The Best Way to Invest in This Type of Market

14 May 2020

“Fear incites human action far more urgently than does the impressive weight of historical evidence.” – Jeremy Siegel

“When is the best time to buy?”

It’s a question we’ve been getting a lot in these uncertain times.

We’re receiving a staggering amount of bad news every day. As COVID-19 continues raging around the world, we’re flooded with stories of death and devastation. The financial media is saturated with negative economic forecasts and earnings reports that can rapidly cause analysis paralysis. It all makes us want to socially distance in a cave until the coast is clear.

But, seeing as there aren’t enough caves in Singapore, what are your options when everything seems so dire and the future so murky?

Investing right now may seem terrifying, but sitting in cash poses problems too. For one, inflation continues to erode the value of cash on a daily basis. Costs are still rising even now. Have you wondered why, when a barrel of oil is being traded at close to $0, pump prices aren’t?

And yet, it may be stressful to watch markets continue to rise, against your beliefs that they should be crashing. It may actually make you feel like a hero when you see market prices going down, because it would justify any decisions to sell or stay in cash for now.

However, allow us to suggest better options that are supported by evidence from history and financial science.

1. Lump Sum Investment

One of the most direct ways to invest when you have money is to put it to work all at once. History and theory both support immediate investment. On average and across global markets, lump sum investments are more likely to outperform systemic implementation strategies that break up your investments into smaller amounts and invest them over a fixed period of time.

This conclusion is consistent with financial theory. Time is your greatest ally in the stock market. Immediate investment lets you expose your full investment to upward-trending markets for a longer period of time. $1 in the market every year for 30 years will perform worse than $30 in that same market from the start. Assuming an average return of 7%, the first produces $102; the second will give you $228. Simply staying in cash would give you $30.

Remember, markets go up 70% of the time and bear the effects of inflation. If that wasn’t the case, nobody would want to invest.

2. Dollar Cost Averaging (DCA)

However, what if you’re worried that markets might collapse on the day right after you invest that large chunk of cash? This is a common fear amongst most investors.

In such situations, systematic investment would make sense. You could evenly split up your funds and invest them regularly into the market over X number of months. This helps you take emotions out of the picture and reduce the fear that would otherwise keep you from investing at all.

Systematic investing is sometimes thought of as a risk-reduction strategy, as it can mitigate the impact of an immediate market dip.

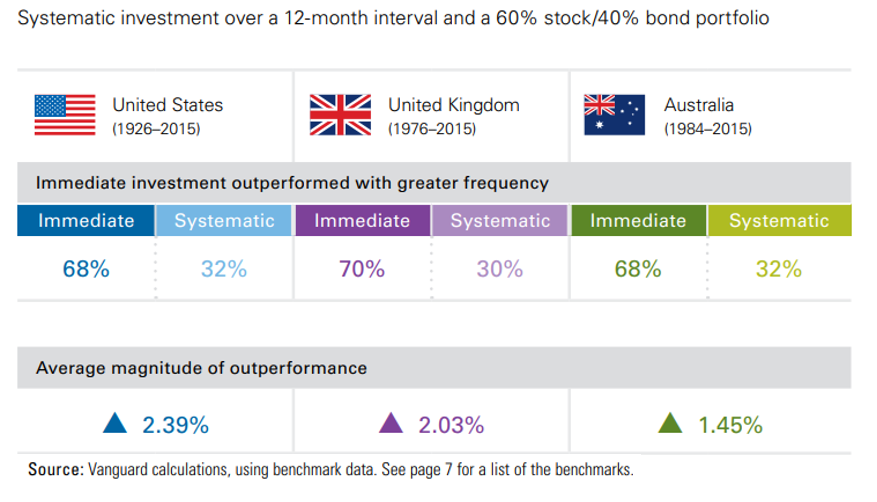

However, academic research shows that investors receive a lower return with this method of investing in the majority of scenarios. In a separate study of three major markets over long market cycles, Vanguard found that a lump sum investment outperformed a 12-month DCA the majority of the time, with significant difference.

