Does luck play a part in investing?

24 May 2019

Photograph by Evan Amos

Is investment success just a matter of luck? If you are looking at short-term investing, the answer is probably yes. But if you are a long-term investor with the ability to sit still for 15 years or more, luck – or the lack thereof – has much less to do with how your investments perform.

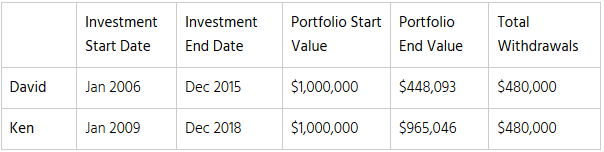

To illustrate this, meet two investors: David and Ken.

- David retired in 2006 with a sum of $1 million. He decided to invest this to keep up with inflation. As he was able to tolerate quite a high risk, he put $700k into a globally diversified portfolio of stocks and the remaining $300k into a globally diversified portfolio of bonds. He then withdrew $4,000 every month (about 4.8% of the invested principal per annum) to cover his expenses.

- Ken was David’s classmate from school. In 2008, he was retrenched from his job during the height of the Great Financial Crisis and decided to retire. Inspired by David, he also chose to invest $1 million and withdraw $4,000 every month, and began doing so in January 2009.

Ten years after their retirement, both men met for lunch and compared their investments. David was shocked to find out that while he had lost almost half his money, Ken still had most of his capital left! Both men had invested with the exact same starting capital and asset allocation. They had withdrawn the exact same amount of money over the years. So, what gives?

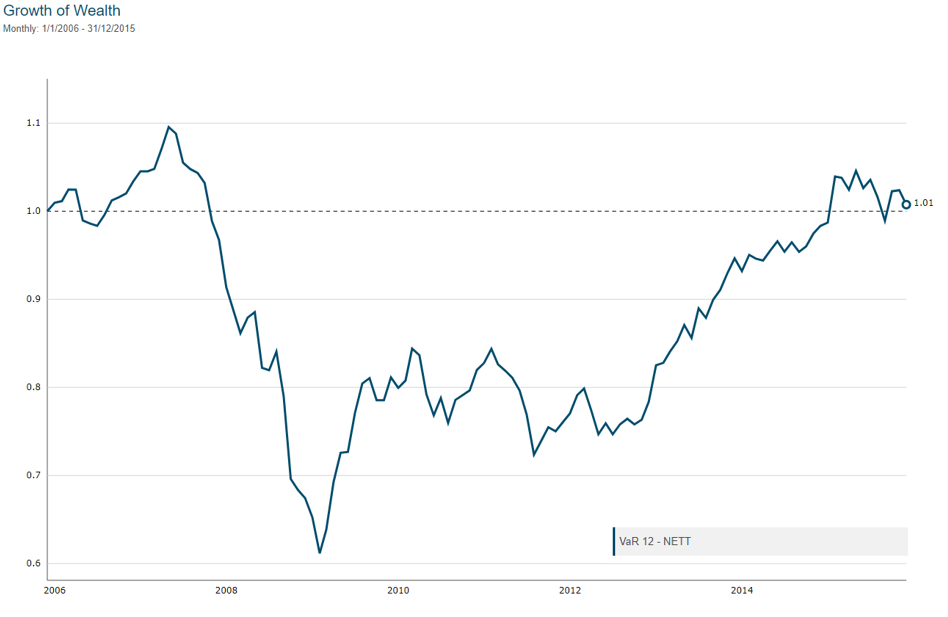

Well, David had the bad luck of investing just before the Great Financial Crisis. He entered the market near its peak in 2006, and then suffered one of the most devastating drawdowns in history.

The chart below uses a GYC VaR 12 portfolio to represent a globally diversified 70% equity and 30% bond SGD investment (fees included in performance). It shows how investing through the crisis and holding on for 10 years would only get you back where you started. When factoring in a total withdrawal of $480K ($4,000 x 12 months x 10 years), it is no surprise then that David’s investment value was nearly halved.

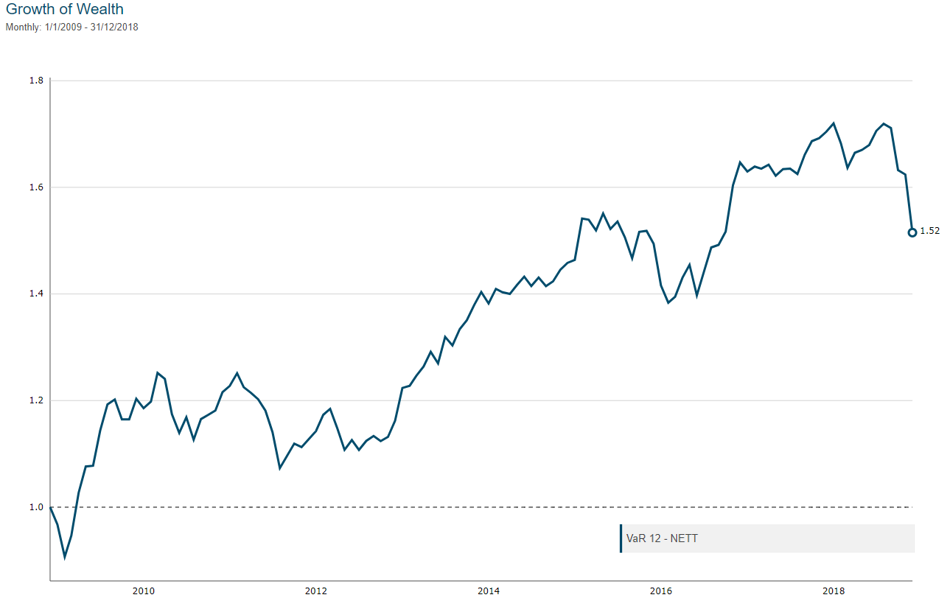

In contrast, although Ken was retrenched in a bad economy, he entered the market when it was near its bottom. The chart below shows how his investment performed.

