What Do You Do in Shaky Markets?

06 September 2019

“Our favourite holding period is forever.”

– Warren Buffett

As financial advisers, we find that times of market turbulence always produce the same questions from concerned investors:

“Should I be selling?”

“Why is my portfolio dropping?”

“Shouldn’t you be moving to safe assets?”

“Why aren’t you doing anything?”

Despite our reassurances that the evidence shows the best strategy is usually to stay put, many are still unconvinced and choose to pull out of the market, thereby locking in their losses and permanently impairing their long-term investment plans.

It doesn’t help that the media actively stokes their fear by constantly publishing alarming headlines about the market and the economy. However, from the media’s perspective, they only do so simply because bad news sells better than good or neutral news.

Yet most of these fears are unfounded. Whether or not investors end up suffering in these times depends not so much on what the market is doing but much more on how they behave. Here is an illustration of how behaviour is the primary determinant of investment outcomes.

Anyone investing into the market from 2015 until today would have had a roller-coaster ride. Over those years, investors would have experienced the market sell-off caused by the Chinese stock market turbulence (which was itself caused by the currency devaluation), the collapse of the oil & gas sector from plunging oil prices, the Greek debt default, BREXIT, the angst caused from the election of Donald Trump, and the more recent threats to globalisation from protectionism, trade wars and tariffs.

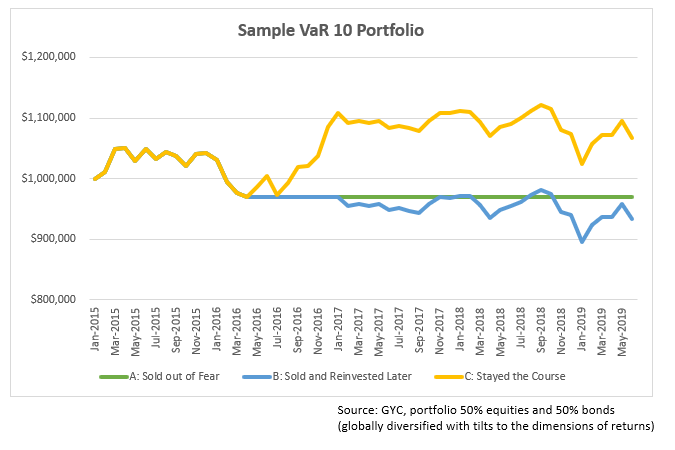

Now, let’s look at how three different investors, A, B, and C, would have ended up based on how they responded to all that turbulence.

Investor A was terrified. Global banks and the financial media were touting recession fears and a repeat of 2008. All that triggered A’s fight-or-flight response, and so A decided to sell and hold cash sometime in early 2016 in order to not lose any more money. This is an approach that many investors took during that time.

Investor B was also afraid, but also concerned about missing out of the market for so long. So B decided to sell in 2016 and hold cash until “things are clearer” – which was sometime around early 2017, after half a year of what looked like a steady recovery. This was also a common response from many investors. Those who were not yet invested in the market meanwhile decided to wait it out until things looked better.

Lastly, Investor C decided to ride through the turbulence, with constant portfolio rebalancing to ensure that the portfolio risk remained constant. C also took the opportunity when prices were low to sell bonds and buy equities at that lower price, and vice versa when prices went up.

The chart below shows how each of them would have performed, using our sample VaR 10 portfolio (50% equities, 50% bonds) as a guide:

As you can see, selling when the market was in a bad place meant that A ended up making those losses permanent, and missing out on the subsequent recovery. B selling and then buying back in when the market was doing better ended up producing even worse losses – because it was effectively selling low and buying high, which is the exact opposite of what investors should do.

On the other hand, simply riding out the turbulence and making use of it to buy more equities during bad times meant that C could make significant gains when prices eventually steadied and rose, as always happens.

This is only a short-term example. However, many more case studies can be conducted for many different market environments showing how staying the course can pay off and how abandoning the course can be very costly. That’s because markets go up about 60% of the time, and leaving the market thus means that you have a 60% chance of losing rather than gaining.

This is why, as advisers, we know that it is equally important to spend time with clients conducting behavioural coaching and explaining how markets work. This is especially important in times of volatility. Helping our investors stick to their long-term plans when they may be tempted to jump ship due to market fears is one of the more valuable services we can provide for clients.

In short, it is always good to remember:

- Have realistic expectations of your returns and risk. No high return investment is going to come with low risks or low volatility. The two are always related.

- It is important to use time to your advantage. Only through holding investments over the long-term will you be able to realise the full effects of the gains.

- Stay diversified. The best way to ensure your portfolio can withstand the rigours of market ups and downs is to ensure that you have proper exposure to equities and bonds in a globally diversified manner. In this example, although global equity markets went through double-digit losses at times, the bonds helped to act as a ballast during the downturns.

- Tune out the noise. Don’t check your investments when markets are crashing. Don’t listen to the financial media or talking heads. It serves no purpose and will only make you fearful and confused.

The fact of life is that markets will move up and down. That is the nature of risk, and it’s the risk you assume when you invest for a return.

Always remember the potential downside of prematurely selling your investments or trying to time your entries and exits in response to your emotions and the news. It would also be wise to heed the words of an investing great, Warren Buffett, that we included at the beginning of this article.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.