The Death of Bonds and other ‘Death’ Claims

01 November 2019

“Reports of my death have been greatly exaggerated.”

– Mark Twain

On 16 October 2019, two analysts at the Bank of America declared that the 60/40 balanced portfolio was dead. (This is an investment portfolio holding 60% in stocks and 40% in bonds.) Their reasoning was that “investors were buying bonds for returns, and not for safety”; and that, combined with where bond prices are now, meant that bonds had lost their diversification purpose.

Let’s look at a couple of other famous death claims over the years. Following the tremendous stock and bond losses in the 2008 Great Financial Crisis, a claim was made that modern portfolio theory was dead. On hindsight, however, we now know that investors of poor quality companies and a few select “high quality” investment products lost money purely due to the systemic problem of how US mortgages had been packaged and rated. Although stocks lost their value on paper, they rebounded after 6 years, and there was nothing wrong with actual high-quality government bonds.

Going further back in time, we had the famous 1979 Businessweek article that proclaimed the ‘death of equities‘. Stocks subsequently went on a nearly two-decade-long rally, again effectively disproving that spurious ‘death’ claim.

It now seems commonplace to see flashy headlines proclaim the sad demise of a well-known investment principle, usually based on claims that as it didn’t seem to work for the past 5 years, it would presumably never work again.

Yet while all these headlines seem to have some basis, the research backing them up is flimsy at best. A little sleuthing will show that either the dataset used covers just too short a time frame, or that they were based on the wrong type of data in the first place.

For example, the Bank of America piece highlighted how the prices of stocks and bonds have been moving together for over 65 years. On that basis, they claimed that bonds do not provide diversification benefits.

However, digging deeper, you will find that the data they used was actually for 30-year US treasury bonds. How many investors do you know would actually want to hold a bond that repays their principal only after 30 years? Secondly, you don’t need to know about the intricacies of the bond duration equation to know that the longer the term of the bond, the higher its risk and sensitivity to interest rate fluctuations.

Holding 30-year bonds is simply not representative of what investors do when using bonds for proper diversification and asset allocation. Investors mostly hold high-quality bonds that mature within 1 to 7 years – which is what we also hold in our core bond positions for investors.

Kenneth French, a finance professor at the Dartmouth Tuck School of Business and one of the co-authors of the famous 3-factor model in financial science, notes that investors misunderstand the purpose of diversification as eliminating volatility of the overall market. This is not the main purpose of diversification, which is to protect against additional volatility or risk arising from the characteristics of individual firms or asset classes; not the market itself.

“Diversification works,” he said in an interview after the 2008 crisis, “and investors would have had even more uncertainty about the return on their portfolios if they had been poorly diversified.”

Research shows that prices of assets move together only for a short while during extreme crises. Subsequently, the benefits of proper diversification show up in investor portfolios.

Many investors have heard of diversification. However, due to misinformation from financial media and even some practitioners, they may end up with portfolios that are not properly diversified. Diversification is not just holding the correct amounts of the different asset classes available. To be properly diversified, you have to ensure that your investments are allocated across the different investment factors that drive returns. What does this mean?

For example, if your portfolio did well over the last 5 years, it was likely allocated to mega-cap growth companies like the large technology firms in the US. You remember the FAANG hype (“Facebook-Apple-Amazon-Netflix-Google”) that was making its rounds a few years ago? However, looking back at the dotcom bubble in 2000 provides evidence that whilst allocating heavily towards a certain segment of the market (e.g. technology stocks) may double your money, you would not be able to keep it for long!

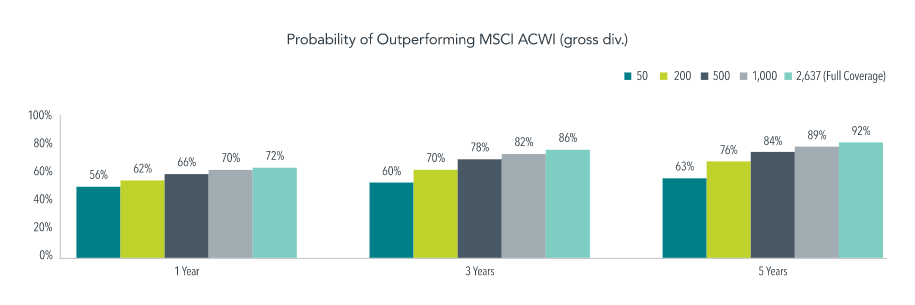

Apart from diversification across asset classes and investment factors, you would also need to hold a significant number of stocks and bonds to ensure a high probability of out-performance. Dimensional Fund Advisors published recent research that showed how a portfolio only starts showing increased out-performance when holding a higher number of stock holdings.

Over a one-year period, a portfolio with 50 stocks has a 56.2% probability of outperforming. For a portfolio with over 2,000 stocks, that probability increases to 71.9%! This difference was even more pronounced over longer investment horizons. For example, over a five-year horizon, the probability of out-performance increases from 63.5% for a 50-stock portfolio to 91.9% for a >2,000 stock portfolio. See the diagram below:

What this means is that investors need to be broadly diversified across and within asset classes, across investment factors, and to have a large enough base of stock and bond holdings. This becomes even more important during times of high market volatility.

So, talk to your adviser and do a check-up as to whether your existing investment portfolios measure up to the proper diversification metrics. If not, you could be unwittingly taking on more risk than you intended.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.