Looking back is bad for your financial health!

16 April 2020

“Life can only be understood backwards; but it must be lived forwards.” – Søren Kierkegaard

We don’t walk forward while looking back. Neither do we continuously look into the rear-view mirror when we drive. If we do so, we are very likely to collide into something and really get hurt.

So, why do we always look back when we invest? We want to buy things that have risen in price. And we act, often poorly, after we read the news headlines.

Let’s be realistic. The economic data is likely to be very bad over the next few months. People have been forced to stay at home. Businesses cannot operate efficiently, and consumption cannot take place. Things cannot get done, normal lives cannot be led.

But you should not fear the data nor what will be reported. Do remember that the stock and bond markets are forward-looking mechanisms. By the time you read about any news and want to act on it, the stock market would have already incorporated that information into stock prices days or even weeks ago. The prices you see being set today are determined by the aggregate expectations that investors have for the future.

1. Prices Reflect the World’s Expectations at that time

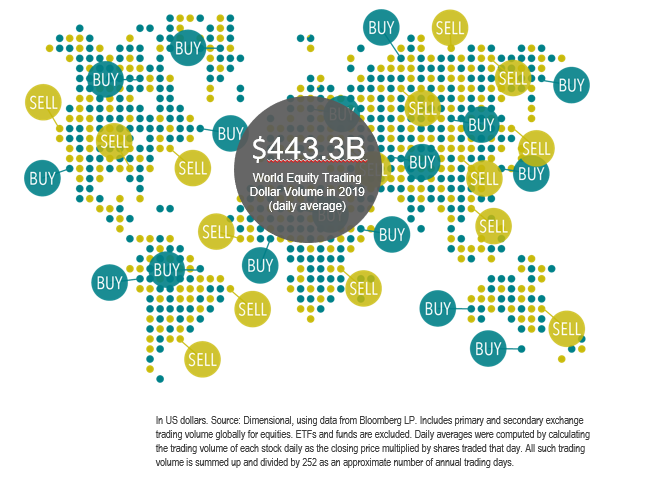

You are not the only person investing. The investment world is made up of many millions of other participants, both individuals and institutions. For every trade, the one selling thinks they are selling at a good price. Meanwhile, the one buying thinks they are buying at a good price. They can’t both be right.

So, if both sides think they are making the right decision, who is correct? Unfortunately, we can only know on hindsight. That is why you should buy when you have the money and only sell when you need the money.

2. Prices are Forward Looking

We have a tendency to try and connect the dots between random events. This is how our human brains work to help us understand and make sense of what happens in the world.

Nicholas Taleb wrote about this in his 2007 bestseller The Black Swan, where he dubbed this behavioral trait the ‘Narrative Fallacy’.

Most investors are not aware that they use lagging and past data to make future decisions. This results in a big de-synchronisation that leads to mistakes which can be devastating to investment plans.

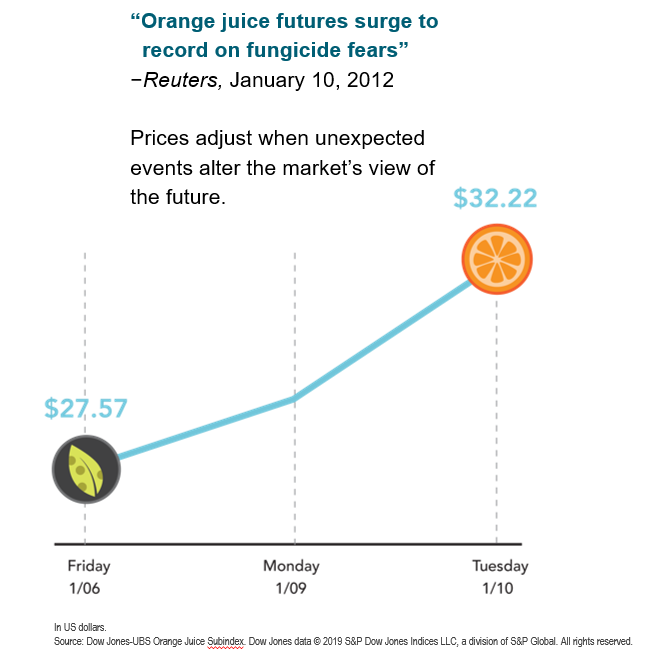

The simple illustration below shows how orange juice prices surged in 2012, based on news with only some mild causative effect that did not justify the significant price increase. The lesson here is to read the news for information, not analysis.