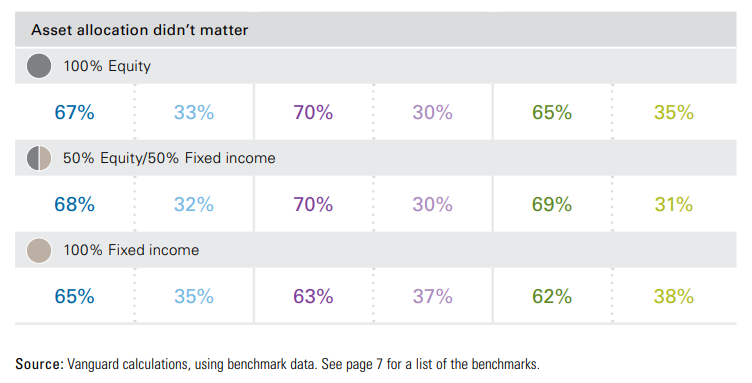

You might argue that DCA would work better when looking to invest in a higher percentage of risky assets. However, the research shows that this is untrue as well – even a 100% bond portfolio benefits from a lump sum investment over DCA.

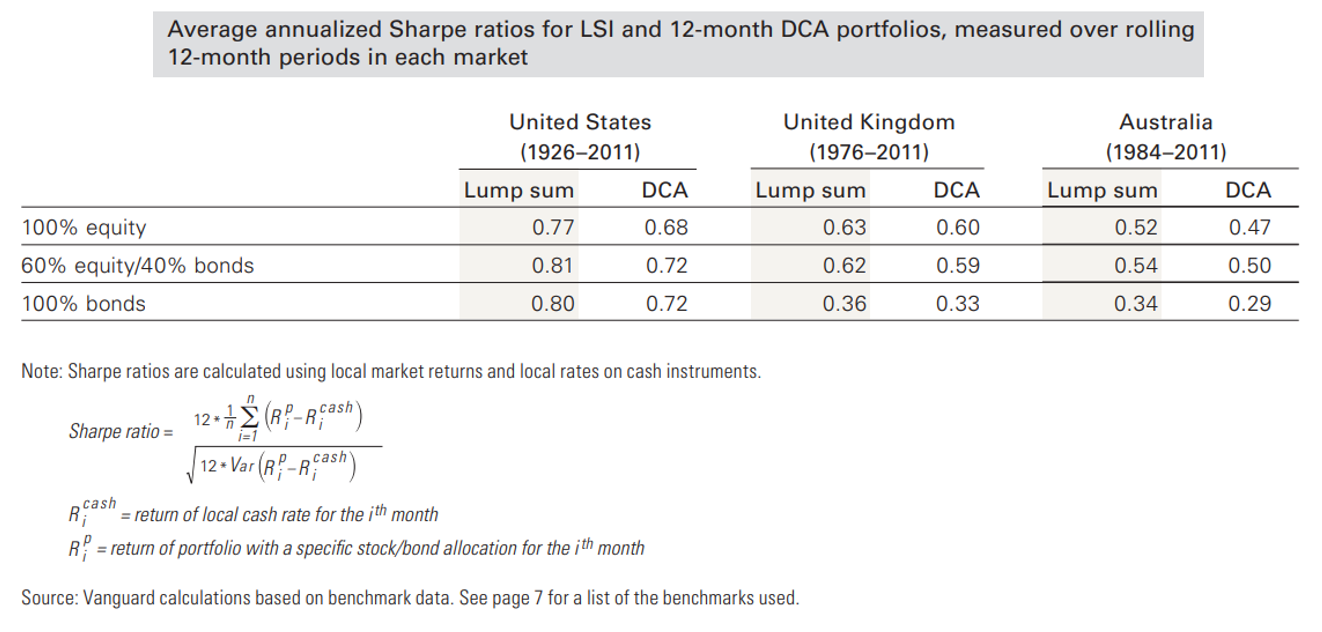

Sharpe ratios, which measure the ratio of investment returns to risk, also show that a lump-sum investment is a much better investment option.

We must nonetheless qualify that this only applies to investors who have spare cash at hand and are looking for the best ways to invest that money. DCA is still a very good way to save and invest over the long-term for investors who invest as and when funds become available, for example through their earned salaries.

You may also notice that systematic implementation outperformed lump sum investing about one third of the time. When were those times? They were severe instances of markets continuing to go down and stay down for extended periods of time. They also work when they enable an investor to sit still without altering the investment or asset allocation during a market crisis.

Despite the evidence against it, many investors still prefer the comfort and ‘safety’ that DCA provides over lump sum investing. As long as stock and bond markets continue to provide returns above cash, this will be true.

So, if you want to know the answer to the best way to invest right now, we can tell you that a lump sum investment has the best chance of providing you with the returns you want to achieve.

But if you don’t have the confidence to do so, a disciplined DCA programme that invests your money over a period of time – no longer than a year – is your next best option. It will ensure you don’t have cash sitting on the sidelines for extended periods of time, and that it will be invested properly into your desired asset allocation.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.