Saving Up – One Coffee At A Time

28 June 2019

When you first start your investment journey and don’t have much capital, the road to financial security can seem long and tiring. However, the truth is that building up wealth and investing for the future is actually simple. All you need is time, discipline, and the price of a cup of coffee.

We recently had the pleasure of meeting with Debbie, the daughter of a close friend. She was very interested in learning about investing. She was a fresh university graduate who had just started a job at a local bank three months ago. Like many young Singaporeans, she had barely any savings and constantly griped about how everything was too expensive. She wanted to buy a house and a car, but felt that these were way out of her reach.

So, Debbie met up with us for a coffee. Starbucks was her preferred joint for a cuppa. She and her peers were accustomed to meeting up to revise notes and hang out, all whilst chugging down lattes at one of the many Starbucks outlets peppered throughout the island.

“So, how much do you spend at Starbucks each week?” we asked her. She thought about it for a while. “At least one, sometimes two a day,” she said. “There’s this really convenient outlet at Singapore Land Tower, just when I exit the MRT.” Given her love for her Vanilla and Caffè Lattes ($7.30 or $6.60), that would cost her roughly $70 a week, or around $280 a month.

“What if you gave up this expensive coffee and put that money into a long-term investment plan instead?” we suggested. We highlighted how much she would save every month. She appeared circumspect. It would be hard to give up her tasty drink and the experience it came with. She also couldn’t comprehend how saving a few dollars a day would make any difference to her financial health.

The first part of the problem needed to be dealt with by replacing the experience with a comparable or better substitute. Making coffee at home and bringing it to the office (or bringing a coffee machine to the office) would be one way to save money as well as broaden her coffee horizons. However, if her priority was socialising with friends over coffee, why not consider the many local coffee outlets? Many of of them now come with good coffee, comfortable seating and clean, modern decor. She would save at least two thirds or more on each cup. If she still craved her favourite Starbucks drinks, she could then have them as an occasional treat, rather than a daily indulgence. This would also give her something to look forward to, and intensify her ability to appreciate and fully savour each drink.

The second part of the problem could be dealt with a systematic long-term plan, normally distributed returns and the power of compounding. We have written about this before. Research by Nobel laureate Eugene Fama and Kenneth French also shows how long-term returns converge towards the normal.

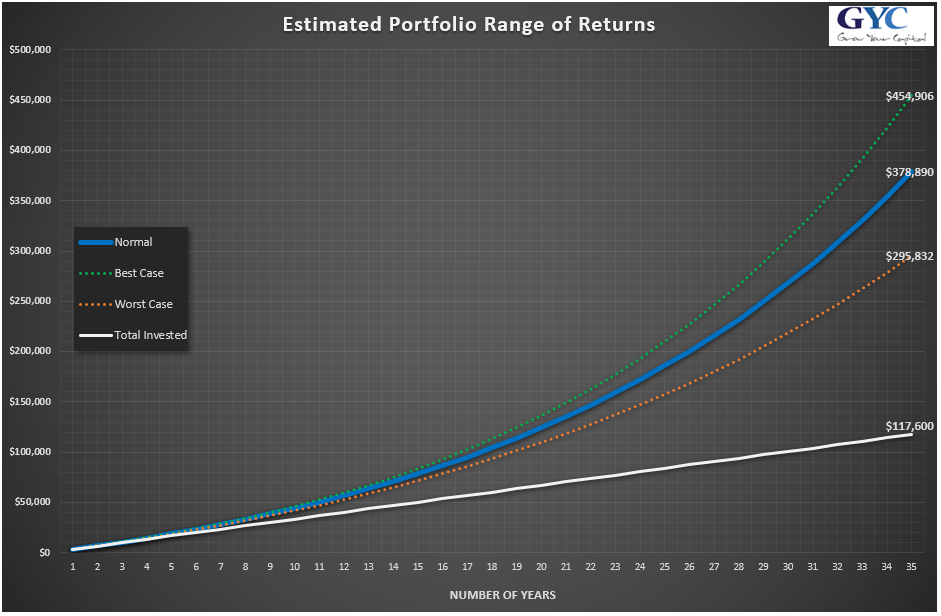

A diversified portfolio comprising 70% equities and 30% bonds provides a nett return after fees of 6.1% over the long term. If Debbie were to start with $0 (yes, $0!) and put $280 a month into such a portfolio (a representative example here), she would accumulate a sizeable sum of over $350,000 by the time she retires.

Assuming that her salary increases over time, if she bumps up her monthly investments to $500 or $1,000 a month, she would be able to accumulate over $1M by retirement. We note that these long-term returns are only possible if she invests in an evidence-based manner – investments which are indexed and tilted towards dimensions of returns. No other solution would be able to achieve it.

“Are you sure that’s possible?” she asked, not fully convinced. “It sounds too easy.” It really is, we said. The reason most people don’t achieve this is because they started too late, or got distracted by fancy investment schemes that didn’t work out as planned, or just simply did not have the discipline to follow through.

However, with the amount of market data that’s available, we can build very good estimates of long-term returns. The chart below shows her contributions versus the range of returns based on whether she is lucky, average or unlucky over the duration of her investment:

Even in the worst-case scenario, she would more than double her invested capital!

Debbie was excited. She agreed that consistently saving a small amount month after month would be relatively painless, and she had time on her side. After all, she had nearly 40 years available to invest in the market before she would be likely to need the money. And because of the simplicity and liquidity of the instruments, she could take it out any time she wanted to purchase other big ticket items, like a house or car.

She now calls this investment and savings plan her “Starbucks Portfolio”, and is determined not to lose sight of the end goal. For those of us who might be older than Debbie, there are valuable lessons to be learnt as well. We always tend to underestimate the power of gradual savings and patience when investing in the market, just as we tend to jump onto the latest gimmick promoted by the financial media or well-meaning friends and relatives.

We definitely cannot control whether the markets go up or down, but we can control our own behaviour and habits. If we are able to find ways to save money and get into the habit of squirreling it away bit by bit under a proper evidence-based investment plan, there is no reason why we cannot succeed in building our long-term wealth.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.