Key Questions for Every Investor

05 March 2018

Whether you’ve been investing for decades or are just getting started, at some point you’ll likely ask yourself some of the questions below. Listening to friends, family or the financial media may not be the only way to get the right answers. Instead, a little discipline and some help from a fiduciary advisor will help put you on the right track.

Hopefully, some of the answers to these questions, which use key principles, data and reasoning, may help improve your odds of investment success in the long run.

1) What sort of competition do I face as an investor?

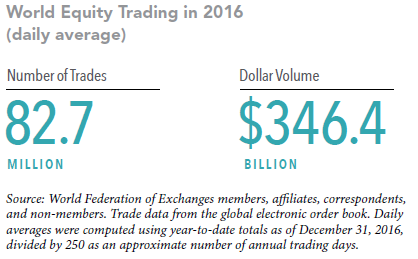

Millions of investors, traders, banks, institutions buy and sell securities every day. The total aggregate of all buy and sell prices in real-time helps to set the actual price of a security at any given moment. This means competition is stiff, and trying to guess whether stocks are correctly priced is very difficult, even for professionals with the vast amount of data available to them.

However, this is good news for investors! Rather than using an investment strategy which seeks to find securities that are priced “incorrectly,” investors can instead rely on the information in market prices to help build their portfolios. The diagram below shows the average number of daily trades and volume from stock exchanges around the world in 2016.

2) What are my chances of picking an investment fund that survives and outperforms?

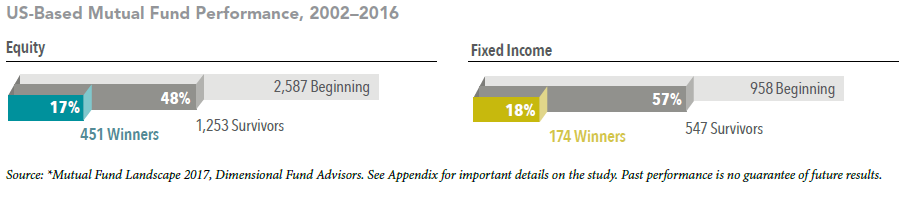

Flip a coin and your odds of getting heads or tails are 50/50. The odds of selecting an investment fund that would still be around 15 years later are about the same (i.e. only 1 out of every 2 funds will survive). However, selecting a fund that outperforms has even worse odds. The market’s pricing power (see question 1) works against fund managers who try to outperform through stock picking or market timing.

One need not look further than real-world results to see the truth in these statements. Using research on the US stock market (which has the longest track record) as shown in the diagram below, only 17% of US equity mutual funds and 18% of fixed income funds have both survived and outperformed their benchmarks over the past 15 years.

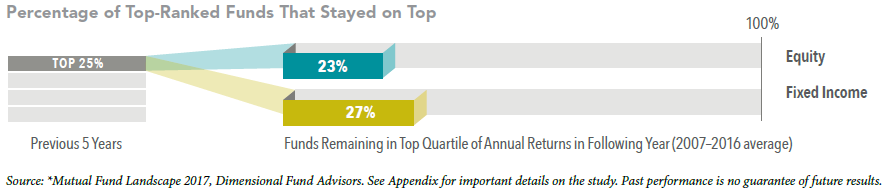

3) I am buying funds which have excellent past performance. Does this mean they will continue to do well in the future?

Many investors select funds or strategies on the basis of their past returns. However, research shows that most funds in the top quartile (top 25%) of the past five-year returns did not maintain a top-quartile ranking in the following year. In other words, past performance offers little insight into a fund’s future returns. Even if a fund should continue to do well in the future, the chances of picking that successful fund is difficult and considered a low-probability event.

4) Do I have to outsmart the market to be a successful investor?

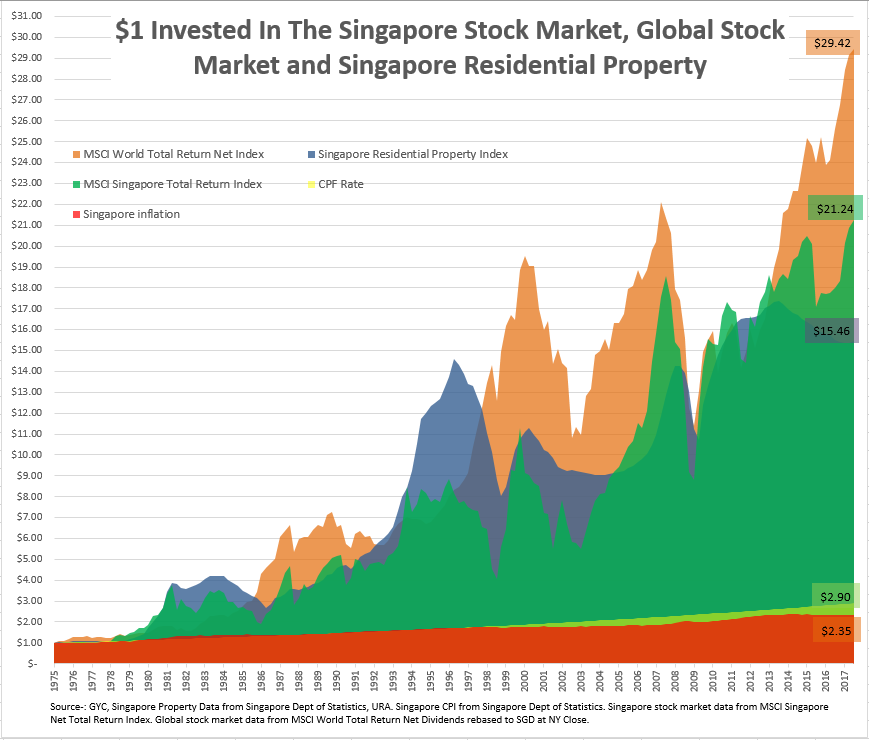

What is more important is to have a long-term plan and stick to it. Financial markets have rewarded long-term investors. People expect a positive return on the capital they invest, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. There are times, however, when the realised return was much lower than the expected return due to volatility, risk and investor sentiment. Nonetheless, investors who had stuck to their plan would have been rewarded.

