The Failure of Market Predictions – Part 2

26 January 2017

In our second part on the fallacy of predictions, we will present more examples of why it is detrimental to one’s health (stress) and also wealth to play this fool’s game.

Predictions are notoriously difficult to get right on a systematic basis. Because of that, it is best that investors apply basic finance principles to their investments – hold for the long term, try not to time, buy more when the market is down, and trim when the market is high (rebalance). Any other method that purportedly gives an abnormally high market return is unlikely to persist over the long term.

As the Jan/Feb 2016 correction was just starting, many well-known hedge fund managers and CEOs made all manner of bearish predictions. George Soros was one of the prominent ones who proclaimed that it was the beginning of the 2008 crisis again. Just the thought of the terrible bear market of the Great Financial Crisis would have made many investors panic and sell their assets at a bad time – when the correction was already underway.

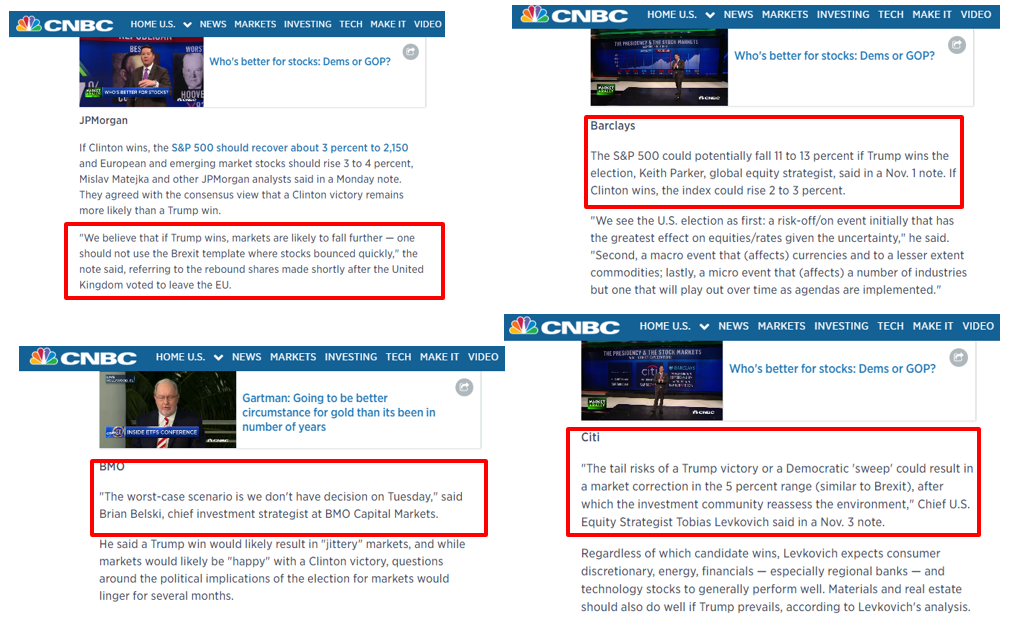

Prior to the US Presidential Elections in Nov 2016, the general market consensus was that Trump would be disastrous for markets and a Clinton administration would be good for stocks. As such, many banks and investment brokerages issued client reports detailing the level of disaster to portfolios and investments should Trump come in. Some even went to the extent to quantify the exact loss.

JPMorgan ” We believe that if Trump wins, markets are likely to fall further – one should not use the Brexit template where stocks bounced quickly”

Barclays “The S&P 500 could potentially fall 11 to 13 percent if Trump wins the election… if Clinton wins, the index could rise 2 to 3 percent”

Citi “The tail risks of a Trump victory or a Democratic sweep could result in a market correction in the 5 percent range (similar to Brexit)”

So, what happened? Trump won and markets rallied. How did those professionals get it so wrong!?

Was it really surprising to us? Not at all, especially if we view markets as efficient and forward-looking. In the lead up to the elections, markets were a bit wobbly and had corrected slightly. It is likely that the market had already priced in the possibility of a Trump election. As soon as the predicted disaster which was Donald Trump did not materialise, investors likely had to buy back and reallocate into the market, driving up prices and creating the so-called “Trump Rally”. Whoever stayed out of that short burst during November and December would have likely been left kicking themselves for listening to those erroneous forecasts. From Nov 8 to date, Global Equities has added over 7% in gains.

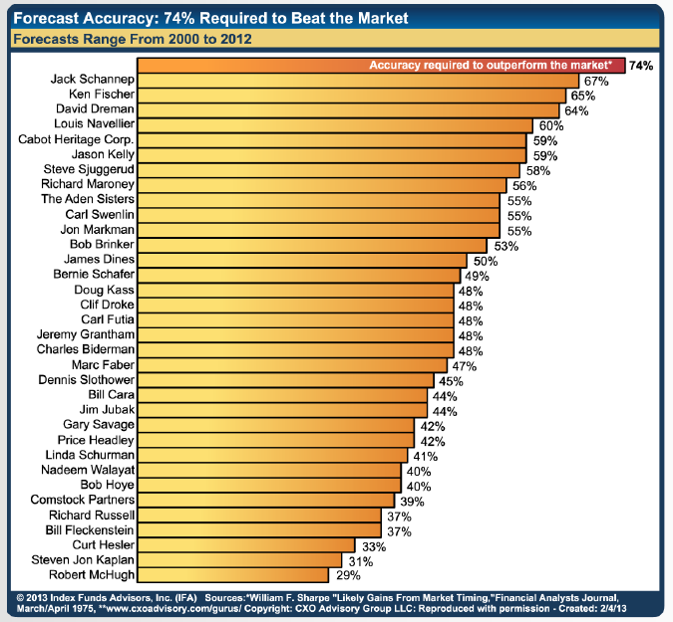

In Part 1 of our post, we noted that many market pundits have to shout out extreme or doomsday scenarios just to be heard and to make it to the headlines. But what about well-known investment newsletter writers and strategists who purportedly have a coherent and logical timing/tactical strategy to beat the markets? Taking a study done by William Sharpe and reported by Index Fund Advisors, these market timers required a forecasting accuracy of 74% to outperform a benchmarket portfolio. From the diagram below, no one was able to beat a buy and hold strategy. Now, we are not saying that these people are not able to beat the market with some well-established market timing strategy. It is the difficulty of executing and also performing CONSISTENTLY over a period of time that causes them to underperform benchmarks. Add transaction costs into the mix, and it is likely that returns from market timing will fall even further behind the benchmark.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.