Which is the best country to invest in?

07 February 2020

“There is a close logical connection between the concept of a safety margin and the principle of diversification.”

— Benjamin Graham

As we enter the Year of the Rat, investment advisors and CIOs have been offering up varying thematic predictions about how the year will unfold. Take all this advice in jest. There is no evidence that a certain country, or a type of company, sector or even specific assets perform better during different zodiac animal years. So, rather than search for what’s good in a rat year, consider diversifying instead.

Every day, we enjoy the benefits of an interconnected world. We might start our day with a cup of coffee that originated in South America, check our email on a smartphone designed in California and manufactured in Taiwan, then shower and change into clothes woven from Egyptian fabrics before driving a German-made car or riding in a French-built train to work.

As consumers, we rarely think twice about the benefits of access to the wide range of goods the global market has to offer. Yet, as investors, we like to stick to familiar, recognisable names. We thus concentrate our portfolios in favour of our home market, or on a specific country or theme, at the expense of global diversification.

In a survey done by Eastspring Investments, Singapore stocks form 40% of Singaporean investors’ holdings – despite the Singapore stock market representing less than 1% on the world stage. To further compound this problem, many Singaporeans love to hold properties, multiple ones at that. With property forming a huge absolute amount, we are already overly-exposed to our home market and economy.

It is understandable why investors prefer to seek the comforts of home. There are many uncertainties around accessing overseas investments. Investors may be unfamiliar with the companies, confused over the wide range of products, and unsure how to navigate the tax implications of foreign jurisdictions. However, neglecting the benefits that global diversification has to offer may increase risks and decrease the investment opportunity set.

Diversification Helps You Achieve the Returns of All Stock Markets

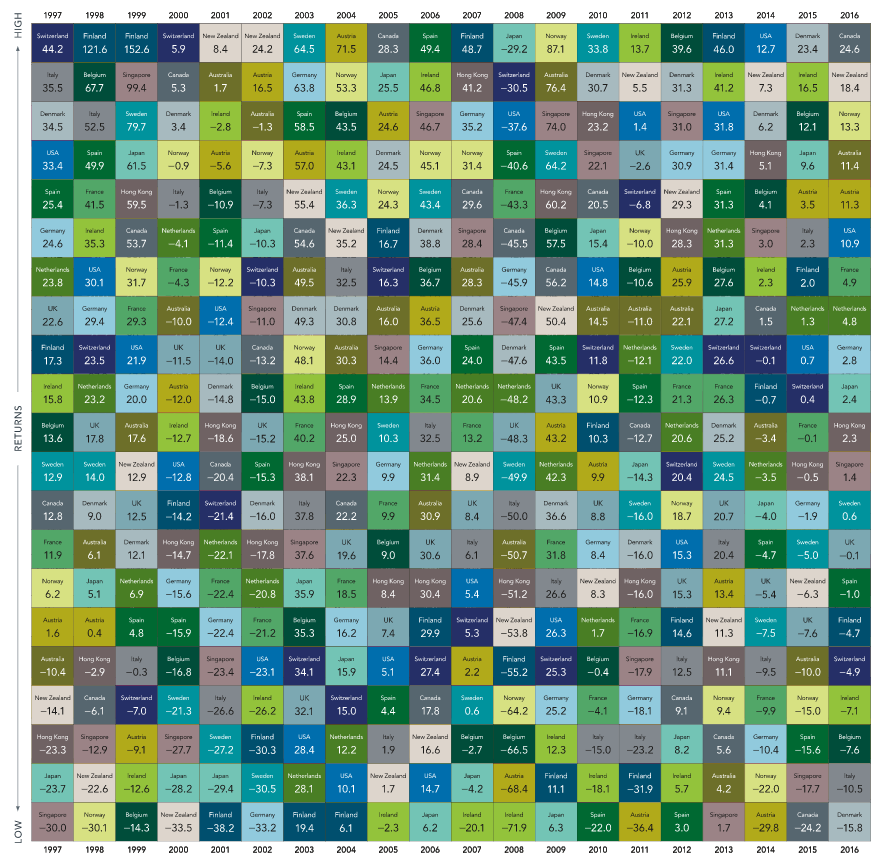

The chart below shows how variable the annual stock market returns of developed countries are. You can see how there was no one consistent winner. Over the 20 years ending in December 2016, 13 different countries (out of 21) each took the top spot at least once. No country had the best‑performing market for more than two consecutive years.

