How to Spend Your $600 Solidarity Payment

28 May 2020

“You’ve got to tell your money what to do or it will leave.”

— Dave Ramsey

Extraordinary times lead to extraordinary measures. Finance Minister Heng Swee Keat just announced a fourth COVID-19 support package on Tuesday, 26 May 2020, which will go towards job support for affected workers and the social service sector.

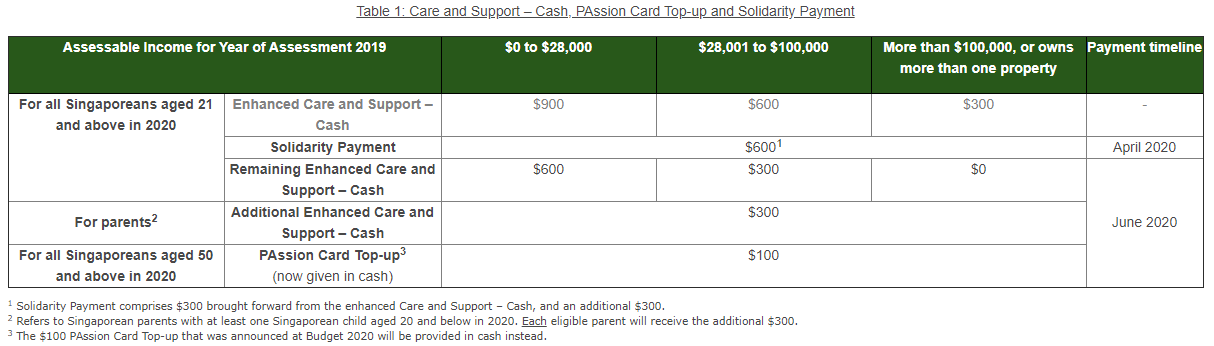

For most Singaporeans, however, the main point of interest was the earlier ‘stimulus’ payment of $600 that each individual would get under the Solidarity Budget:

But before you run out and spend the money (assuming you haven’t already), stop and think about it for a moment. You really don’t need to stimulate the economy if you don’t want to.

Since the outbreak, many of us have found it difficult to make good financial decisions. Some have also taken advantage of the downtime to re-look at their lives and finances, and take the opportunity to sort out what they couldn’t in the past. There is nothing like a global health crisis to make you realise how fragile life is and how swiftly what you take for granted can vanish almost overnight.

So, if you’re still thinking about how to spend those ‘free dollars’, you may want to consider a bucket approach.

Cash Bucket

You could save the money to cover your short-term spending needs. Ideally, you should have at least 6 months of living expenses saved up in the bank in case you suddenly lose your income.

However, as central banks have been pumping vast liquidity into the market during this crisis, interest rates on savings accounts are close to 0%. If you want slightly higher yields, you can look to placing your cash in short-term money market or high-grade bond funds instead.

Investment Bucket

There are plenty of opportunities here. You could top up your existing investment portfolio to help you reach your long-term goals just that bit faster. If you haven’t yet started investing, your Solidarity Payment could help you attain the minimum lump sum to get started, assuming you don’t have more urgent expenses.

You could also top up your (or your family members’) CPF accounts to achieve a decent risk-free interest rate. (Do remember that this is a one-way street and you won’t be able to touch most of your CPF money until you reach retirement age.)

If you have kids, you could start your little ones along on their investment journey by opening a monthly Regular Savings Programme account. Make the commitment with them to save and invest a specific amount every month.

Charitable Bucket

A lot of volunteer welfare organisations and religious institutions have seen a sudden and drastic reduction in their donations and offerings, due to circuit breaker measures resulting in the suspension of services and activities. This has impaired their ability to help those in need, whose numbers have also swelled.

Many businesses have also suffered a severe loss of revenue despite still having salaries, rentals and other fixed costs to pay. This in turn has led to pay cuts for individuals and possibly retrenchments. As such, many are in need of financial support to tide them over this period until such time they are able to find another job or income stream.

Perhaps you can use your Solidarity Payment to help out people you know who are in need, or to donate to your favourite charity.

If the organisation you donate to is an Institution of a Public Character (IPC), you’ll likely be eligible for a deduction on your taxable income. Do good and get some good in return. Please refer to the IRAS website for more details.

Debt Bucket

This is not related to your cash payout, but is still an important component of your financial plan.

Many people are experiencing rising debt during this period. If you’re struggling to keep up with your bills, call up your mortgage provider, utility, insurer or even credit card company to request for flexible payment options. Many institutions have rolled out debt relief plans in response to the economic impact of COVID-19. The Monetary Authority of Singapore (MAS) has an FAQ page that addresses some commonly asked questions.

Resilience is a key part of the human spirit. Despite that and the raft of measures that have been rolled out, there will still be many individuals and businesses that may fall through the cracks and suffer in this economic downturn. If you need to spend the money, do so.

However, if you have your buckets already covered, why not do something that would benefit yourself and others at the same time? Support a local business by booking an online class. ‘Dabao’ meals from your neighbourhood café. Invest in a new or existing hobby and get the supplies from the mom and pop shop down the road.

We don’t know when life will return to normal. In the meantime, consider helping those who are more severely impacted, and give them a reason to smile.

Till we meet again, stay safe and healthy!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.