Should You Buy the Large Tech Companies?

07 August 2020

“But in this world nothing can be said to be certain, except death and taxes.”

— Benjamin Franklin

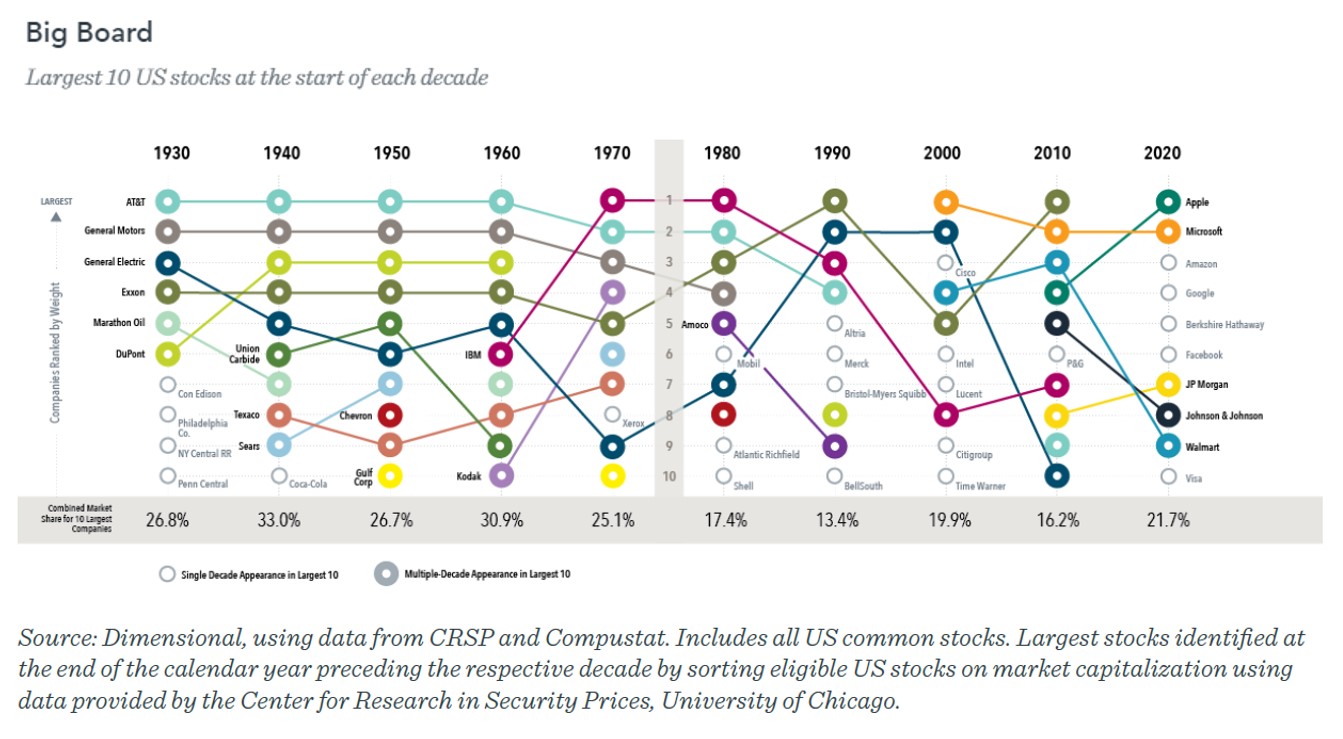

Ten stocks accounting for over 20% of the market. A tech giant perched at No. 1, sweeping up almost 6% of the total market share.

Does this sound like the market today? Surprise! It’s actually a snapshot of 1967 – more than 50 years ago! Back then, IBM was the marquee technology firm capturing 5.8% of the market. In comparison, Apple held only 4.1% of the market at the end of 2019.

You may have heard of the FANMAG stocks – Facebook, Amazon, Netflix, Microsoft, Apple and Google (now trading as Alphabet). They have posted impressive gains over the past few years, and all of them are now worth many times their initial public offering prices. Their success has persisted even through the COVID-19 sell-off. QQQ, an investment vehicle based on these large tech names, has been posting double-digit positive returns this year.

This has made FANMAG stocks very attractive to investors. With their dominance over the markets, it seems as though they are too powerful to fail. However, as the 1967 example shows, what we’re witnessing right now is not a new normal. It is an old normal, and we’ve been down this road many times before.

