US Presidential Election – Does it matter to markets?

28 August 2020

“Bad officials are elected by good citizens who do not vote.”

—George Jean Nathan

While COVID-19 has been dominating the news cycle, the US presidential election is a mere two months away and we can expect it to return to the spotlight soon. After all, this election will determine the president of the largest economy in the world!

Investment management firms and banks have already begun offering their predictions on which candidate will be victorious. They have no shortage of theories about how each outcome would affect different market sectors and other world economies, and have been leveraging on the election to sell their thematic investments. By dangling the opportunity to make more money or avoid losing some, they hope to lure you or scare you into changing your market positions and engaging in further transactions with them.

As with most short-term predictions, however, such forecasts are inherently dubious. You’ll effectively be betting on the outcome of the US election, as well as how markets will react to those wins. What are the chances you’ll be right on both counts? This is gambling, not proper investing. Instead, investors would do well to look to history for some guidance.

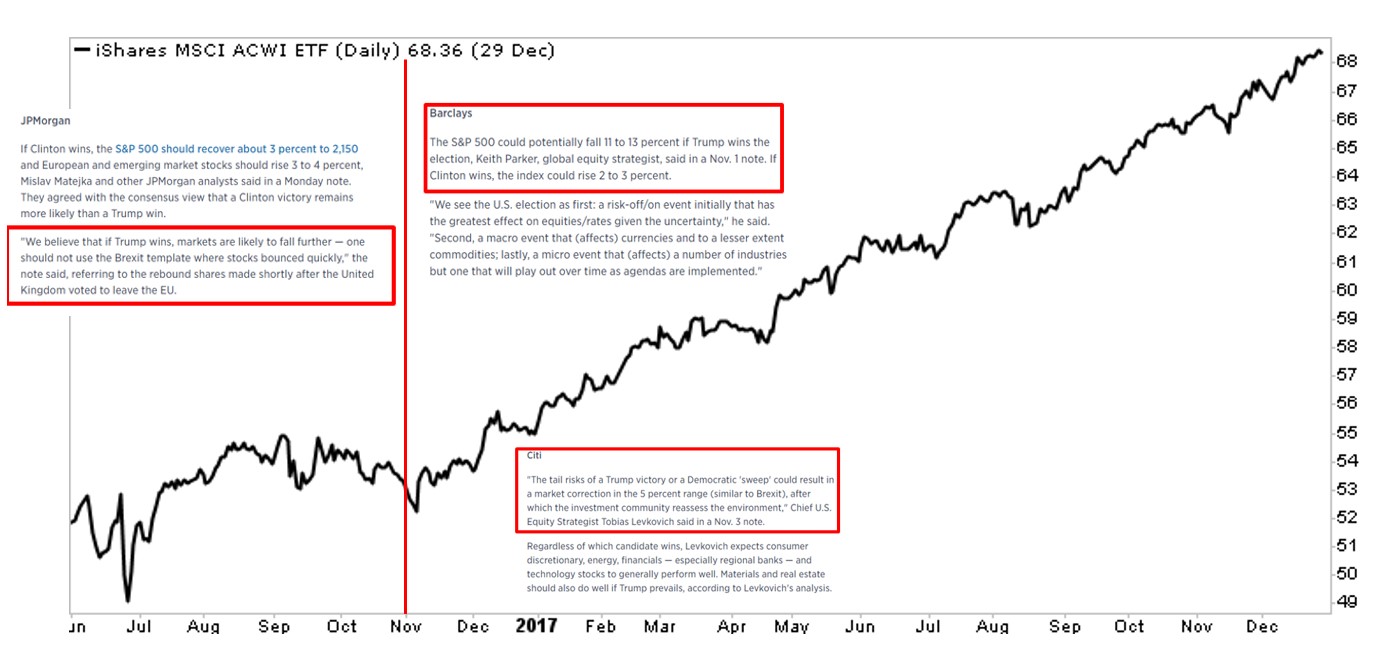

It was only four years ago that the US held its last presidential election. Market strategists and chief investment officers (CIOs) all over the world were unanimous in their claim that Trump would be a disaster for markets while Clinton would be good.

