5 Steps to Save for Your Dreams

24 July 2020

“A simple fact that is hard to learn is that the time to save money is when you have some.” – Joe Moore

Few things beat the sense of achievement of having saved enough for something you’ve always wanted. Whether it’s your dream home, a trip round the world, or treating your loved ones to a fancy meal, it’s immensely satisfying to finally reap the rewards of your patience and discipline.

Growing up, most of us first learn to save by dropping coins into a piggy bank. We later graduate to using a proper savings deposit in a bank. We watch our hard-earned savings slowly grow with interest as we diligently squirrel away any funds we can spare.

Unfortunately, interest rates have been suppressed for a long time now. Many local banks have responded by slashing their interest rates, and our savings accounts can no longer grow at the same rate they used to.

But what if you could save in a more efficient way, and end up having to spend less in the long run?

That’s where investing comes in.

There is a whole world of investing options that can significantly grow your investments beyond their original capital. This is most suitable for long-term goals. If you’ll need the money in three years or less, you would want to stick with liquid, low-risk deposits that can be easily accessed when you need the funds.

While investing carries higher risks, you can mitigate some of this risk through proper asset allocation in a well-built portfolio. You can also mitigate your risk by thoroughly understanding the characteristics of your investments. Knowing that equity markets move in cycles and can go up and down will mean that you will be much better prepared to weather and take advantage of market meltdowns.

If this is something you’ll like to do, you can start with these five simple steps:

- Determine how much you need to save

- Decide when you will need the money

- Figure out how much you can afford to save

- Use a Time Value of Money (TVM) formula to determine what return you will need

- Decide where to invest your savings to get that desired rate of return

For example, if you’d like to save $1 million for your retirement in 40 years and can afford to put $500 a month towards this goal, you will need an annual return rate of about 6% after inflation. You can then look for an investment portfolio with underlying assets that are able to provide that return.

Unfortunately, this is where it gets tricky. How do you find an investment that will give you that targeted return? After all, most investments have a disclaimer along the lines of: “past returns are not indicative of future performance”.

This is perhaps where an evidence-based financial adviser can offer some assistance. They should provide you with an index-like portfolio of globally diversified equities and fixed income, comprising underlying securities with very long term returns that correspond to your desired return.

Here are some advantages to investing your savings.

It keeps you from buying something else

It can be tempting to spend your savings on other things when that money is just sitting in your bank account. Perhaps you may have the willpower to not yield to temptation, but why make things harder than they have to be?

One of the best ways to ensure that the money you’ve saved will stay that way is to move it out of your bank account. Keeping it in a separate investment account will also make it easier to see the progress you’re making towards your goal.

You’ll reach your goal more quickly

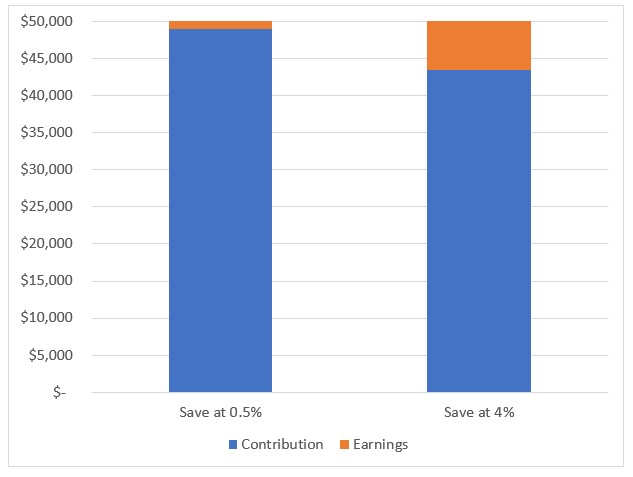

Let’s say you want to save for a down payment on your dream home. You estimate that you need about $50,000, and you budget $500 a month towards that goal.

If you save it in a bank account, you’ll typically earn a low rate of return. For our chart, we’ll use 0.5% as an example. At that rate, it would take you 98 months – or a little over 8 years – to reach $50,000. You’ll end up depositing around $49,000 and getting an interest of just over $1,000.

However, what if you invested the same amount into a moderate-risk portfolio with an average return of 4%? You could reach your goal 11 months sooner, with a total contribution of around $43,500.

Of course, as with all investing, this is not without risk. You should make your decision with all the pros and cons clearly laid out in front of you.

A financial adviser can help guide you along the correct path and determine how much you need to save, what type of investments would suit your risk appetite, and how to construct a proper portfolio.

With all the facts before you, do some simple verification before you make that investment decision. Then let it rest, and revisit it periodically to ensure that you remain on track to realising your dreams!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.