Do you have the FAANG Mentality?

14 February 2020

“Risk comes from not knowing what you are doing.”

— Warren Buffett

Many investors think they know what they are doing. “I’ll buy this stock or product, since I am familiar with the industry,” one might say. Or, “I see a lot of people using it, so it’s sure to make money.” Or, “Technological advances have changed the world we live in, so this time it’s different.”

2019 saw the continued rise of everyone’s stock darlings – the FAANG group, comprising Facebook, Amazon, Apple, Netflix, and Google (now trading as Alphabet). Financial institutions have likewise sold a ton of structured products holding various combinations of these stocks. Meanwhile, Tesla’s eye-popping returns in the beginning of 2020 prompted a lot of financial media coverage.

FAANG stocks have posted impressive gains throughout the years. All of them are now worth many times their initial public offering prices, and many investors have come to see FAANG as a powerful group holding sway over the markets.

But how much of the market’s recent returns are they actually responsible for? And does their performance point to a change in the markets?

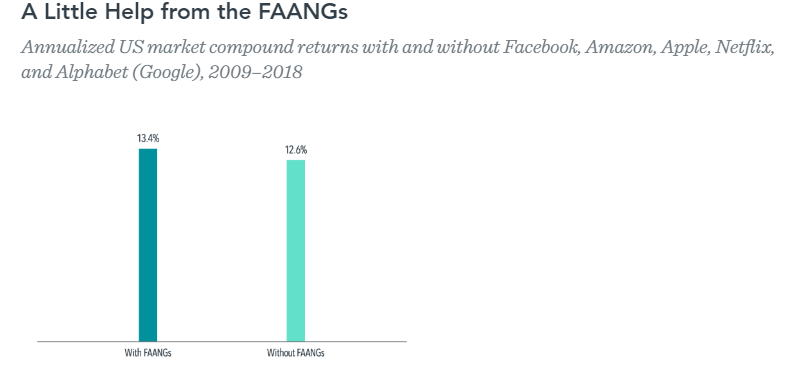

Over the 10 years through 31 December 2018, the US broad market returned an annualized 13.4%, as shown in the chart above. If we exclude FAANG stocks, the market return would have been 12.6%. That 0.8 percentage point bump were the result of FAANG collectively averaging a 30.4% annual return over the decade.

However, this is not unusual. Investors may be surprised to learn that it is actually quite common for a sizable portion of overall market return to be driven by a subset of stocks.

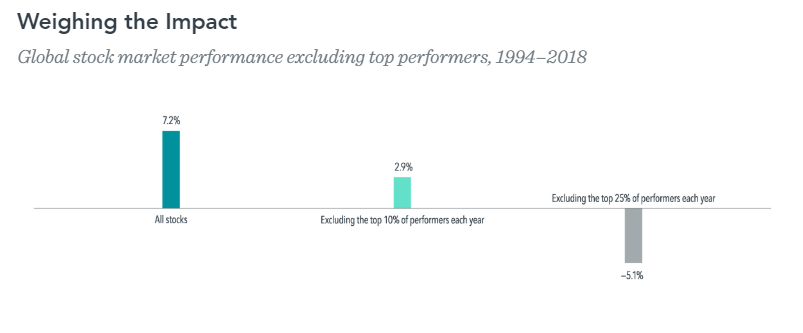

For example, the chart below shows how excluding the annual top 10% of performers from 1994 to 2018 would have reduced global market performance from 7.2% to just 2.9%. Excluding the best 25% of performers would have turned a positive return into a relatively large negative return.

The same applies when capturing the premiums associated with a company’s size and its price-to-book ratio. Research by Eugene Fama and Kenneth French (“Migration,” 2006) provides evidence that these premiums are driven in large part by a subset of stocks migrating across the market.

So, the solution seems to be that we should all be buying the top performers for each year, right? But here’s the catch: research has shown there is no reliable way to predict just what the top-performing stocks will be. Since 1994, among the 10% best-performing stocks, less than a fifth maintained their ranking in the following year.

You may have made a lot of money from the FAANG group, or be looking to jump on the bandwagon. But remember this – the tendency for strong market performance to be concentrated in just a few stocks is also a cautionary tale about the importance of diversification. The fewer stocks you own, the lower your probability of actually holding the stocks that will bring the greatest returns.

So the fool-proof and obvious answer must be to hold as many stocks that are in the market as possible. An investment approach built around broad diversification can thus help achieve a more reliable outcome for investors over the long term – sharp acronym or not!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.