The Purpose of Bonds in Your Portfolio

20 September 2019

“I would much rather own many common stocks than bonds.” – Warren Buffett

Most investors think of bonds as very safe instruments. It seems simple: you buy a bond, and then get all your money back after a fixed period of time. In the meantime, you are paid a fixed interest (or coupon) throughout the period that you hold the bond. It is similar to a fixed deposit, but with a much longer duration – sometimes up to 30 years!

However, what many investors forget is that a bond is actually a loan to a company, and with that comes its own peculiar set of risks. Much like lending money to a friend, if something were to happen to the other party, you’re unlikely to get your loan back.

Companies need money for reasons such as funding expansion plans, helping their cashflow, and so on. So they go out into the debt market to try and entice investors to lend them money through a bond structure, incentivising investors by promising to pay a certain coupon rate until the money is returned (or when the bond matures). Bigger and well-established companies can attract investors with a lower rate of interest compared to smaller and lesser-known companies whose financial strength is not as strong.

This is where the risk lies. Investors forget that the only reason they would be promised a higher return is the additional risk they have to take.

Bonds and loans are also not protected against inflation. You’ll get back all your money (a.k.a. par value) after the bond matures, but that money would no longer be worth as much as it used to be due to the effects of inflation (remember, it wasn’t so long ago that food and commodities cost so much less then today!)

Secondly, many investors lose sight of the purpose of bonds. Roger Ibbotson’s work on wealth, asset classes and allocation showed that holding the correct type of bonds with the correct geographical exposure is what helps to buffer an investor’s portfolio against the volatility and risk of other riskier asset classes.

That is the primary role that bonds play in a proper asset diversification strategy. Equities are a driver of return, as described in Eugene Fama and Kenneth French’s seminal paper, which showed how returns were primarily explained by exposure to common stocks. It is the job of equities to bring in returns. It is the job of bonds to make the portfolio safer.

However, when faced with a marketplace of over 440 bond unit trusts, over 390 bond ETFs, and thousands more singular bonds, with nearly $5 trillion worth of bonds in managed funds, many investors may take the easier path of only looking for bonds which would give them the highest yield. They (and even their advisers or relationship managers) often have no idea about the risks they are taking on as a result.

Financial statements published by companies are always backward-looking, and it is very difficult to know the extent of poor practices, losses from failed ventures, creative accounting or even fraud until it is suddenly exposed, by which time it is too late and the bonds have become virtually worthless overnight. Furthermore, many bond funds are also not that forthcoming with detailed information about their holdings. As such, history is replete with examples of cautionary tales for bond investors.

That’s why we as advisers are very concerned when we see our clients’ existing assets and find them holding lower-quality bonds and funds that target the more distressed areas of the bond markets. It’s likely that they were popular due to their high headline yield and promises of high returns over a short time. Many large and popular bond funds and holdings may give one the appearance of having a safe and diversified core strategy, but in reality may actually fall into one of the lower junk grades.

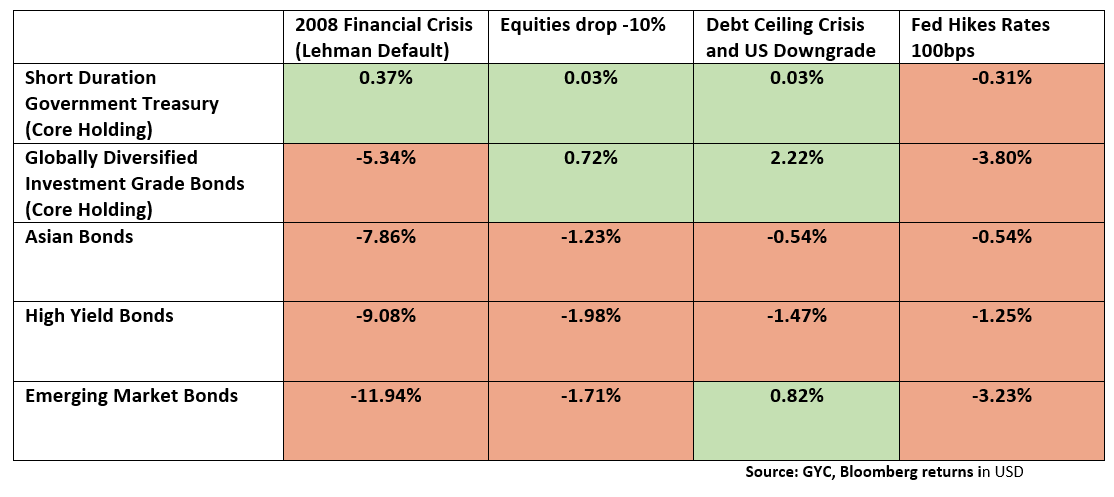

The chart below shows how various seemingly “safe”-sounding bond categories suffer losses when experiencing market events. The first two core holding categories are what we recommend to investors for their bond portfolio.

Many investors are feeling jittery at the moment. Yield curve inversions, talks of recession, trade wars, political instability and countless other problems are all causing financial markets to be unsettled. In these times, you want your bond holdings to act as a ballast, stabilising your portfolio instead of making it even more risky. The worst thing that could happen during a market downturn is if your equities, bonds and other asset classes all lose money at the same time – which is very possible!

Investors can sometimes unknowingly veer into riskier holdings and lower credit quality bonds. It is thus imperative that you know what you own, what you could expect to lose, and understand your underlying investment strategy and your purpose for holding bonds in the first place. That way, you can also anticipate how your portfolio will move in various market environments, and can ensure that your investments are properly positioned in the event of a potential market downturn.

If all investors were to do so, then perhaps we would no longer keep seeing news about investors losing money over bond defaults over and over again. History may not repeat itself, but it certainly does rhyme.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.