The chart below, with predictions from major financial institutions, provides a refresher of what actually happened. It uses the ACWI ETF (All Country World Index) as the proxy for global stocks, and proves that basing investment decisions on forecasting – even from such reputable institutions – gives you a low probability of success.

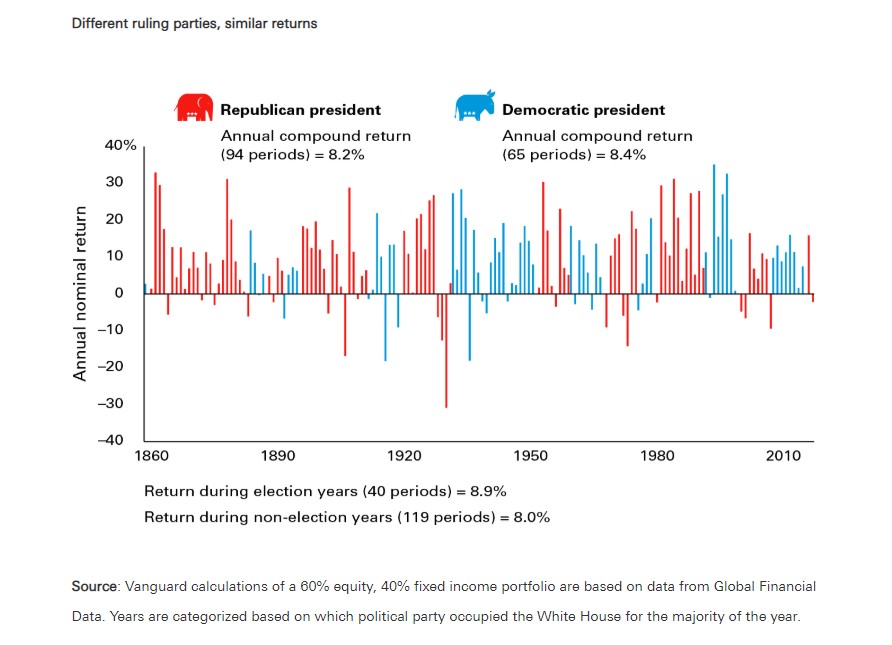

What about the different political parties in the US? The popular belief is that Republicans are more business-friendly, and as such would be good for stock markets – and vice versa for Democrats. However, long-term research reveals no statistical difference in market returns regardless of whether a Republican or Democratic president was elected. Electing a Democratic president saw an average annual compound return of 8.4%, with a comparable 8.2% for a Republican president. Surprised?