3.Economic and Investment Models Are Pure Guesswork

Anyone who has done financial modelling – or tried to estimate the following year’s budget based on expected sales of their firm – will know that such forecasts are notoriously difficult to pin down.

These guesses are dependent on so many dynamic variables that can change on a whim. Recently, some economists have been reporting how the current economic climate brought on by the Covid-19 lockdown will be the worst ever.

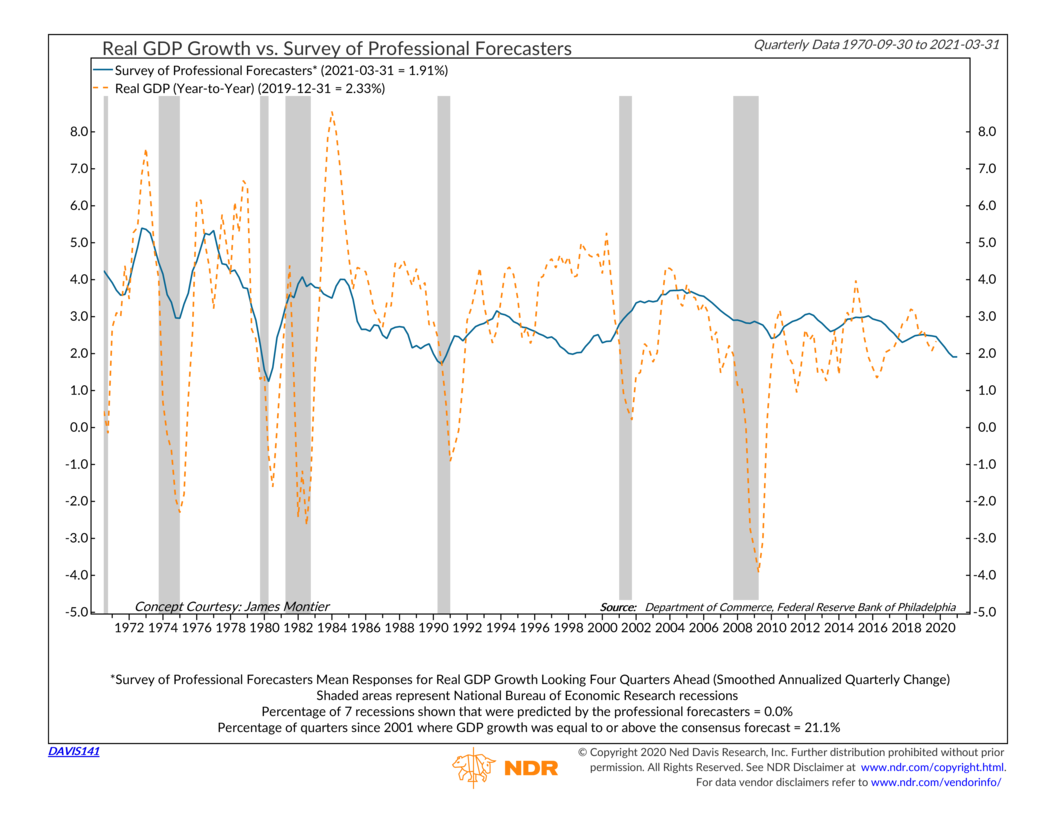

Are they right? The truth is that nobody really knows for sure. The chart below shows how wildly inaccurate economists can be in predicting economic output (with a 0% success rate), even though one would expect this to be their forte. The lesson from this is: don’t read too much into forecasts and predictions. As no one can predict the future, these are educated guesses at best, with too many unknown variables.

4. When News and Data is Bad, That’s Good for Markets

Due to the global lockdown, the world is likely to be in a recession. Many people are expected to lose their jobs. Sadly, some of us may also lose loved ones to this virus.

