Does a Sell-Off Equate to a Negative Year?

04 June 2020

“Stocks take the elevator down but the staircase up.”

— Anon.

This quote has been played out during this market turbulence that has seen the stock market plummeting so much faster than it rises. It’s a typical observation in nearly all market sell-offs. The primary culprit is our behavioural biases.

Nobel laureate Daniel Kahneman and cognitive psychologist Amos Tversky documented this phenomenon in 1979 as the ‘prospect theory’. They noticed that people were more fearful of losing money than making it, which we have written about before. This has meant investors would rather sell first and ask questions later, afraid of higher losses if they wait and markets continue to fall. Conversely, the fear of missing out on potential gains does not affect them as much.

However, volatility is a normal part of investing. Market tumbles may be scary but not surprising. If you cannot remember what kind of losses you should expect from your portfolio, speak to your adviser about it. Explaining possible outcomes, losses and returns, and detailing the exact specification of your investments is what any investment adviser worth his salt should be expected to do.

Whenever markets hit a bump (and they will), investors tend to assume that they will be sitting on losses for the year. That could very well be true if you are holding undiversified investments like a handful of stocks, illiquid investments or other risky products. But if you are holding a diversified, market-like exposure portfolio, this is unlikely to be true in many cases.

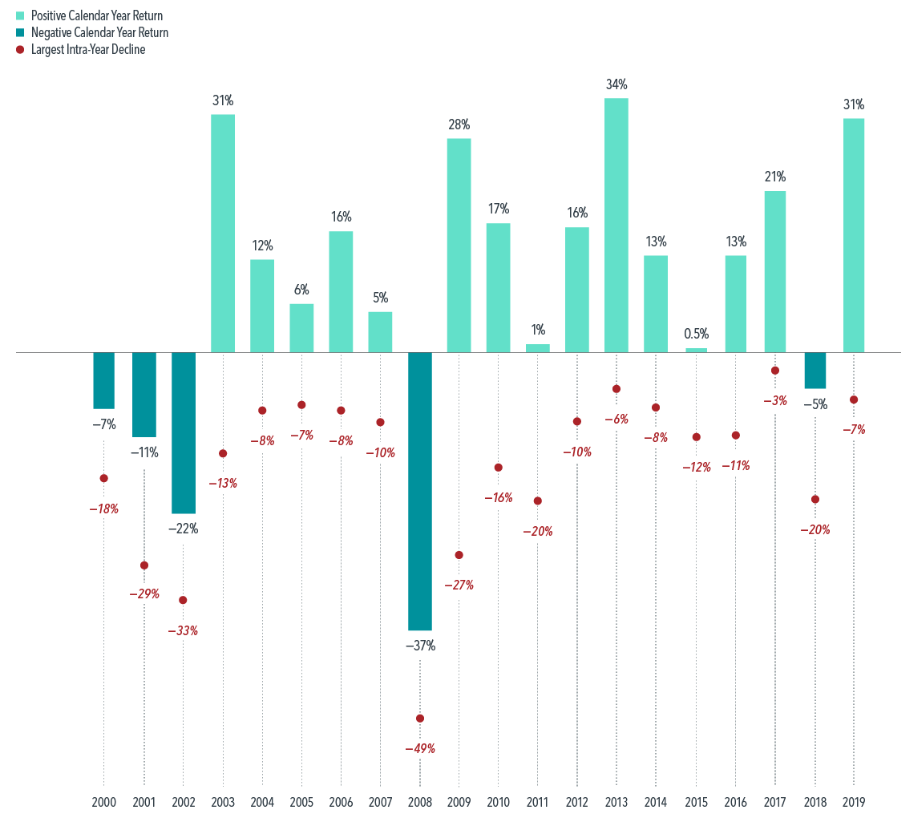

A look at the broad US stock market (below) shows both the worst loss of the year (in red) as well as the complete market return (green bar) for that year.

(Click to enlarge)

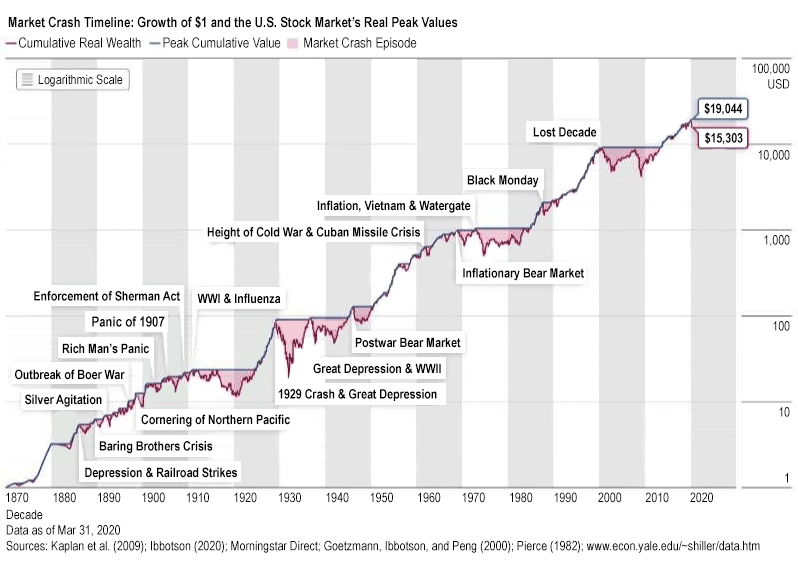

As you can see, the chart shows that 15 out of 20 of the past calendar years produced positive returns, despite notable dips of as much as 27% in many of those years. Having such a long-term focus can help investors keep perspective. One way to get that perspective is to study past market declines and their corresponding recoveries. The chart below shows how $1 would have grown over the decades and through all the tumultuous periods along the way.

(Click to enlarge)

Market turbulence is no fun. That’s especially true if you see your investment values decline. But while investors often face each new crisis – including this one – thinking, “this is unprecedented”, history shows otherwise. As long as you have a properly diversified portfolio, with the appropriate mix of equities and bonds, you can sleep easy at night knowing that every crisis you might experience is only temporary in the bigger scheme of things.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.