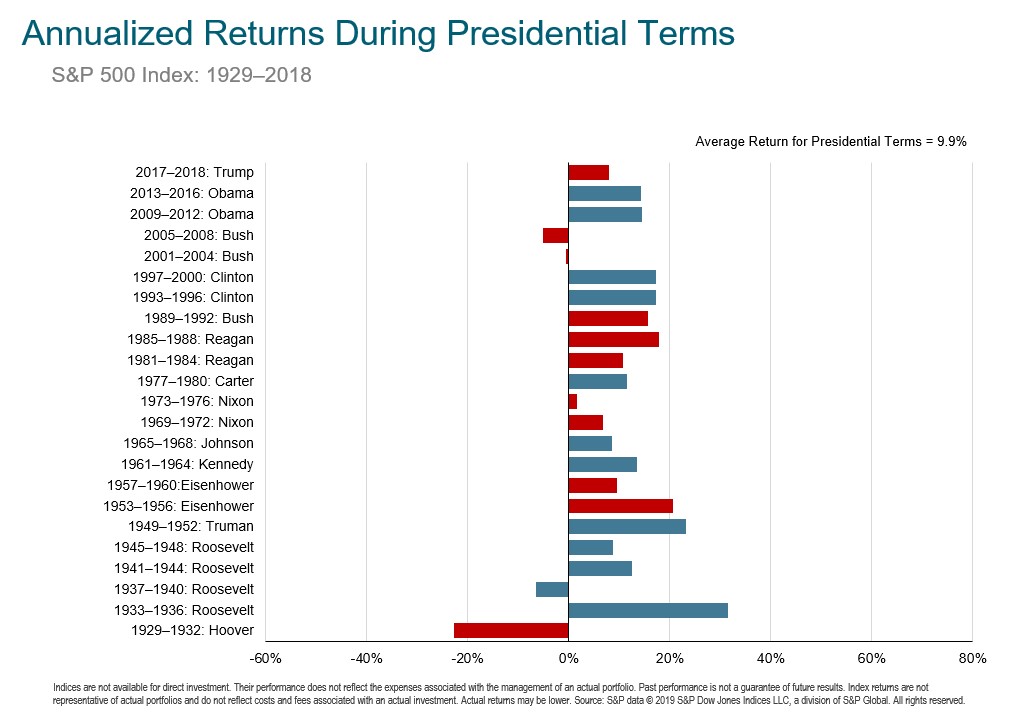

More granular market information also shows no discernible difference to returns while either a Republican or Democratic president was in office. The diagram below shows US market returns during the terms of past US presidents.

