Love Your Country, But Beware of Over-Concentration!

07 September 2018

Every year, the month of August typically stokes our national pride and patriotism, filled as it is with a range of Singapore-themed activities, discounts and events, all of it peaking with the National Day Parade on the 9th of August. For many of us, Singapore is our home. It is where we grew up, where we forged our ties and experienced the highs and lows of our lives. It is well and good to love your country.

However, it is not good to be over-invested in any single country’s stock market, regardless of how much you love your country.

Most of us work in Singapore. We own a home in Singapore. We have cash savings in Singapore dollars stashed away in bank accounts in Singapore. In short, we are already fully exposed to Singapore’s economy, such that further putting all our investments into Singapore stocks could further lead to over-concentration risks. Should the Singaporean economy tumble even just a little, that overexposure could cause financial pain across all your assets. Instead, it is much better to diversify and spread your risk around the world, across different economic sectors and countries.

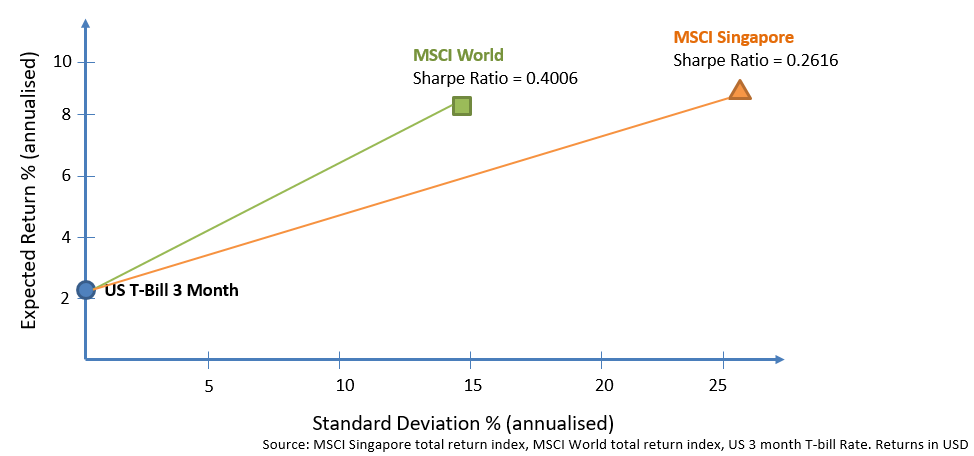

The Singapore stock market represents a mere 0.5% of the total world market capitalisation, and our FTSE Straits Times index is represented by only 30 Singapore stocks. That’s a highly concentrated bet, even if you allow for the fact that large-cap Singapore companies tend to pay generous dividends. The chart below shows the advantages of diversifying to a global portfolio as opposed to investing solely in the Singapore market. While, on an annualised basis, the returns of the Singapore stock market slightly beat the global market, from a risk-adjusted perspective (as measured by the Sharpe ratio), owning a portfolio of global stocks makes better sense for most people.

There is no harm in owning more than the 0.5% that the Singapore stock market makes up in a global portfolio. Investors typically have a home bias and feel more comfortable owning companies that are household names. But it is important to diversify across both developed and emerging markets.

The global stock market is large and represents an excellent investment opportunity with over 44 countries and 12,000 investible stocks. Economies often do not work in lockstep, and neither do the stock markets. When parts of the world are doing poorly both from a market and currency performance perspective, there are usually others that are doing well.Owning a properly diversified portfolio ensures a higher likelihood of an overall positive return – and increases the probability of a consistent performance. Holding a diversified portfolio from both developed and emerging economies also enables you to target areas of higher expected return such as size, value and profitability.

Apart from owning too much of their home country’s stocks, investors often misunderstand diversification. You may own 100 stocks, but if all the stocks are related to property REITs, or the telecom sector, then you are not diversified at all. The easiest and most cost-effective way to diversify would be to own indexed investments. These indexed instruments can either be “actively indexed”, utilising asset class investing concepts like the funds offered by Dimensional Fund Advisors, or be passively indexed instruments like ETFs.

Indexing takes away the need for guesswork: you do not need to know which is the best company to invest in, nor which up-and-coming country to put your money into. The index automatically readjusts according to how economies and the stock market grow, and you will automatically own the stock. For example, in the 80’s there was no such thing as emerging markets. Today, due to the growth of these economies, they form around 15% of a global equity portfolio. You need not have kicked yourself for missing out on China’s growth – if you owned an indexed instrument, you would automatically have been allocated to Chinese companies.

However, simply owning indexed investments is not all there is to it. How you put the instruments together into a portfolio is very important as well. You will need to ensure that you are well spread throughout all the different asset classes – equities, fixed income, commodities, cash – and have an estimated measure of what risk and return your portfolio will bring. Investors with high financial literacy might be able to assemble their own portfolio, but if you are unfamiliar with the process, ensure that you work with a fiduciary advisor to guide you along the way. Keeping your overall portfolio risk aligned with your personal risk tolerance will mitigate rude shocks and emotional stress when markets go through down cycles.

In the end, what matters to your investments is not how individual countries or asset classes perform each year, but how all the investments work together in a portfolio to meet your financial goal. Having a concentrated position in a few investments, just because you feel comfortable or knowledgeable in the area, is not an ideal situation, as you will have a bumpier ride and are likely to suffer from lower returns in the long run. Instead, constructing and investing in a properly diversified portfolio will give you a smoother, and more consistent, investment journey.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.