Behavioural Biases in Investing

Chasing Hot Themes

10 January 2016

This is actually a follow-on to our article on the recency illusion.

How many times do we have a certain mandate (for e.g. a conservative investor to invest only in strategies with a Value-at-Risk number below 7%, or the investor who gives up 3 years into a “Growth” strategy to buy into bonds because “Growth” isn’t working out too well) only to switch to something else because we heard of a good idea from a magazine, a friend or the news?

This fallacy of Chasing the Next Hot Theme is a sure-fire way to underperform tremendously and subject the investor to a Style or Risk drift – where the initial investment mandate is not followed but deviated from. Only after suffering a big loss does the investor try to search for what went wrong, only to find to his or her dismay that the current investment strategy is no longer aligned to the original intent.

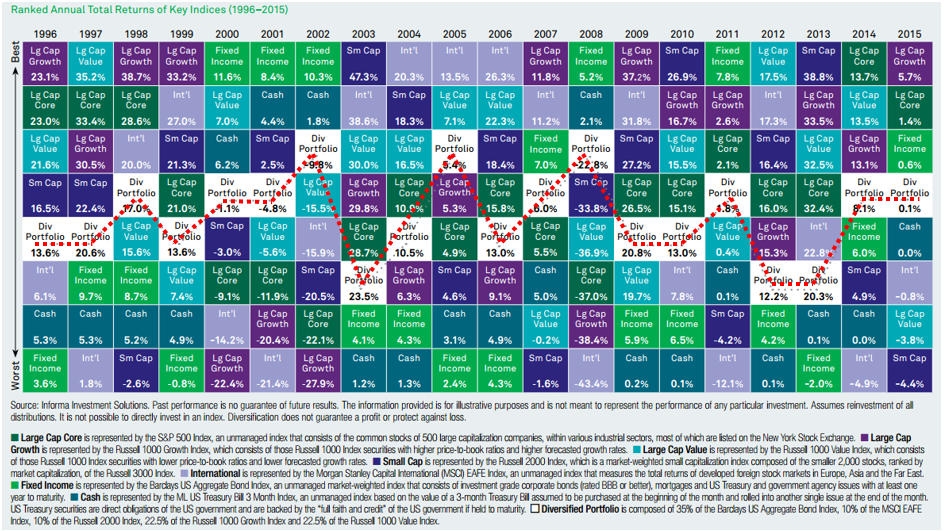

The diagram below shows the top sector performers in each calendar year, ranked according to returns. You will notice that it is a myriad of colours, for there is no systematic way to allocate to the best performer every year. During bull markets – equity growth does well. During bear markets – cash or fixed income does well. How does one forecast with precision and certainty? It is impossible.

The best way to get a consistent return year in, year out, is to hold a broadly-diversified portfolio (both geographically and by market sector) – which can be seen in the white boxes and dotted red lines. There is less variability. Investors need not forecast and be stressed over whether it will work out or not, and you will be able to sleep better at night.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.