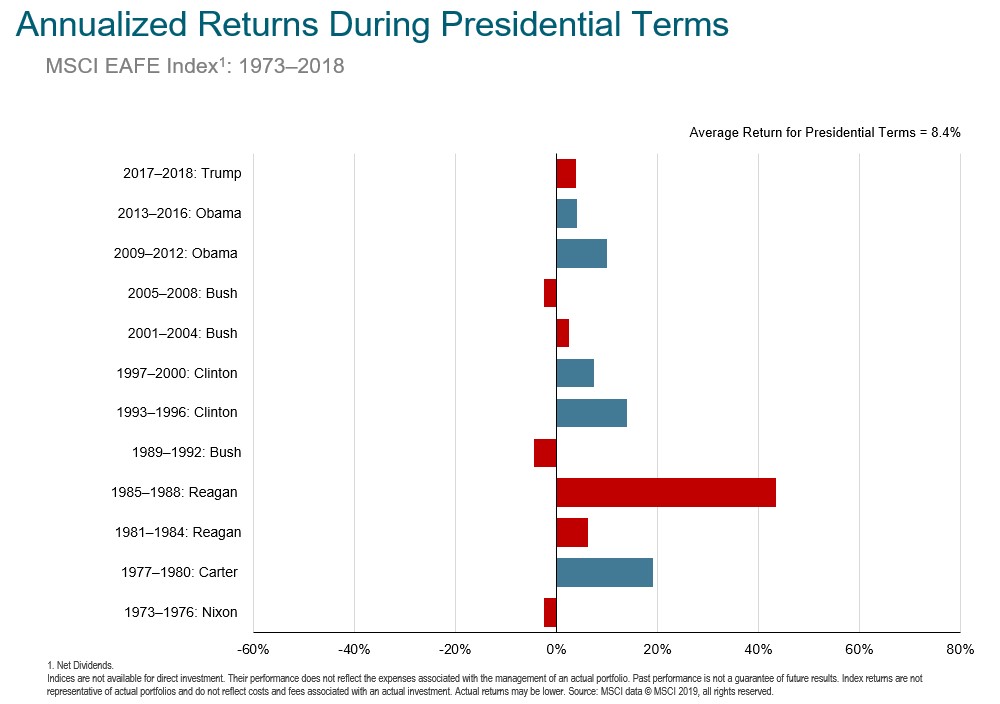

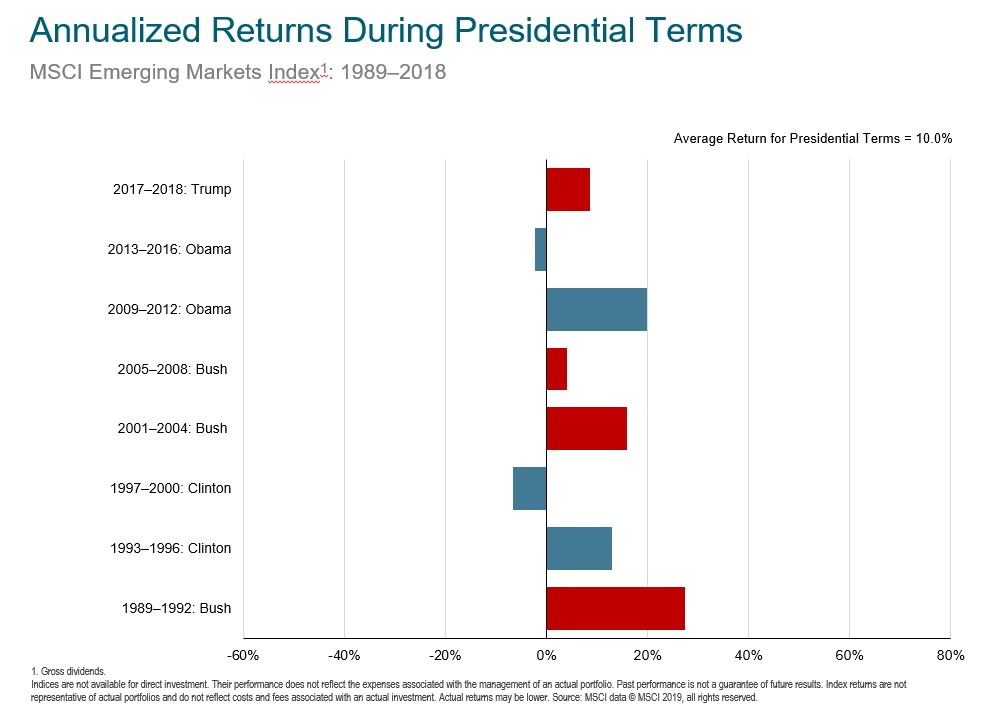

You might believe that the US President’s foreign policy might affect international stocks, such as with Trump stoking China-US tensions. If so, you would also be on the wrong path. The diagrams below displaying returns during the terms of past US presidents show no difference on both international and emerging market stocks. (Note – EAFE: 21 developed market countries around the world.)

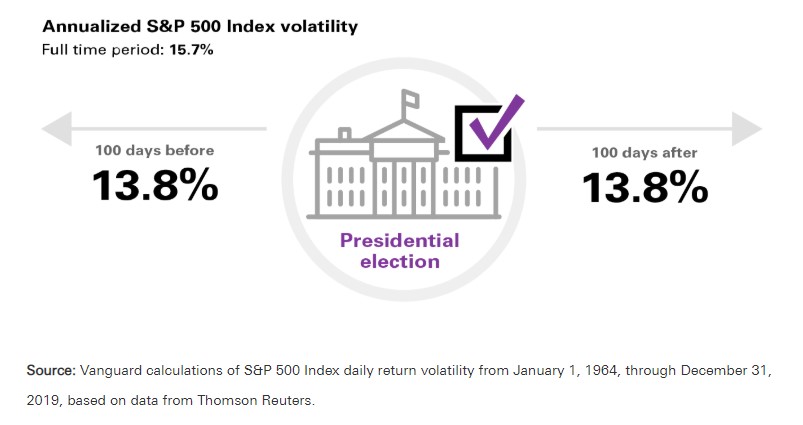

Another common theme is the belief that volatility and turbulence will strike markets during the election period. Investors hoping to escape that may be looking to sell to cash or hide in “safe haven assets” such as bonds or gold.

Interestingly enough, the data shows the opposite effect. Equity volatility was modestly lower in the weeks leading up to and following a presidential election than over a full market period. The results are not statistically significant, but counter-intuitive all the same!

In the end, investors should always be aware that investment themes and predictions rarely pan out the way we expect them to. The COVID-19 sell-off was a stark example of how markets can rally despite the economy being in the midst of a terrible slump.

It could be devastating to your investments if you lost sight of your long-term goals and strategies just to trade on an emotional whim. Remember: markets are affected by thousands of different variables. Politics are but a small component of the overall picture, and as you can see from the evidence above, it rarely pays to base your trades on a single election.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.