How Do You Profit in a Trade War?

28 June 2018

As different parts of the world head off for their annual summer holidays, politics and trade issues are seen hogging the financial headlines once again. “Stocks drop as trade concerns simmer!” blared prominent financial news outlets just a couple of days ago. The very next day, the same news outlets swiftly changed course, declaring: “Stocks rise as trade war fears recede.”

Are you confused yet? How swiftly positions can change surely lends itself to the question: can anyone actually position themselves ahead of what is happening in the markets, in a way that would let them profit from those predictions before others do, and before those positions change again?

Stock picking makes sense if you believe that investing is all about picking successful companies (ahead of everyone). But identifying good businesses is one thing. It is another thing altogether to predict that the stocks of your selected companies will beat the prices set by the overall stock market.

Every day, the market comes up with market views from highly qualified (and highly paid) analysts, strategists, and CIOs (Chief Investment Officers) about the merits of one stock/sector/theme over another. Fundamentally, these opinions take into account management quality, competitive advantages, product differentiation, balance sheet strength, earnings growth, margins, and so on. Yet the premise being pushed by the media is that individual investors have the time and capability to sift through all the different market views and come up with their own game plan on which companies to invest in. In other words, you, as the individual investor, are trying to be better than the army of highly qualified analysts out there. Is that really possible?

It’s a complicated and daunting task, and one which is entirely unnecessary. Why? Because the market has already aggregated the views of millions of intelligent, highly-informed and highly-expert investors about each company’s prospects. All that information and analysis is reflected in its daily price, which constantly change as new information enters the market. So, even if you put together a deeply thought-out analysis of a company’s worth, you can still get it very wrong.

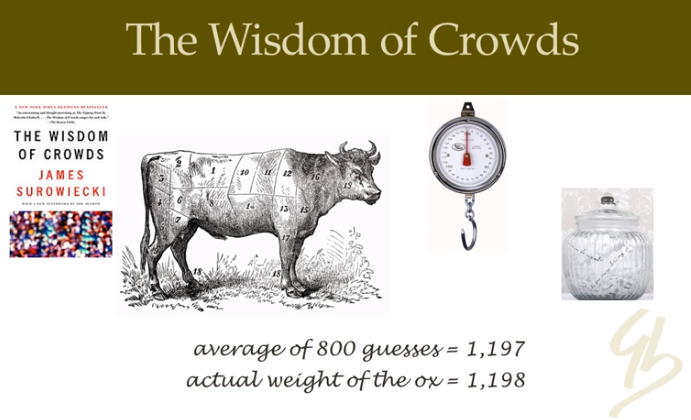

If you consider a particular company worth investing in, there’s likely someone else in the world who finds that same company poor enough to sell. This concept of market pricing was explored in the early 1900s by an English academic, Sir Francis Galton, and in the story told in James Surowiecki’s book on the wisdom of crowds. The premise is very simple – no individual, no matter how brilliant or intelligent, is able to solve problems or come to wise decisions as efficiently as the average responses of a large group of people.

So, does this mean that no one can do it alone? Of course not, but the probability of success is so very much lower. Academic research has shown that, even for professional managers, luck, rather than skill, very often explains their success. Individually, you could also get lucky basing your investment strategy around perceived mispricing and forecasts about the economy and market conditions. But this approach rests on a couple of very big assumptions – that the market, collectively, will eventually come around to your way of thinking, and that the economy and the particular industry you have invested in will pan out as you imagined. Those are very big ‘ifs’, indeed!

Unfortunately, this view remains prevalent in the media and much of the financial services industry. You need to gather together a few good ideas about individual stocks or themes, and concentrate your portfolio around those “high conviction beliefs.” However, research has shown time and time again that trying to outguess the market adds no value over the long term. Thinking of selling or shorting Chinese stocks because of the trade war? Many people have already considered that and acted upon it. Tariffs on European cars or foreign steel imports? Market participants have already adjusted their investments based on that information.

What can an investor do, then? A better approach is to accept that current market prices are a fair reflection of the combined views of participants in a highly-competitive marketplace. Diversifying your stocks as broadly as possible and rebalancing as prices and circumstances change would mean that you do not have to rely on a handful of stocks or investment themes to do well. You would then be less at risk from stock-specific or industry-specific factors that can blow a big hole in your strategy (and money).

Ultimately, investing is about the future and not the past. Market prices are forward looking and are determined by ALL market participants. Rather than try to outguess the market and assuming you could profit before others, believe that current prices already reflect the aggregated views of global investors each day. Holding a globally diversified portfolio will then ensure that you are well-positioned from the many possible outcomes that may arise from this “trade war” idea or any other thematic play. It is best to leave such views, politics, and other fancy trading ideas out of your portfolio.

(Note that excerpts of this article were taken from Outside the Flags 5 (2017) by Jim Parker, Dimensional Fund Advisors.)

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.