Investing in Property – Things to Consider

14 September 2018

In 1985, the American heavy metal band Mötley Crüe released the power ballad “Home Sweet Home”, which spoke of a yearning to go back home. This desire to go home – or to own a home of our own – can be very powerful. For some of us, the urge to own multiple properties as investments can be even stronger! It doesn’t help that our media readily feeds this urge with their constant reporting on people who have made it rich from property investments. Strange that you hardly read about those who lost money in property investments!

The MAS appears to be concerned about the prices that investors are willing to pay in the property market. They recently tweaked the Additional Buyer’s Stamp Duty (ABSD) rates and Loan-to-Value (LTV) limits to try to cool the property market down, suggesting fears that we are headed into a bubble!

Before you jump on the investment property bandwagon like so many others before you, you should first ask yourself these simple questions:

- Are you debt free and have no existing mortgages? (Keep in mind that interest rates are going up)

- Do you have existing diversified and liquid investments, or are at least contributing monthly to some sort of programme?

- If you have children, have you set aside or at least catered for their future expenses?

- Do you have sufficient cash in a liquid account to pay for at least 1 year of variable expenses?

If you have answered NO to any of the questions above, then perhaps looking to invest in real estate (or other alternative investments which lock up your money for a fair amount of time) is not a very good idea. As with any investment, we cannot predict what will happen in the future, but before you take the plunge, undertaking a simple due diligence and thinking through this process will help you make the best decision with your money.

Why Am I Investing?

Just like with the stock market, knowing your purpose for investing in property will help you rationalise and hold through difficult cycles. Hopefully, you’re not investing merely because you heard your friends talking about it. Some real estate investors look for the possible cash flow and income that a tenanted unit can bring. Others are simply fixated on price appreciation.

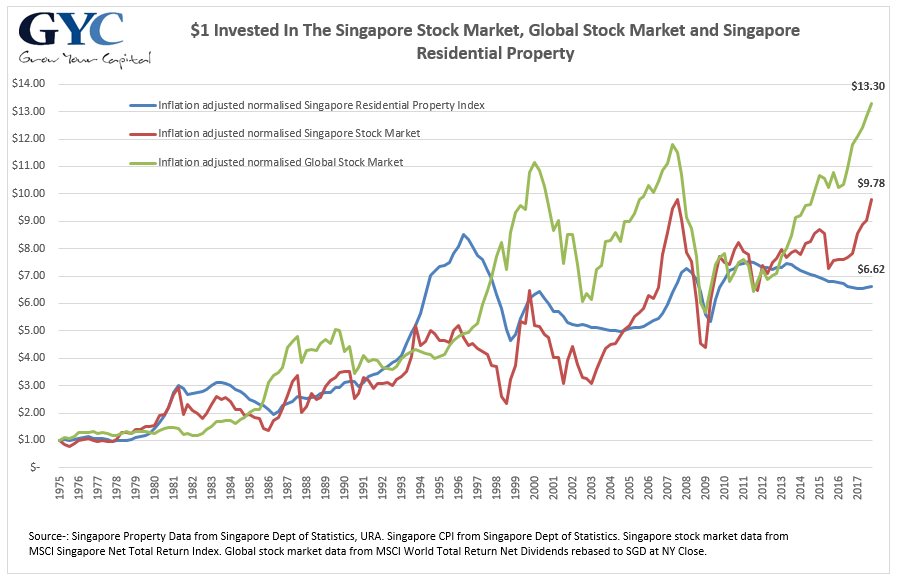

Having realistic expectations and some understanding of your possible expected returns would also help tremendously. In the long run, property performs above inflation, but below stock market investments.

The chart below shows the inflation-adjusted returns of the Singapore property market, the Singapore stock market and the Global stock market. You may notice that property also goes through good and bad cycles. Investors banking on price appreciation through leverage have to be aware that it is extremely difficult to time the cycles, as there tends to be a lot of policy intervention in the property sector as compared to the capital markets (stock investments).

How Do I Get Access?

There are many ways to invest in property. You can take the simple, traditional approach of buying and managing your own properties. Or you could get into a structured deal where a group of investors pool their money together to invest in bigger ticket properties. Or you could do it with small amounts of capital, by accessing publicly traded real estate investment trusts (REITs) which span residential, commercial and industrial properties.

Apart from the daily traded REIT vehicles, property investment requires a lot of time and effort as well as it involves less diversification and liquidity. There are also different tax ramifications for the investment, unlike in capital markets where there are no capital gains nor dividend withholding tax (depending on the jurisdiction).

How Does This Fit Into the Overall Scheme of Things?

Many investors tend to rationalise that investing in property helps them to diversify their investment holdings – typically stocks and bonds – and gives them exposure to a supposedly-uncorrelated asset class. However, this misses an important point: you would likely buy this property in your home country, a place where you most likely work and already have local savings and a home in. You are already overexposed to the local economy. Further adding a large asset class that will be affected by the same country’s economic cycle is a risk that can and should be avoided.

What Are the Risks?

Apart from the fact that property investments are typically leveraged and thus amplify gains or losses, the property market goes through very long drawn cycles (see chart above). Property deals are typically quite large and lack diversification in your portfolio (depending on your net worth). It would take huge amounts of capital to buy enough property assets to be properly diversified, which would involve holding properties in different countries.

Besides portfolio risk, there are also other smaller risks to take note of. Do you know the ongoing costs for maintaining your property? What about the local property and income tax laws for a landlord? Do you really want to do this all by yourself, or hire an agent to do it for you?

Can You Beat The Market?

This question is something similar to what stock investors should ask themselves. As a property investor, do you have the ability to be ahead of everyone else? How do you know if the cycle is turning? Is the price you are getting much lower than what others have paid? What is a good deal, and is it a “value” buy?

There is nothing wrong with investing in property as an alternative asset class, especially if you have done your homework and know that owning such an asset will help you achieve the diversified returns you need. However, for many people, this is not the case, and puts you in a more risky financial position than you may be prepared to bear.

Don’t just jump into property investing because your friends or acquaintances are doing it, or because you have read good things about it. As with all huge investments, ask the right questions to the right people and think very carefully about your financial position before you take the plunge!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.