Now, when David saw what had happened to his wealth, he panicked. “I don’t think I can survive another financial crisis,” he thought. “I stayed invested for 10 whole years, only to end up with half my money gone. If I stay on, I might lose the rest of it.” So, he sold all his investments and put them in the safest thing he could think of – a bank deposit. Such behaviour is very common among investors who suffer a great loss in a market crisis.

However, by withdrawing everything, David immediately locked in his losses and gave up the chance of participating in a market recovery. In return, he ended up with a bank deposit that earned him a measly interest rate of about 1% per annum. If he continued to withdraw $4,000 per month, his entire capital would be exhausted in just over 10 years’ time.

What David did not realise was that if he had held on for another year or so, his investments would have recovered and allowed him to eventually recoup his losses. He would have ultimately regained most of that original $1 million, even while continuing to withdraw $4,000 every month.

We know this due to research that shows how long-term market returns converge towards a normal distribution. The longer you stay invested, the more predictable (and positive) your final return will be. Achieving this is only possible if you invest in a very broadly diversified manner, with thousands of underlying stocks.

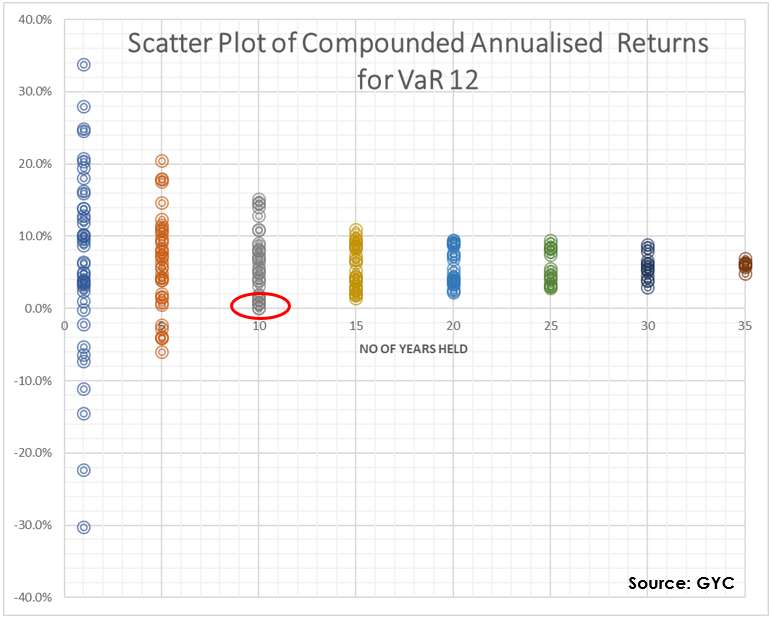

The chart below shows the long-term scatter plot of returns for the VaR 12 portfolio. You will notice that the possible range of returns narrows rapidly over time and becomes decidedly positive from the 15-year mark onwards.

The point circled in red shows David’s performance after he entered the market, invested for 10 years and – due to his bad luck – received the lowest returns from the range of possible returns for that period. However, if he had stayed invested, even if his bad luck had persisted, his final overall performance would have ended up very close to that of the luckiest investors.

What can we learn from this?

- Investing near peaks can result in huge losses in the short to intermediate term (up to 10 years). However, if you have the time and the discipline to stay invested, research shows that your final returns will bring you back in line with those of your ‘luckier’ counterparts.

- If you don’t have the time to wait out a crisis, deciding on your asset allocation beforehand is all the more important. Increasing your fixed income buffer will provide you with a relatively stable source of funds to withdraw from in a time of crisis. This ensures that you won’t have to touch your stocks, and when the market recovers, having that stock component intact will speed up your overall portfolio recovery. In this example, David could have funded over 6 years’ worth of expenses by selling his $300K worth of bonds before needing to touch his stocks.

- Always have spare cash ready. As Ken’s example shows, investing in a crisis reaps big rewards.

- Don’t be afraid of a recession or market crisis. If you have spare funds, capitalise on those moments to boost your overall returns.

If you think waiting on the sidelines would be preferable in order to avoid David’s situation, you may want to rethink that strategy. Research done by Vanguard shows clearly how waiting to invest or investing in small amounts over time does worse than putting all your money to work at once. Why? It’s because markets go up 70% of the time. When you are not in the market, you miss out. The purpose of systematic investing (or dollar-cost averaging) is more to minimise regret than to optimise returns.

Most people who think that luck plays a large part in any investment end up afraid to invest, as some analyst or economist out there will always be forecasting a recession or market crisis. But, as we have illustrated above, waiting it out can be worse for you than investing at the wrong time. As long as you know how to make smart decisions about your money (or have an adviser that can help you), the evidence shows that the effect of luck is diminished over time.

So, even if you get unlucky, don’t fret! There can still be a happy ending to your story.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.