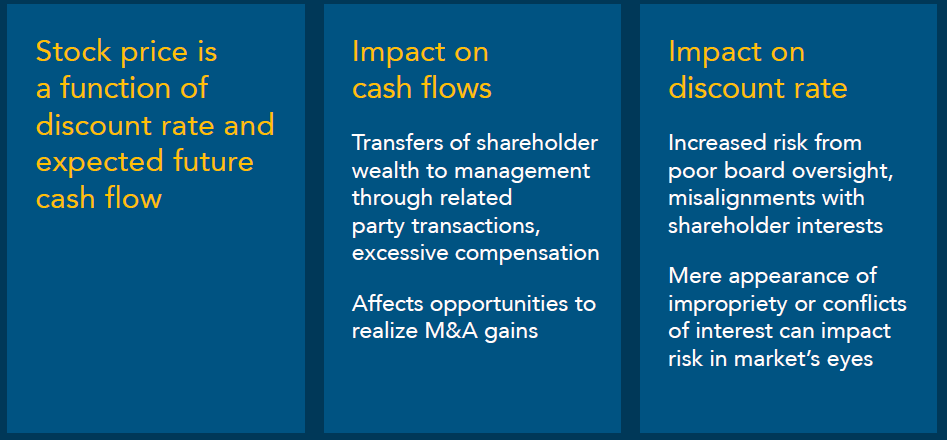

Companies with improved corporate governance likewise often see higher stock prices, lower discount rates and higher cash flows. One area of focus in ESG investing is to decrease investments in companies with anti-takeover provisions (poison pill), related party transactions, and that are not adhering to industry best practices. Such activities are not just ethically-questionable but are also shareholder unfriendly, decreasing the value of ownership. For example, providing unreasonably high compensation to their management will negatively impact a company’s cashflows and reduce shareholder wealth.

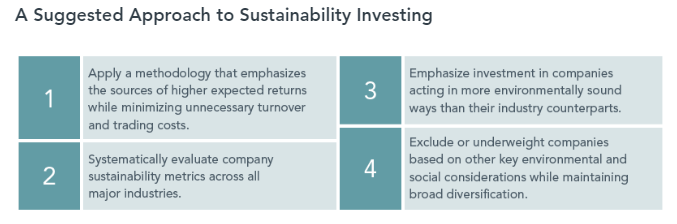

The managers we work with have been using a patented investment methodology to effectively implement sustainability strategies for more than a decade.

This combination of company selection and weighting allows for a substantially reduced exposure to greenhouse gas and fossil fuel emissions – important goals for many investors – while providing a robust, broadly diversified investment strategy that is focused on the drivers of expected returns, such as smaller capitalisation companies, value and profitability.

The key takeaway here is that investing well and adhering to your values need not be mutually exclusive. It can be a win-win situation for investors.

By starting with a robust investment framework and overlaying it with ethics and sustainability considerations, we can have a cost-effective approach that allows you to pursue your values without compromising on sound investment principles or accepting lower expected returns.

Invest well, and invest well.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.