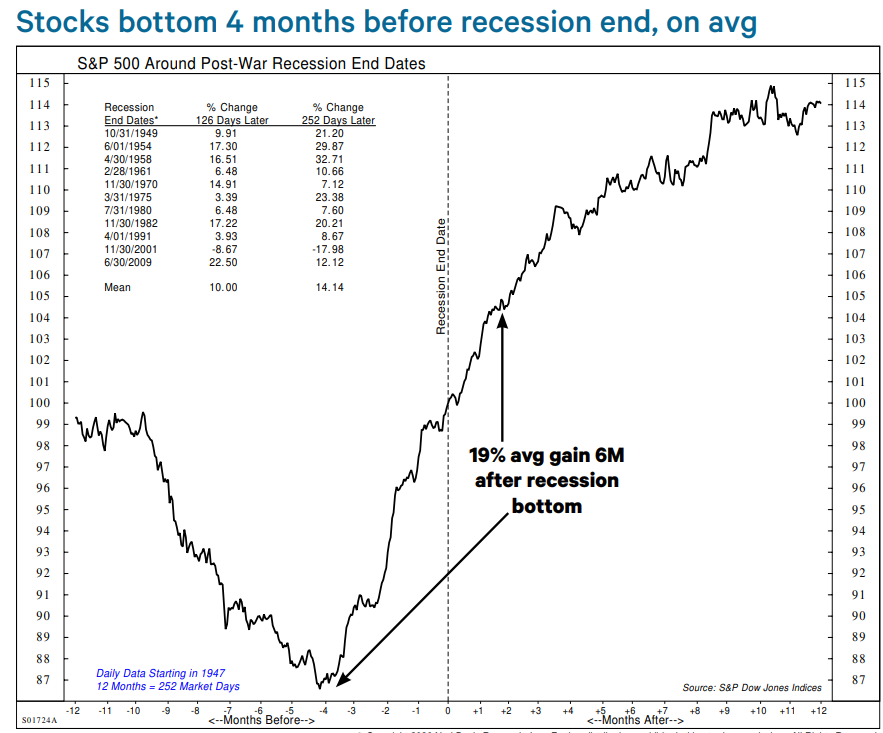

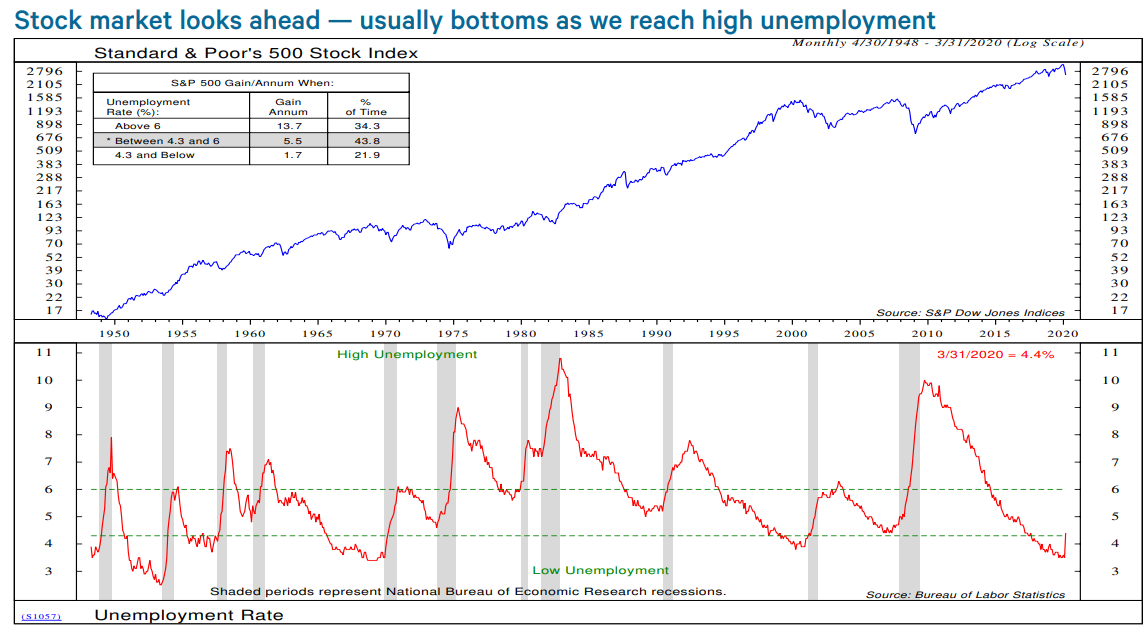

But this gloomy environment should not automatically extend to your investments. We highlighted earlier that stock markets are forward-looking mechanisms. The markets will thus price in the good news long before the economic and earnings data are released (lagging effect). On average, the stock market bottoms about four months before the end of a recession. If you only react when official economic data looks terrible (reflecting what has already happened in the months before), you will thus miss out when the markets rebound. Remember that economic data is a lagging indicator. You would then have locked in your losses and permanently impaired your portfolio by curtailing any chance of recovery.

5. Stocks and the Economy Are Unrelated

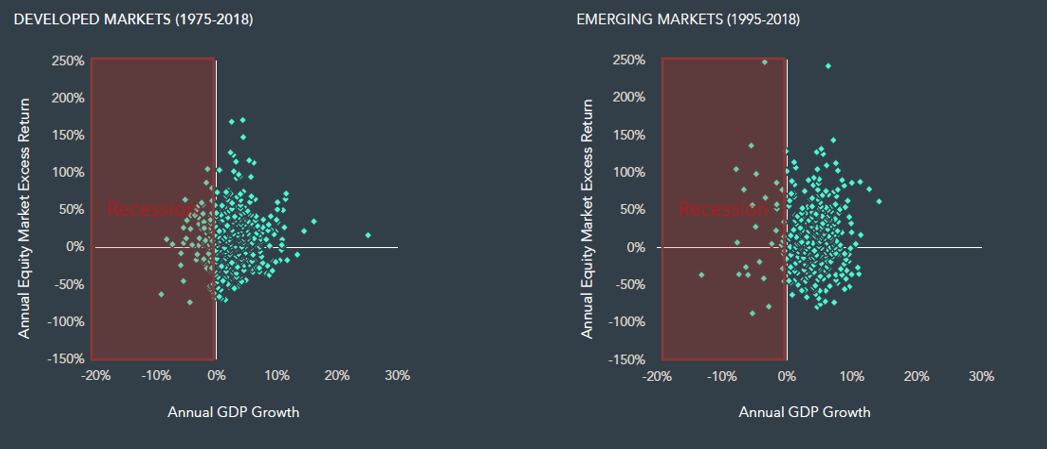

The picture below was trending on social media last week. It seems strange that global stocks had rallied +20% from the bottom even as the news flows kept getting worse. Most people think that markets would go down when the economy is bad, and vice versa. But – surprise, surprise – the evidence shows that markets and the economy actually have no relationship.

The diagram below shows all the past annual stock market returns of both developed and emerging markets plotted against their annual economic growth (GDP). A negative GDP growth means that the country is declining or in a recession (shaded in red). You will immediately notice that there is absolutely no pattern or relationship between GDP growth and stock market returns. Even more so for negative GDP growth, where stock market returns are shown to have been both positive and negative at such times!

Taking Things in Perspective

The current climate understandably triggers many worries in investors over how markets could perform in the future. However, the above charts and examples are meant to debunk erroneous investing beliefs that are sadly pervasive amongst many investors, both seasoned and new. No one can predict market returns, not even the well-meaning economists from the IMF.

If your portfolio is already properly diversified and you have discussed with your adviser how to properly structure any withdrawals, then you should not worry and let us manage this for you, based on hard evidence, not guesswork. Don’t overreact to bad news and sell down your investments.

Remember that, historically, the best days of the market tend to arrive together with the worst ones. And missing these best days has been shown to permanently harm the ability of your investments to generate long-term returns – as you can see in the chart below.

In essence, the ups and downs of the market should not affect how you live your real life. As the quote goes, life should be lived looking forward!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.