How do you face a financial crisis?

15 November 2019

“The global financial crisis – missed by most analysts – shows that most forecasters are poor at pricing in economic and financial risks, let alone geopolitical ones.”

—Nouriel Roubini

Are you still afraid of investing in the stock markets because you fear a financial crisis might be just around the corner? Should you wait it out until “the coast is clear”, or gingerly “step into the investing waters” and hope for the best? Which would be the correct move for you?

Although it has been slightly over a decade since the Great Financial Crisis of 2008, many investors remain scarred by it. Some of them saw half their wealth get wiped out. If you were one of them, you may still be afraid of getting back into investing. However, unless you are lucky enough to have enough funds to support you for the rest of your life, investing is a necessary step to reaching your financial goals.

This can be difficult to accept, especially when doomsayers point out that the current market environment may be similar or different to the period leading up to that 2008 crisis. But the fact is it can actually be difficult to draw useful conclusions from those observations. Financial markets are notoriously unpredictable in the short run. They only become predictable over long periods of time, which is why we always prescribe investing for the long term. The way to face a financial crisis is to pick an investment approach which you can stick with – especially when the tough times come. A good adviser will also show you how your portfolio will fare in past crises or mentally rehearse you through a crisis and explain what is going to happen so that when it happens, you will be better prepared. Its like the safety announcement or video that airlines have to show whenever you fly.

As they say, time heals all wounds. Being more than 10 years removed from the crisis perhaps makes it a bit easier to take the past in stride, but back in 2008, nobody could have envisioned the future we are currently in. Headlines such as “Worst Crisis Since the ’30s, With No End Yet in Sight“, “Markets in Disarray as Lending Locks Up” and “For Stocks, Worst Single Day Drop in Two Decades” were the recurring nightmarish news headlines at that time. Watching the financial news on television, reading the newspapers and checking one’s investment account were, for many, heart-dropping experiences.

While being an investor today (or during any period, for that matter) is by no means a worry-free experience, the panic and dread felt by many investors during the financial crisis were distinctly acute. Unfortunately, at exactly the wrong time, many investors finally decided it was more than they could stomach, and sold out of their investments – right before the market recovered. On the other hand, many who were able to stay the course and stick to their plan managed to benefit from the subsequent massive rebound in 2009.

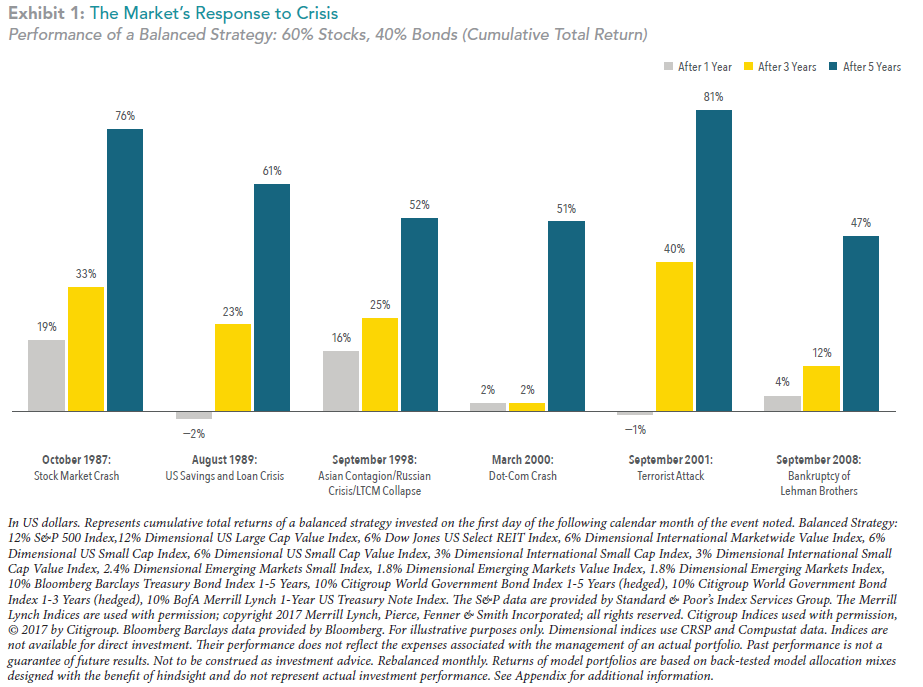

Contrary to what many people think, it is important to note that this crisis and its subsequent recovery was not at all an anomaly in stock market history. Exhibit 1 below shows how a balanced investment strategy (60% equities and 40% bonds) performed in the subsequent years (1, 3 & 5 years) following different crises, including the bankruptcy of Lehman Brothers in the middle of the 2008 financial crisis. Each event is labelled with the month and year that it occurred or peaked.

Although a globally-diversified balanced investment strategy invested at the time of each event would have suffered losses immediately, financial markets did recover, as can be seen by the 3- and 5-year cumulative returns. Thus, to help you face a financial crisis, it is infinitely useful to know how your portfolio would have fared in the following years after past crises. So before such periods of discomfort hits you, having a long-term perspective, appropriate diversification and an asset allocation aligned with your risk tolerance and goals can help you maintain the discipline to ride out the storm. A fiduciary financial adviser can thus play a critical role in helping you work through your fears with objective and evidence-based advice, and in providing counselling when things seem darkest.

For some investors, there is always a “crisis of the day” lurking at the back of their minds. Post-2008, we experienced many smaller market crises: from the Greek bankruptcy to the Euro debt crisis, BREXIT (which is still on-going), Chinese currency devaluation and slowdown, Oil price collapse… the list goes on. But as we know, predicting future events, or how the market will react to them, is virtually impossible. But we can learn from history on the aftermath and it seems quite consistent that markets do recover.

It is important to understand that market volatility and risk are part of investing. Investors must be willing to accept increased uncertainty in order to enjoy the benefit of higher potential returns. The worse alternative would be to keep your money under your mattress, which would instead expose it to certain inflation risk.

The key to successful long-term investing is being able to stick to your investment philosophy through good and bad times. A well thought out, transparent investment approach can help you be more prepared for uncertainty, and improve your ability to stick with your plan and thus capture the long-term returns of capital markets.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.