Uncertainty and the Perfect Market Timing Strategy

02 August 2019

An edited version of this article was published in the 27 July 2019 issue of TODAY.

In quantum mechanics, Heisenberg’s uncertainty principle states that the more precisely you determine the position of a particle, the less precisely you can determine its momentum, and vice versa. This is an inherent property of wave-like systems. There will always be something unknown.

We observe a similar inherent uncertainty in the investing world. We offer our capital to companies not knowing if they will succeed or fail, but it is that very uncertainty (and its associated risk) that we are remunerated for.

On 10 May, the US decided to impose $200 billion of tariffs on Chinese goods, intensifying the US-China trade war just when it had appeared to be simmering down. This led to market turbulence as investors rushed to sell off equities and grab bonds. Most of them were too late, taking losses in the process. Then, at the recent G20 summit, the US and China agreed to restart talks and US President Trump allowed Huawei to do business with US companies again. The US Fed then came out to say that they might be cutting rates to support the economy. Stocks promptly rallied and bonds fell, and investors once again fell over themselves to reverse their previous actions, suffering additional losses just to end up back where they started.

This process happens over and over again in investing. It isn’t surprising, then, that many investors fail to achieve decent returns. Not only does the continual flip-flopping often involve buying high and selling low, but investors also incur transaction costs from every trade they make.

The financial media and the industry’s trove of experts are always eager to offer neat theories on market behaviour. Central bank policies, terrorism, earnings reports, crazy politicians, financial regulation and even spurious market indicators like planetary movements or NFL Super Bowl winners are all fair game when it comes to explaining why the market is going up, down or nowhere at all.

Investors who are already in the market have a natural desire to pre-empt uncertainty or respond to it. Timing the market helps them feel that the market is predictable and they are in control. Yet while they may sometimes get it right, the opposite is far more likely.

Some investors prefer to rely on market experts (or “gurus”), and subscribe to their newsletters to help them with stock picks as well as when to buy and sell. However, studies (in 2012) and more detailed academic research (in 2017) into the forecasting accuracy of market gurus, show that even the best of them do not meet the required level of accuracy to beat a simple buy-and-hold diversified strategy. Nobel laureate William Sharpe determined that an investor needs to be accurate at least 74% of the time to beat the market. However, out of all the forecasters studied, the best had an accuracy of only 68%, while the average accuracy of the whole group was 47%. The conclusion of the research was that the majority perform at levels not significantly different than chance, which makes it very difficult to tell if there is any skill present.

In reality, however, there is actually a perfect market timing strategy that would capture all the gains and none of the losses. Nobel laureate Robert Merton’s work on market timing included an example of such a strategy. First, buy a share of the stock market, and then buy a one-month put option— where the person selling the put option agrees to buy that share in one month at a set price. If the market price falls below that set price, you can then gain from the deal. If the market price rises above the set price, you can choose to ignore the put option and reap the gains directly from the market.

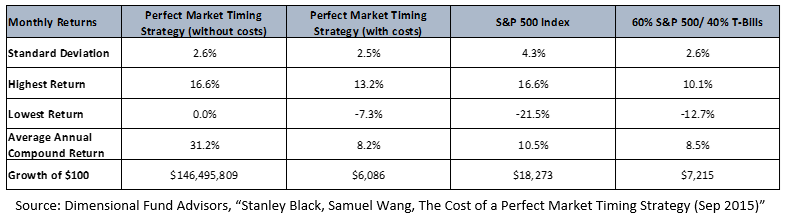

This strategy has a remarkable track record with annual returns of over 31% and growing $100 to over $146 million over 50 years (the period of study was from Oct 1962 to Dec 2014), assuming no transaction costs. Unfortunately, there are costs involved: buying put options requires you to pay a premium to entice a seller to take on the risk and agree to the deal; otherwise, the seller would only stand to lose.

The price of the put is always high enough that it arbitrages away all the advantages of this perfect timing strategy. Its final return then becomes very similar to that of a 60% equity and 40% bond strategy. However, note that the returns are far inferior to that of a 100% equity strategy, although the volatility is lower:

So, if there’s no real-life perfect strategy to move in and out of the markets, what can investors do? Here are some pointers:

1. You Don’t Need to be 100% In or 100% Out

Many investors visualise being either invested 100% in stocks or 100% in cash. However, a blended portfolio of 70% equities and 30% bonds or 50% equities and 50% bonds may be more suited for your financial goal. Working with a fiduciary goals-based adviser will help you figure out which strategic allocation would be best for you in terms of the risk you can afford to take and the return you need to get there. Combine this with periodic disciplined rebalancing to achieve the best long-term chance for success.

2. Lock in Your Gains

If you are on track to meet your goals, there is nothing wrong with enjoying the returns you have already made by adjusting your asset allocation slightly or even trimming some profits off your portfolio. After a period of good returns, you could put those gains into short-term fixed income or cash-like deposits for safety and spending. This way, you won’t feel overly hurt if your investments get hit by a market correction.

3. Average In

If you’re afraid to invest everything in one lump sum, split it up into smaller amounts and average into the market to spread your risk. Although lump sum investing may bring better returns for investors, dollar cost averaging will spare you the emotional stress of deciding when and how to commit that vast amount of money. Professor Kenneth French at the Tuck School of Business, Dartmouth College, notes that people feel greater regret about things they did rather than did not do. Most people would find it worse to invest only to lose money, rather than not invest and miss out on an equal amount of returns. Dollar-cost averaging helps to soften that potential loss and makes it much easier for investors to overcome the inertia that keeps them from getting started.

In the end, uncertainty is an inevitable part of investing. Contrary to what many people think, there’s really no secret formula that can tell you the right time to enter or leave the market, or what assets would perform best or worst. The last few years have shown that even the most seemingly-logical investment bets don’t always turn out the way they are supposed to – with examples that include betting on Brexit, the last US presidential elections and the recent trade wars between the US and China.

However, as we have shared above, there are still actions you can take even if you can’t predict the future well enough to time the market. Investing is ultimately just a means to an end—an end that presumably involves peace of mind. There is therefore little sense in giving up that peace to worry about the inherent uncertainties of investing.

(This is part of a series of articles that we have been writing for Singaporean investors.)

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.