Children and Markets – Could Be The Same Thing!

12 July 2019

The past one and a half years have been very volatile for investors. For those of you who have kids, it might remind you of a 2-year-old’s behaviour. One moment, they can be the sweetest angels, and then burst into a tantrum without warning. You know it’ll happen eventually with kids. You can expect the same of markets.

Most investors hope to identify the signs of an upcoming downturn or approaching volatility so they can get out of the markets before it’s too late. However, unless you have powers of prediction never before seen on Earth, you would be far better off staying calm and riding out the storm.

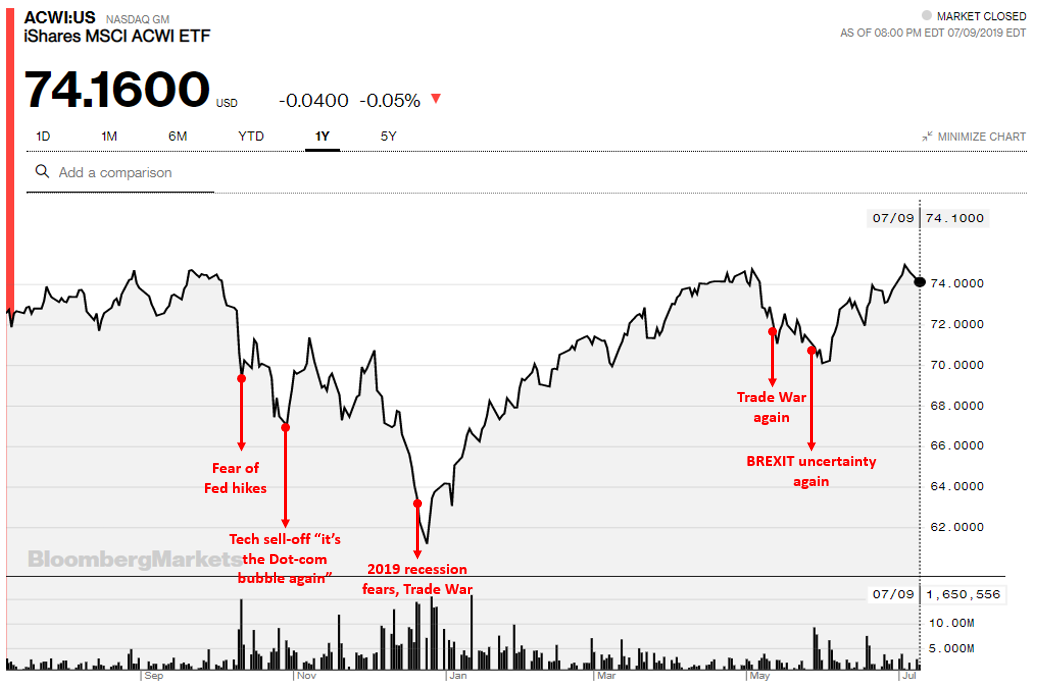

The chart above traces the performance of global stocks over the past year. It shows how quickly volatility can strike, but also how quickly the market can recover. This means you need to train yourself to do absolutely nothing in market downturns – not out of fear or uncertainty, but because that is the optimal course of action, based on decades of tried, tested and well-researched academic data.

Trust Your Portfolio and Asset Allocation

If you have a well-built investment portfolio that is diversified, low-cost and suited to your risk level, you have nothing to worry about. Diversification will take care of the systematic risk (over-concentration) in your investments. Hidden costs in investment products slowly eat away long-term returns, so having a cost-optimised portfolio will ensure you don’t suffer those unnecessary losses.

Risk comes from your asset allocation. When you first conceptualised your portfolio, you would have decided on a certain proportion of equities and bonds based on how much risk you could tolerate. The primary purpose of bonds is to provide a buffer during the ups and downs of the market, to act as a cash-alternative hoard when you need to drawdown on the portfolio, and to allow you to buy more equities through rebalancing when prices are down.

Sell Only When You Need the Money

Far too many investors sell in response to alarming news or when they hear about economic problems from friends. However, you invested for specific reasons. You should sell only when you need the money for those reasons. If you give in early, especially during market turbulence, you would only end up locking in those losses, virtually ensuring a poor return and a lousy investment experience.

Markets Change Quickly

You can see from the previous chart how record highs and record lows are being constantly made, there one second and gone the next. Attempting to chase all these events will keep you perpetually one step behind; by the time you make the trade, something else would have happened. In the end, you’ll end up all the more stressed, and having to deal with more costs from transactions and spreads that eat into your returns.

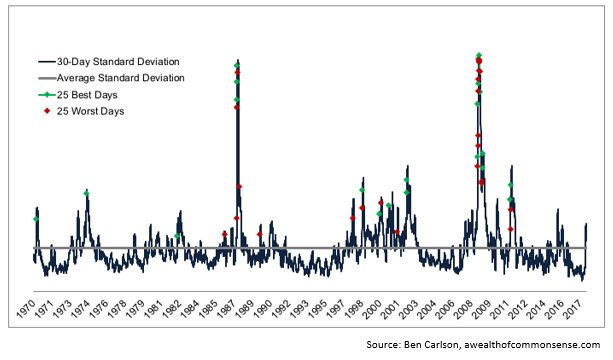

Most of us intuitively know that volatility means bad market days and losses. However, the diagram below shows how volatile the best days for market returns are. If your strategy is to sell early in times of volatility, you’d thus be ensuring that you miss those best days – which are responsible for the majority of gains in the market.

Doing nothing doesn’t mean standing still and ignoring reality. Market volatility – especially when there are losses – are perfect opportunities to rebalance your portfolio. We have written often about the benefits of rebalancing. In a nutshell, rebalancing will fortify your portfolio and enable you to generate higher returns at a lower risk.

We rebalance whenever our managed portfolios asset allocations drift away from their targets. This ensures that investors are never exposed to risk above their tolerance, and gives them ample opportunity to do well in many different conditions.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.