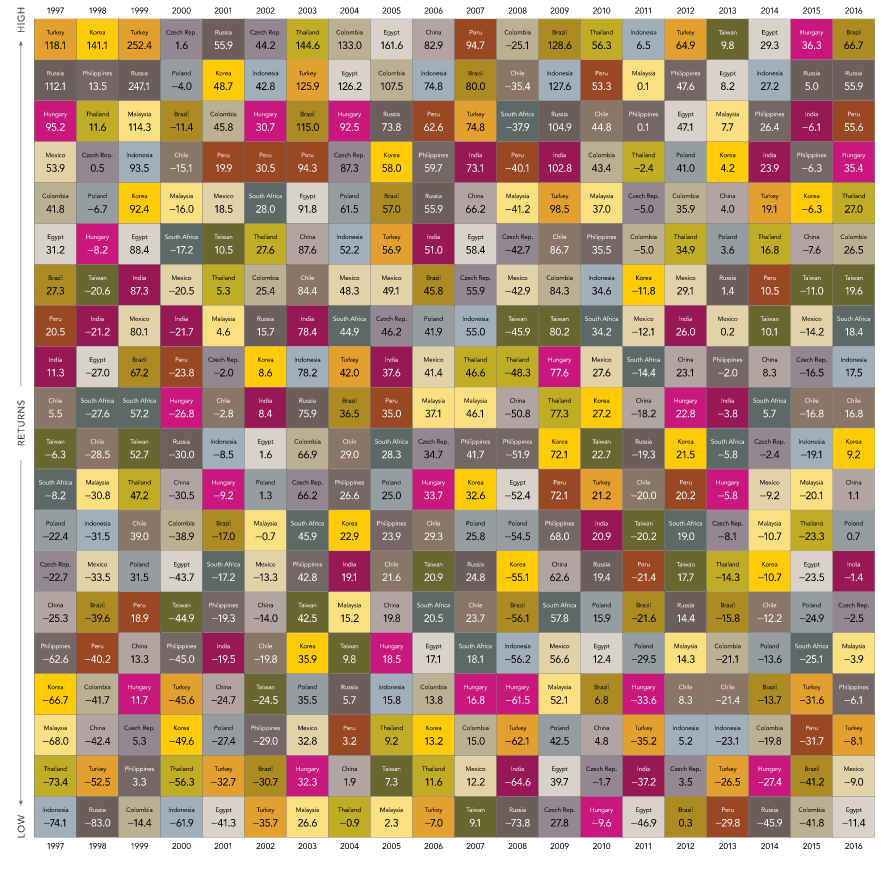

You may ask, what about Emerging Markets? China has been the growth powerhouse since the 2000s. Surely it should rank at the top?

And yet the chart below shows otherwise! It is no less variable than the chart of developed countries. 13 different Emerging Market countries (out of 20) had the best-performing market of the year at some point. No country had the best-performing market in consecutive years.

What this data shows is that it is difficult to know which markets will outperform from year to year. By holding a globally diversified portfolio, however, investors will be well-positioned to capture returns wherever they occur.

Diversification Helps You Lower The Risk Of Your Portfolio

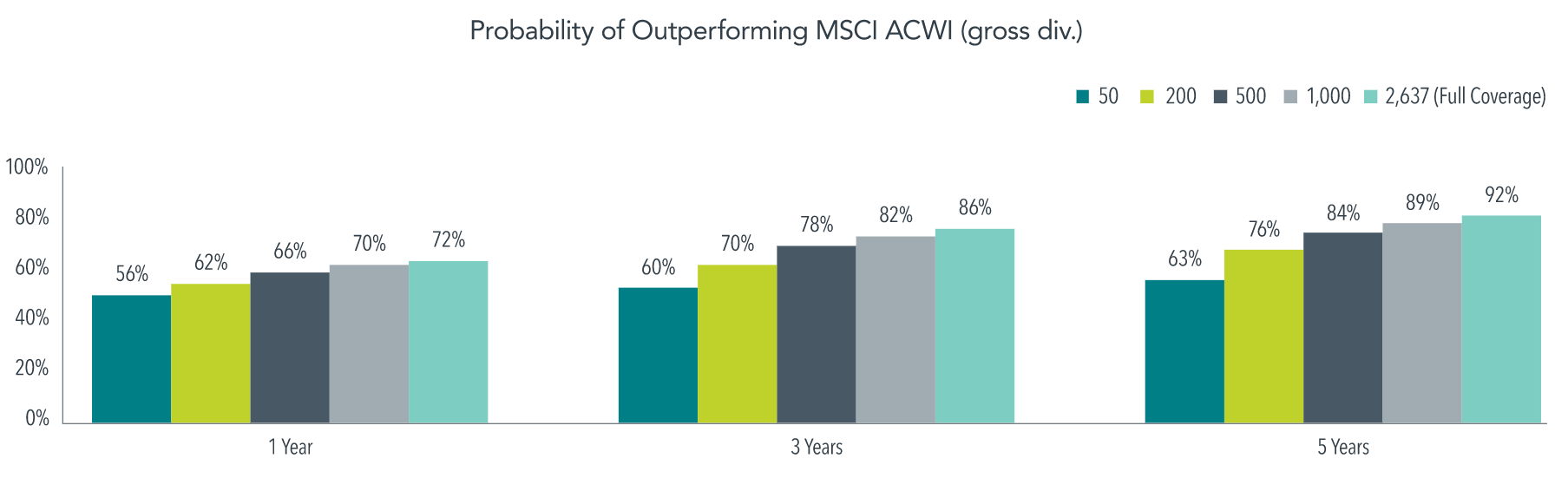

Consider the research shown below, which shows the probability of outperformance for portfolios of 50, 200, 500, 1,000 and over 2,600 stocks. As you can see, the number of stocks or securities in a portfolio is directly correlated to its performance. Holding thousands of securities significantly increases the probability of doing better than the global stock index benchmark.

