What to Do After All the Big Losses?

20 March 2020

“You need patience, discipline, and an ability to take losses and adversity without going crazy.”

— Charlie Munger

February 2020 was the 22nd worst month for stocks (in SGD) since 1975. March could be worse. It’s still too early to tell, although the last few days have been bad. Many bad months in the past occurred during some of the worst market sell-offs, such as 1987’s Black Monday, 2008’s Great Financial Crisis and 1997’s Asian Financial Crisis, just to name a few.

Market sell-offs are usually short and sharp affairs. Rallies, on the other hand, take a longer time to build up. This is partly due to how human brains work. Neuroscientists have found that merely expecting to lose money triggers a fight or flight response, while being told you’ve lost money activates the right amygdala in your brain, creating an emotional stress response that makes your pulse race and your skin break out in sweat, putting you on edge and ready to react.

That is why investors are so quick to sell out of the market the moment they expect or experience a loss. A financial losing streak also activates the hippocampus, the part of the brain majorly responsible for learning and memory. This means that you’ll remember all that stress and anxiety from the loss, learn that markets are dangerous, and as a result take a longer time to get over that shock and get back into the market even after conditions have improved.

All these instincts have enabled humans to survive through the millennia. Reacting without thought is what lets us dodge an oncoming car or jump away from a snake. Remembering dangerous and stressful situations is what lets us remember not to run back into the cave with the angry bear. But it’s these instincts that also make us want to sell our investments, grab our money and flee from a falling market.

Unfortunately, that’s most likely to happen at the worst times to do so. It would also cause us to miss the rebound when it eventually occurs – sometimes very shortly after the fall. As we have previously shown, the worst days of the market are often clustered with the best days when market volatility is high.

The table below shows the highest monthly losses that the global stock market has suffered (in SGD) since 1975. There’s some good news about those big monthly losses. Markets are almost always up again after 1 to 3 years. Of course, there are outliers, for instance as a result of a significant global economic recession that depresses growth for a long time. But that is not the situation we are in right now.

| Monthly Loss | 1 Year Later | 2 Years Later | 3 Years Later | |

| Oct-2008 | -19.5% | 20.3% | 26.6% | 23.3% |

| Oct-1987 | -19.2% | 23.6% | 39.8% | 11.7% |

| Aug-1990 | -13.2% | 1.2% | -5.0% | 22.2% |

| Aug-1998 | -12.1% | 26.0% | 36.8% | 33.3% |

| Sep-1990 | -12.0% | 15.2% | 5.1% | 31.3% |

| Sep-2001 | -10.2% | -7.7% | 19.8% | 38.2% |

| Jun-2008 | -10.2% | -19.3% | -4.6% | 4.2% |

| Feb-2009 | -10.2% | 46.4% | 59.6% | 52.3% |

| Dec-2018 | -9.7% | 17.7% | Ongoing | Ongoing |

| Jul-2002 | -9.4% | 13.4% | 36.8% | 52.4% |

The market circumstances were naturally different in each of these historical scenarios. They had different starting points for inflation, interest rates and stock valuations. Regardless, each scenario followed an almost identical pattern – because at the end of the day, humans are the ones interacting and trading in global financial markets. So, if you understand market psychology and how our brains work, you could use those insights to make you a better investor.

We’ve Been Here Before

Over the past 40 years, we’ve had 7 corrections (declines of 10% or more) and 4 bear markets (20% or more). You should take heart that the coronavirus situation is not the Global Financial Crisis: Part II. Unlike in 2008, where severe systemic issues within the financial system eventually created the crisis, the markets are functioning properly this time around, with central banks quick to provide support to ensure that institutions don’t seize up – much like disaster relief efforts after a tsunami or hurricane.