5) Should I invest in international stocks and bonds? How do I do it?

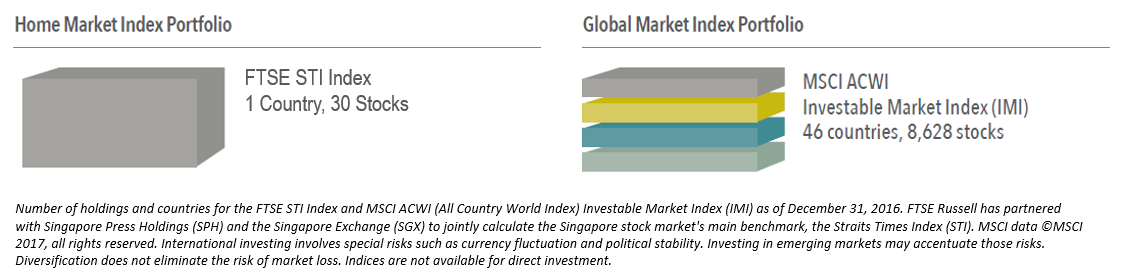

Diversifying from 1 stock to 50 stocks is good, but still insufficient if all the 50 stocks are in your home market. Instead, global diversification can broaden your investment opportunity base. By holding a globally-diversified portfolio, investors will be well-positioned to seek returns wherever they occur in the world. The diagram below shows how investing globally allows an investor to diversify far beyond their home market.

6) Will making frequent changes to my portfolio help me achieve investment success?

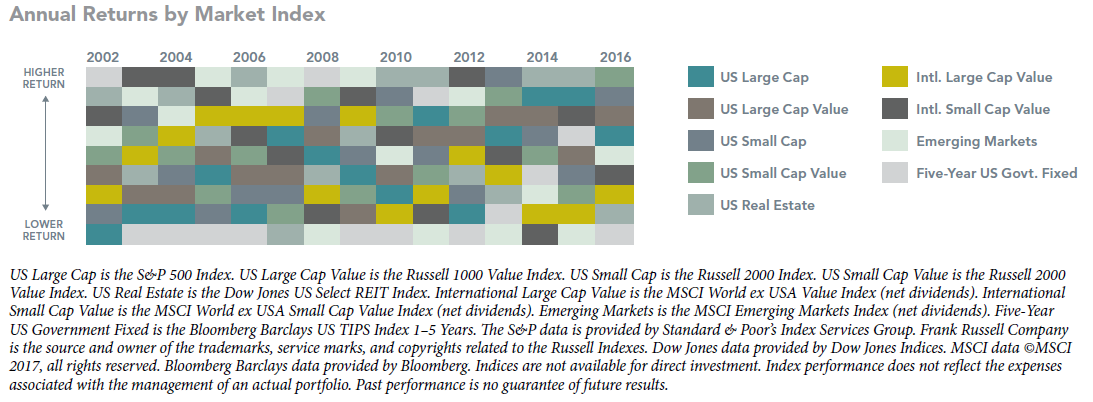

How do you know which sector or country will do well this year? Would it be technology? How about banks? Maybe China will outperform? All these decisions need to be made on lagging and past data. It is very tough, if not impossible, to know what will happen tomorrow, let alone one year ahead.

As such, it is better to avoid market timing calls and other unnecessary changes that can be costly. Allowing emotions or opinions about short-term market conditions to impact long-term investment decisions can lead to disappointing results. Rather than trying to capture the outperformance of narrow areas of the markets, a more robust and consistent strategy would be to allocate to ALL of them. The diagram below shows how random the highest performer for each year can be.

7) Should I make changes to my portfolio based on what I hear on the news?

Have you heard statements like: “Trump’s fiscal policy looks set to ruin the US!”; “Rising interest rates will cause the market to collapse!”; “Steel and aluminum tariffs trigger sharp US stock market sell-off”; or “You’re missing out on the longest rally in the history of the stock market”?

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. If headlines are unsettling, consider the source and try to maintain a long-term perspective.

Research and evidence shows that big bear markets are caused by only two main factors – whether the economy is headed into a recession, or whether there is a financial crisis. As long as these two conditions are not evident, investors should ride through the volatility that comes as part of investing and keep to their long-term plan.

8) Everything is confusing! What should I be doing?

Work closely with a fiduciary advisor who can offer expertise and guidance to help you focus on actions that add value. Focusing on what you can control can lead to a better investment experience.

- Create an investment plan to fit your needs and risk tolerance. What is risk tolerance? Many investment products do not state the level of loss, and many financial advisors do not know how much your investments could lose. Ensure that your advisor explains this clearly to you. In addition, your preference for risk changes over time, so make sure you review it on a regular basis.

- Structure a portfolio along the dimensions of expected returns.

- Diversify your investments globally.

- Manage expenses, turnover, and taxes. Many funds and investment products have hidden or high fees. Make sure you know what you are paying for.

- Finally, stay disciplined through market dips and swings. This cannot be emphasised enough. If you do not have the guile to do so, work with someone who can guide you through the tough times in the market.

*Some content adapted from Dimensional Fund Advisors LP.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.