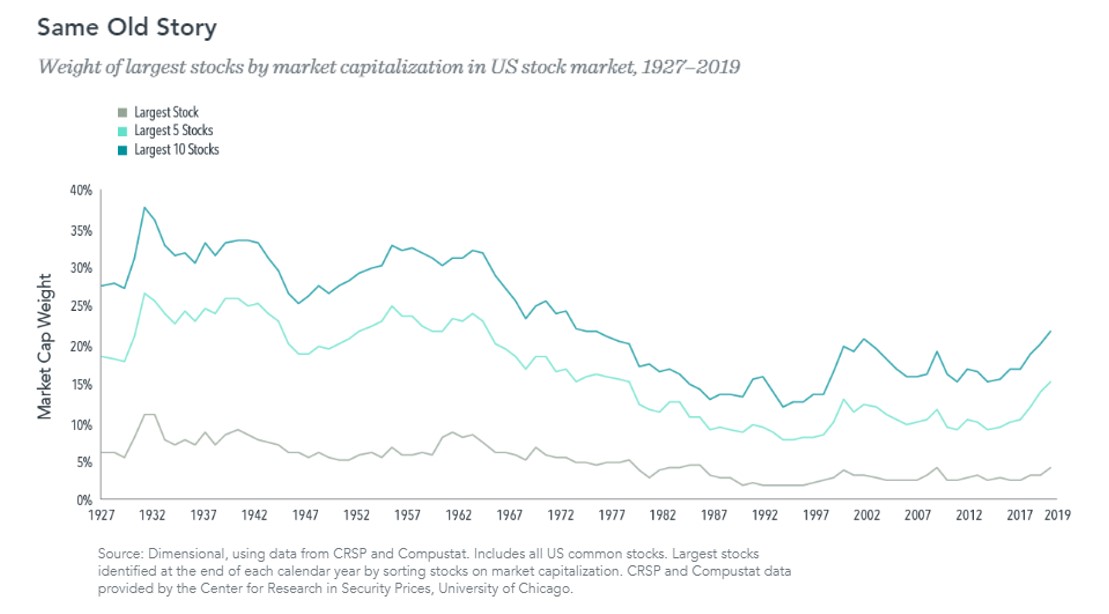

A top-heavy stock market has been the norm for as long as the stock market has been around. In fact, the earlier part of the 20th century saw the 10 largest stocks holding a combined market capitalisation of almost 40%! That’s double the 20% of today.

Some of those top firms survived for quite some time. AT&T was among the largest two companies for six straight decades (60 years!) beginning in 1930. General Motors and General Electric often retained their top 10 ranking at the start of each decade. IBM and Exxon were likewise mainstays through the second half of the 20th century.

While high-tech in the 1940s may have been different from the high-tech of today, many of those firms were also those on the cutting edge of technology and innovation. AT&T offered the first mobile telephone service in 1946. General Motors pioneered such innovations as the electric car starter, airbags, and the automatic transmission. General Electric built upon the original Edison light bulb, contributing to breakthroughs in lighting technology such as the fluorescent bulb, halogen bulb, and the LED.

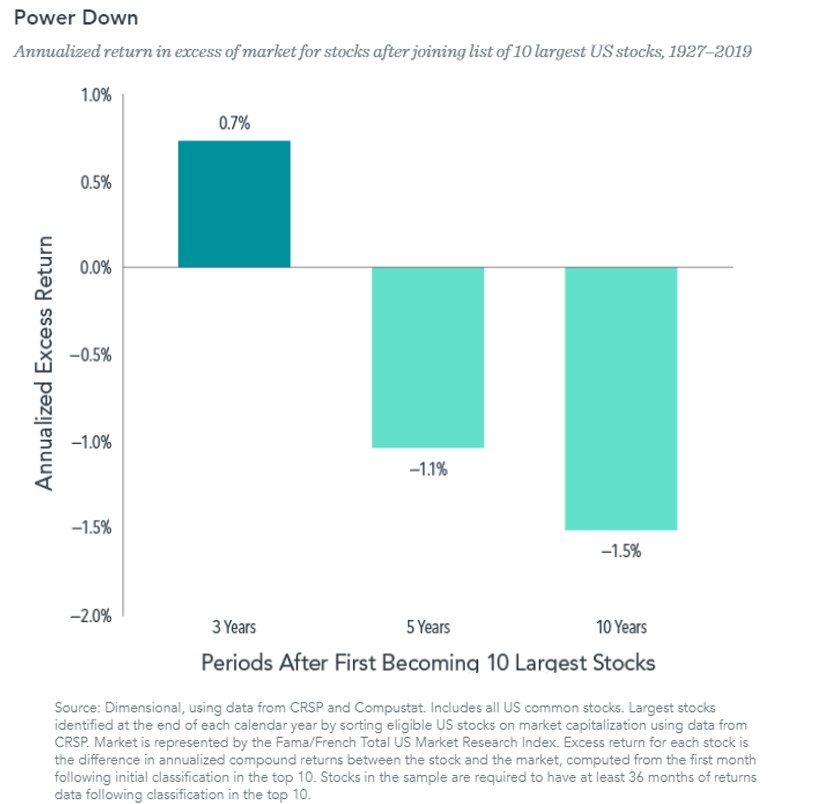

And yet none of these technological powerhouses remain in the top 10 today. The evidence is sobering. Charting the performance of companies following the year they joined the top 10 rankings shows that future results were decidedly tepid.

On average, these stocks outperformed the market by a mere annualised 0.7% over the subsequent three-year period. Over five- and ten-year periods, they actually underperformed the market on average. Some big names disappeared completely, either through bankruptcy or restructuring.

The only constant we can depend on is change. This is especially true with technology firms, given the high-speed pace of innovation. New names crop up overnight as old giants collapse into obsolescence. Perhaps an 18-year-old will found a new start-up tomorrow that usurps Apple’s dominance in 5 years’ time. You cannot be sure that your blue-chip stock holding will stay a blue chip in the long run.

As always, it is impossible to predict the future. There is no way to systematically predict which large companies will outperform or underperform the stock market. Investors should remember that any expectations about the future operational performance of a firm are already reflected in its current price. While positive developments that exceed those expectations may lead to further appreciation of the stock price, they are unexpected – and thus unpredictable – by definition.

All this underscores the importance of holding a broadly diversified equity portfolio that exposes you to the vast array of companies and sectors the market has to offer. Being big, famous and loved (for now) is no guarantee a company will stay that way for long. The ever-changing FANMAG acronym may only be proof of that.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.