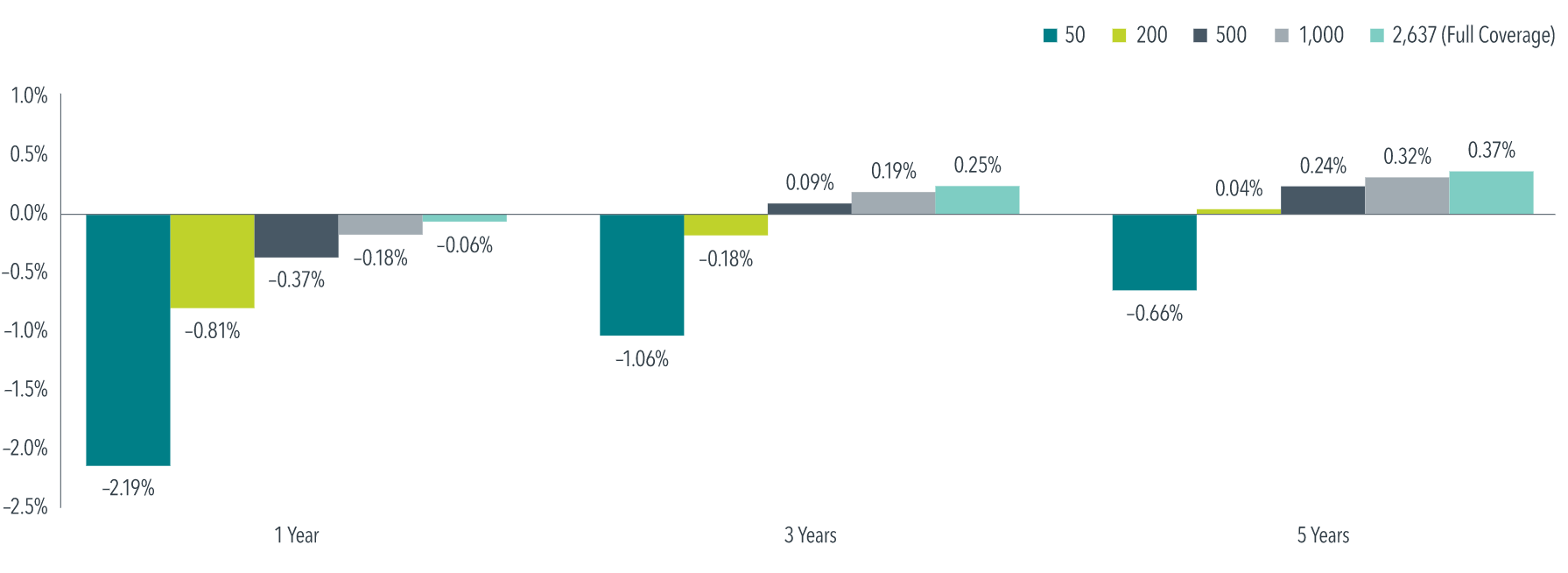

What about periods of poor performance? Those outcomes also improve with increasing diversification. The graph below shows the 25th percentile of excess returns for those different portfolios. As the portfolios become more diversified, even the poorest performance periods become less negative.

For example, the 25th percentile of excess returns for the one-year investment horizon increases markedly from –2.19% to –0.06% as diversification increases from 50-stock sample portfolios to the full coverage index. Hence, diversification may not just improve your chances of outperformance but also meaningfully mitigate the underperformance you might experience relative to the benchmark. Investors who hold a few stocks would be much better off holding a passive instrument such as an ETF. Their stock portfolio would not provide meaningful returns in comparison.

In different market environments, and as sentiments about global diversification and its value ebb and flow, it is helpful to remember that history has not shown any one market in the world to be a consistent outperformer. In our line of work, we always see prospects whose investment portfolios are woefully skewed towards one or two thematic sectors or countries. Although they may hold a number of funds or stocks, they are unaware that the products were all investing in the same thing or exposed to the same economy.

By pursuing a globally diversified approach to investing, you won’t have to attempt to pick winners to achieve a rewarding investment experience. Instead, you can be confident that your portfolio will always hold the best (and worst) performing countries each year. If you need help on how to put such a portfolio together, speak to your adviser to find out more!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.