The Economy and Market Returns are Not Related

18 June 2020

“The only function of economic forecasting is to make astrology look respectable.”

— John Kenneth Galbraith

The US is currently experiencing record unemployment. The numbers currently stand at 44 million. Singapore is not faring much better, with unemployment expected to hit 4-5% this year. Those are levels we have not seen since 2003. Businesses are struggling. Many companies are feeling the stress.

And yet, in the midst of all this, markets are nearly 30% up from the March lows and have recouped half of their losses this year. Stocks continue surging amidst bleak economic news.

If you’re confused by this, you’re not alone. The past few weeks have produced many examples of the stark contrast between stock market performance and economic indicators.

Many investors don’t realise that markets are forward-looking. They anticipate what will happen a few months down the road, rather than reflecting what has already happened.

For example, if the market expects the economic environment to weaken company cash flows, stock markets may react before that weakening actually happens. That’s because expectations are embedded in prices. The eventual direction of the stock market will also depend on how the actual outcome compares to expectations. If things don’t turn out as badly as expected, poor economic news can thus still be greeted with a positive stock reaction.

The Economy and Stocks

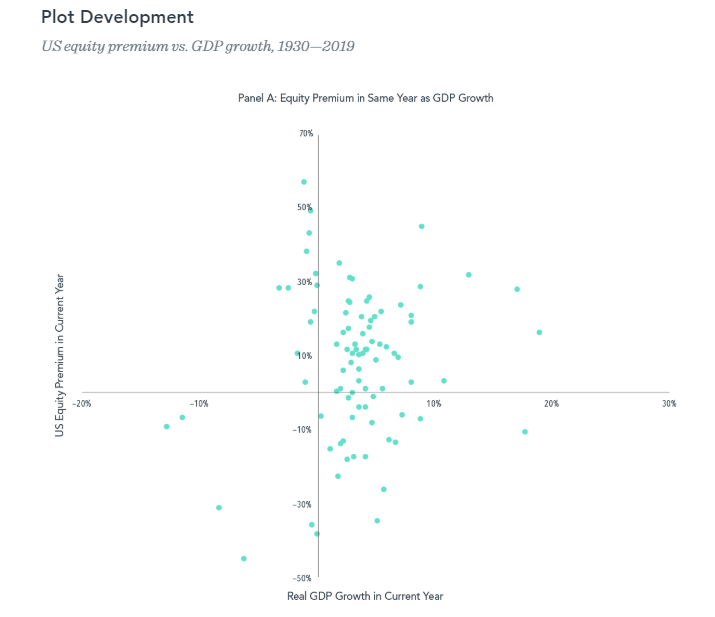

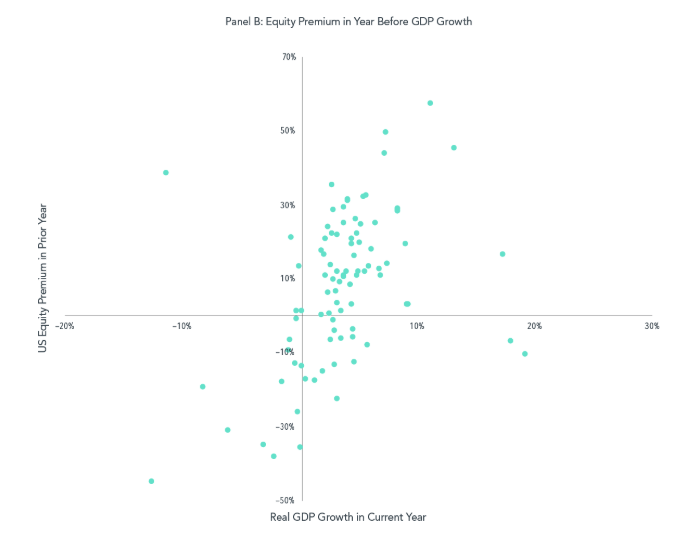

A look at decades of data from the US stock market shows no discernible relation between that and the economy. Changes in GDP have not been strongly related to simultaneous stock market returns. There were many occasions when stock returns were strongly positive despite negative growth.

However, it’s important to note that this does not imply that financial markets ignore macroeconomic data. After all, GDP encompasses several measures of the economy beyond just corporate profits. Many other factors drive stock market returns, and reported data is often lagging.

Debt and Stocks

Some investors are worried about the fallout from large government expenditures designed to ease the economic burden of the COVID-19 pandemic. At the end of the day, will money printing create a financial burden for governments that affects future stock returns? That worry has been fuelling panic-buying of gold and cryptocurrencies.

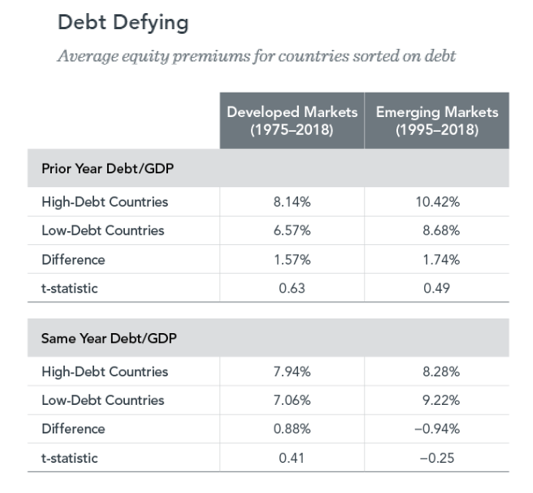

The chart below should help allay those concerns of debt affecting equity performance. When we sort countries each year on their debt-to-GDP for the prior year, we find that average annual equity premiums have been slightly higher for high-debt countries than low-debt countries in both developed and emerging markets.

However, the return differences’ small t-statistics – which measure if there is a significant difference between the means of two groups – suggest these averages are not reliably different from one another.

In the image above, the top table uses prior year debt-to-GDP data to sort countries into high/low groups. For investors more concerned about where the debt ends up, the bottom table ranks countries on debt-to-GDP at the end of the current year (assuming perfect foresight of end-of-year debt levels). In both situations, average equity premiums are similar for high- and low-debt countries.

Like the results for GDP growth, these imply that markets have generally priced in expectations for future government debt.

What Does this Tell Us?

Macroeconomic variables and investment decisions are like Mentos and Coke. Caution should be exercised when combining the two.

The results we have presented here are consistent with markets aggregating and processing vast sets of macroeconomic indicators and expectations for those indicators. Many of our old assumptions do not gel with what typical financial news headlines or strategists declare.

As we recently highlighted, stocks bottom months before the recession ends. Trading and jumping in and out of the market is thus a bad idea; it is very hard to get the timing right, and waiting on the sidelines will also do you no favours.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.