Cryptocurrencies Are Not An Investment

11 August 2017

There has been a recent surge of interest in cryptocurrencies given their phenomenal rise in values. The original cryptocurrency, Bitcoin, has since seen a rise in value from $0.06 in 2010 to over $3,500 USD at the time of writing, whilst the new kid on the block, Ethereum, went up from $1.33 to over $270 USD in just over 1.5 years. So, what are cryptocurrencies, and what do we mean in saying they are not an investment?

Bitcoin was invented because its originator intended to create a form of digital cash. The problem with a cash system, however, is that there needed to be a centralised accounting system to take note of all the units in circulation and ensure that there was no double spending. The solution to this problem was Bitcoin – where there was no need for an accounting system. Every peer who took part in the Bitcoin process had the origin and a list of all the past transactions of the Bitcoin, which was hidden in a string of letters called the blockchain. The main issue with Bitcoin and the newest one, Ethereum, is that these currencies are not backed by any assets, unlike traditional currencies created by central banks of countries. Currencies traditionally have been based upon the value of gold, silver or some form of commodity. Currencies are also backed by the full faith of governments or backed up by sovereign debt. There is no such backing for cryptocurrencies and there is no clear way to determine the value of these except for demand and supply. Cryptocurrencies are based on pure computing power, where a complex mathematical problem needs to be solved before a unit of cryptocurrency is created.

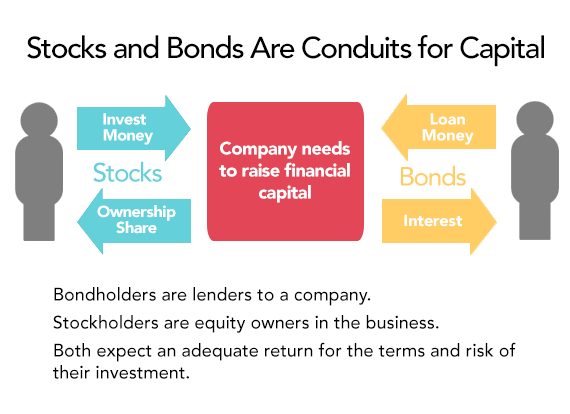

Looking at the fundamentals of investments, we invest in stocks to get an ownership share in a company, and we also invest in bonds to lend money to a company. The money we use to buy these shares or give loans is meant to participate in the global economy and capitalism. Money spent on buying digital currencies does not go towards this same economic purpose. When there is no asset to value behind the cryptocurrency, how can we actually determine its worth? Is the price quoted on the exchange cheap, fair or expensive? The historical record of these currencies only date back a few years, and we do not have a proper dataset to conduct proper empirical research into it. This is the main reason why most are uncomfortable calling it an investment.

There are also a few other problems with digital currencies. Given that there is no vault to store your money, it is all kept in “digital wallets”. There have been instances of online thefts and currency exchanges being hit by faults and problems which could render your currencies useless. Whilst you may be able to track who stole your cryptocurrencies, the anonymity of the entire network (which was the main reason why these were created in the first place) renders such tracking impractical. Online thieves, once they have gained control of your account are also able to change the master password keys to your cryptocurrency which makes you unable to access them anymore. The current instability and unknown nature of who is behind the control of these cryptocurrencies is also another reason not to view it as a proper investment, but rather a bet.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.