Behavioural Biases in Investing

Attraction to Rising Prices

03 February 2016

Don’t we all love a good discount? I know many people who would go to great lengths to bargain, drive to, and hunt for something on sale just to get that extra dollar off. Sometimes, the effort costs much more than the savings, but there is a sense of satisfaction gained from getting that extra discount.

The picture below shows what typically happens whenever there is a good sale. Don’t you feel like joining in? A drop in car premiums, Black Friday 50% sales, CNY sales, you name it. You just feel like grabbing everything within reach before someone else takes it away from you.

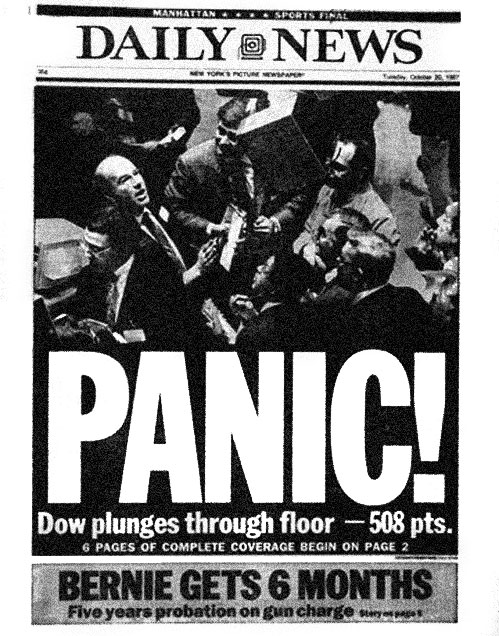

Yet, strangely, when there is a huge discount in the ownership in companies (shares), people run away! Why is this so? Applying the same logic, people should be queuing up in droves just to get their hands on some of these bargains! But everyone stays away, thinking that prices would just get lower.

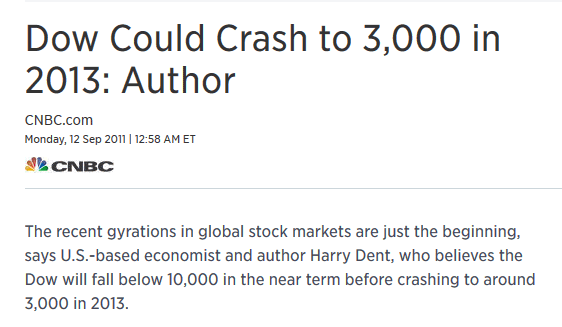

In the same vein, humans are drawn and attracted to rising prices. Whenever stocks go up, they keep coming back to buy more and more, thinking they would go up even further! That’s why you have all manner of predictions, such as “Dow 30,000”, based on the assumption that prices would never fall.

If prices are high, logically, we should cut back. That’s why a good advisor would tell you to trim, rebalance and generally reduce some risk when things get a bit heated. After all, whenever things get expensive in the grocery store or supermarket, don’t we all tighten our belts a bit?

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.