Beware the Insidious Bite of Inflation

04 October 2019

“In this world nothing can be said to be certain, except death and taxes.”

— Benjamin Franklin

This famous quote from Benjamin Franklin, one of the Founding Fathers of the United States of America, appeared in a letter he wrote to the French physicist Jean-Baptiste Le Roy to discuss the new Constitution. We believe that Franklin could have possibly added a third element to the certainties of life: and that is inflation.

Despite low interest rates since the 2008 financial crisis and the relatively high levels of employment in Singapore, future inflation expectations remain low. A regularly-conducted poll on inflation expectations showed that Singaporeans generally expect relatively benign levels of inflation.

One reason could be that our economy is quite stable, and the central bank (MAS) wields control over the currency exchange of the Singapore dollar (SGD). This makes it unlikely that we will experience inflation spikes or sudden sharp increases or decreases in the prices of goods. Any rises in inflation are quite likely to be gradual over time. As such, we don’t expect things to suddenly become too expensive.

The problem with that is that when inflation does eventually happen, it is often too late to take any mitigating action. Remember the story of the boiling frog?

Theories abound when it comes to megatrends that could influence inflation one way or another. Rising technological advances could enhance efficiency and drive down prices in some areas, such as telecommunications. On the other hand, a rapidly ageing population could increase the provision of healthcare costs over the long run.

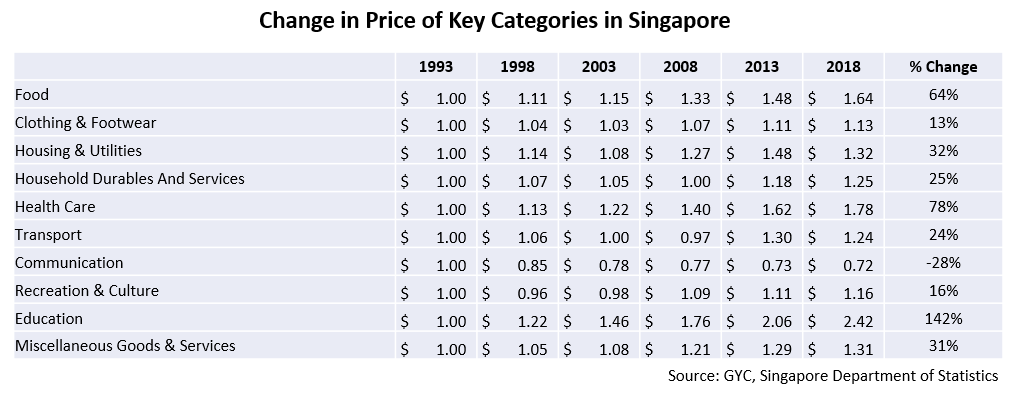

The diagram below shows how $1 worth of various products in 1993 grew more expensive over 5-year increments for the next 25 years. The last column shows the total percentage change over time. You will find that education, healthcare and food experienced the greatest increases in prices. This could have been due to the rising pressure for Singaporeans to spend more to ensure their children get the best start in life, while our ageing population meant a higher demand for medical services and finding it easier to eat out rather than cook.

So, how does inflation affect your portfolio returns? This paper from the National Bureau of Economic Research shows the negative relationship between high inflation and low stock prices. With rising inflation, only a certain number of companies are able to adjust prices upwards. Many other companies are unable to do so if they want to stay competitive. This affects earnings and how investors price the companies.

However, the stock market was only affected during periods of extremely high inflation, which occurred in the 70s and early 80s.

For bonds and fixed income, the relationship is much simpler. “Inflation and fixed income are not a good combination, usually,” said George Rusnak, co-head of global fixed-income strategy at Wells Fargo. “Inflation eats away at your returns, and if your return is fixed in nature, it erodes quickly.”

When you buy bonds (which is essentially a loan to the company), you will usually get back 100% of your money when the bond matures a few years down the road. This means that the value of your future dollars will already be reduced by inflation. Bonds are a poor hedge for inflation, and this is unfortunately something that many investors do not realise.

So, how do you protect yourself from rising inflation and ensure that your purchasing power does not erode over time?

For many long-term investors, the answer would be to have some allocation to a globally diversified portfolio of stocks. In Professor Jeremy Siegel’s book, Stocks for the Long Run, he advocates a diversified portfolio of stocks to hedge against the erosion of purchasing power that results from inflation.

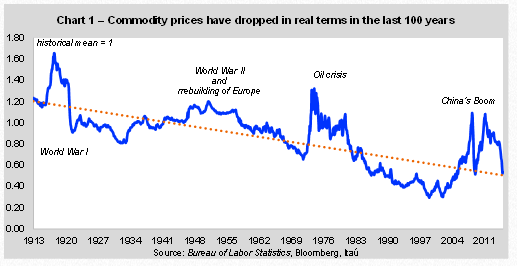

Some other strategies advocate holding commodities like Gold to hedge against inflation. Commodities do help to a small extent, but only for short bouts of inflation. When it comes to prolonged inflation, the real prices (after inflation) of commodities could end up close to zero or even slightly negative. Investors should thus be cautious about over-allocating to these assets.

In summary, although inflation has been low for some time now and therefore out of the media spotlight, it is nevertheless something we need to keep an eye on and factor into our financial planning.

Most people are more concerned about the possibility of market crashes and the volatility and pain associated with them, but protecting one’s portfolio against volatility by buying bonds or holding cash deposits exposes you to an even greater risk in the long run – a decrease in the real value of your money. As you can see, inflation has been slowly increasing over time and making goods and services more expensive. The worst outcome you could have would be to find out only after a decade or more of retirement that you do not have enough to make ends meet, let alone enjoy the sort of retirement you hoped for.

Speak with your adviser to ensure that your asset allocation won’t just keep you sane during market turbulence but would also be able to fulfil your spending requirements in the future; because even though the market has forgotten about inflation, it doesn’t mean it is no longer a threat.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.