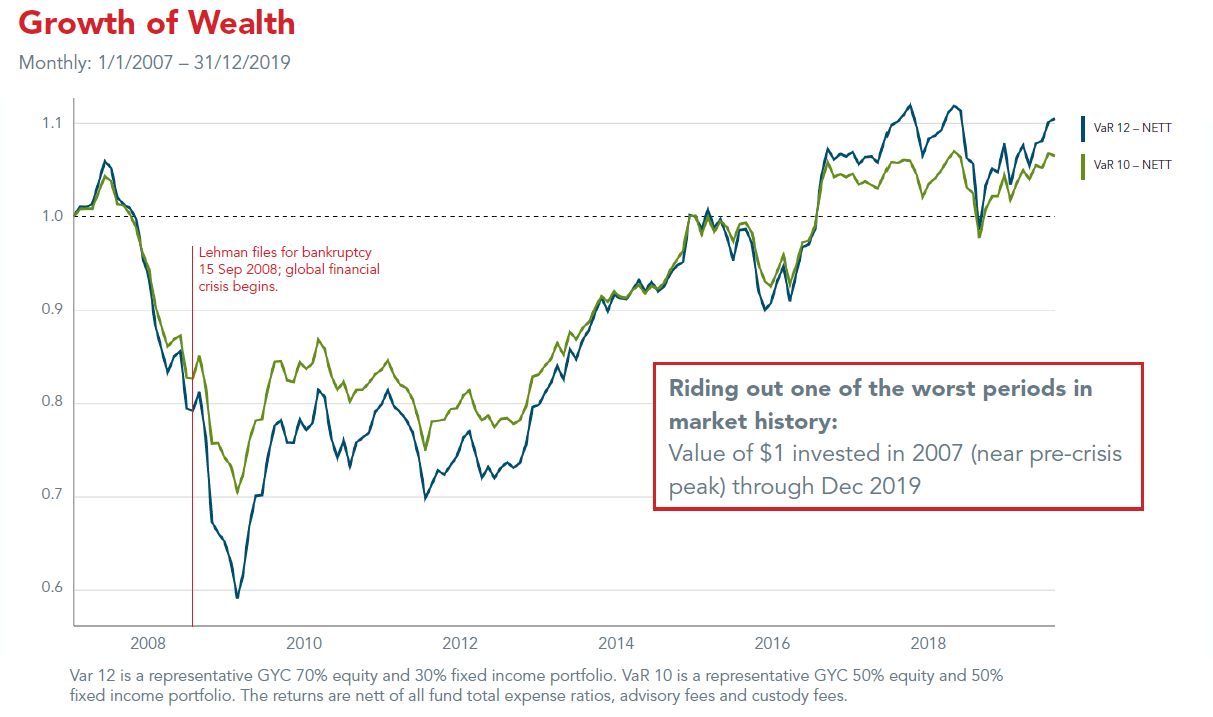

Even after 2008, when lending dried up, banks failed to function properly and businesses around the world went bust, investors who did not sell in panic and who had portfolios systematically buying equities at cheaper prices (like what we are doing now) had those portfolios recover in due time.

Be Systematic

You may feel like a hero when you manage to invest just before markets rise, and then feel like a fool when markets collapse around you. We really don’t know if the markets are going to fall further, or how long this whole saga will last.

However, in order not to be paralysed into inaction, you can implement a systemic plan to invest at specific intervals of time. This will take emotions and speculation out of the process. You don’t need to worry about catching the top, or the bottom. You’ll be able to gain exposure to the market at an averaged price.

If you are still feeling jittery, you can read this recession checklist to make sure you’re well prepared.

Stay Balanced

The reason why asset allocation and including safe bonds in different percentages are important is that they help to buffer your investments against turbulence. They also help you buy high and sell low.

For example, if your asset allocation was meant to have 70% in stocks, and through this market crisis it shrunk to 50%, you should buy more to bring it back up to 70% again. By doing so, you would be buying stocks at a 30% discount, which would benefit you tremendously in the long run. Don’t forget to reverse the action when stocks are on the rise!

Look at Where You Will Be in 10 Years’ Time

Never forget why you started investing in the first place (hopefully it wasn’t just to make a quick buck!). Most likely, you started investing so as to work towards some grand purpose, e.g. sending your kids overseas to study, travelling the world in first class during retirement, helping the kids buy their first house, funding a charitable cause you’re passionate about, etc.

Unless these plans have drastically changed, your investments shouldn’t change as well.

And if markets are at a 30% discount, putting more money into action will have a fantastic wealth creation effect.

After all, who doesn’t like a sale?

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.