Behavioural Biases in Investing

Causal Connections

02 July 2015

A lot of research has been dedicated to trying to understand irrational human behaviour. Everyone is prone to such errors. It is the way we are built. Irrational thinking especially manifests itself when dealing with something very close to everyone’s heart: MONEY. However, understanding potential flaws in your thinking will make you more aware of how these may affect your investing behaviour.

For instance, our mind is wired to automatically search for causes behind a piece of information. The problem is that, more often than not, these ’causes’ are instead erroneous assumptions based in fiction rather than fact.

Here is a simple example:

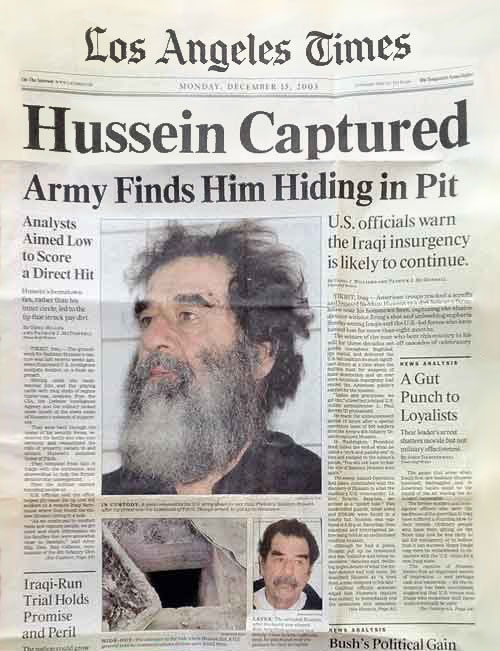

In December 2003, headlines blared about the capture of Saddam Hussein.

At 1301 hours, Bloomberg News reported that US Treasuries rose (a sign of risk aversion) – because Hussein’s capture might not curb terrorism.

Exactly half an hour later, at 1331 hours, Bloomberg News reported that US Treasuries fell (a sign of risk-taking) – because Hussein’s capture boosted the allure of risky assets.

How did the same piece of news cause two different and totally opposite market events? If we were to sit down and quietly think about it, we would find it more plausible that the rise and fall of US Treasuries was due to some other unrelated event – investors buying and selling according to their own requirements and needs, rather than because of one man’s capture.

Every day, we read headlines that are designed to be emotionally charged and make us bypass logical thinking for fight or flight mode. We need to recognise this tactic and refuse to fall prey to it. Always take a step back, and refuse to make any rash decisions without first thinking things through.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.