Preparing for the Upcoming Recession

10 May 2019

Have you heard about the coming recession?

More and more forecasters and strategists are predicting a recession in late 2019 or 2020. Headlines like “Economy at real risk of recession in 2020” and “Bond market flashing signs of recession” are making investors and market participants jittery.

Some are feverishly watching the news or setting alerts, ready to pull out their stocks the moment the recession hits. Others are carefully hoarding cash in preparation to go all in when the market bottoms. Recessions typically mean a prolonged period of companies downsizing, salaries getting crimped and individual financial suffering, and the apprehension involved can produce a non-stop stream of anxiety.

Our brains crave the security of a predictable, certain world. We become very uncomfortable when faced with the sort of uncertainty that’s plaguing the market right now.

And yet, that’s how the market always is. It’s how it always will be. That’s how life is, for that matter. The fact is that a recession will hit us at some point. We just don’t – and can’t – know when.

We have written about forecasts and outlooks many times before and how they are consistent only in their tendency to be wrong. The data shows that no one can reliably predict what will happen in the market. The top investors and finance celebrities have at most only a 50/50 chance of getting it right. For everyone else’s predictions, there’s a greater chance that the complete opposite will happen.

Still, we know that that’s unlikely to ease the uncertainty and the corresponding fears. It always helps to feel at least somewhat in control of what might happen to your money, and so here are some ways that can help you prepare for a recession – regardless of whether it hits us tomorrow or in ten years’ time.

1. Don’t Base Your Investment Decisions on Economic or Market Forecasts

As we cannot pinpoint exactly when a recession will occur, it is not a good idea to alter your investments ahead of time in hopes of supposedly minimising the damage.

Let’s say you had a portfolio full of equities because you need a high rate of return to meet an upcoming goal such as retirement, children’s university education or future home purchase. If your fears of an upcoming recession lead you to sell everything and hold cash, you would lose the returns you might have gained between now and the recession – which could be a few months to several years away.

With those lost returns, would you still be able to meet your goals on time? What if the recession never happens? You would have lost out for nothing, and your financial future would suffer as a result of this misstep.

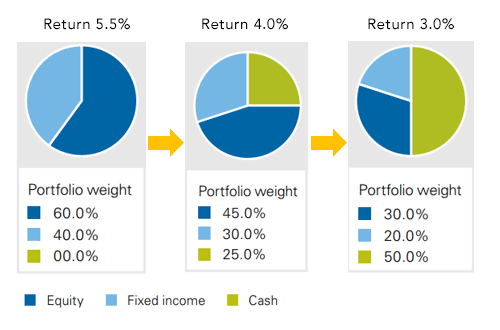

Many investors don’t always realise the type of impact they could unwittingly cause when they start to reduce risky assets in anticipation of some “expected downturn”. The chart below shows how returns are affected simply through the act of selling assets to hold cash.

2. Plan Your Family Finances According to Economic Forecasts

Not touching your investments doesn’t mean doing nothing, however. There are other actions you can take to mitigate the potential damage from a recession:

- Keep your job. Don’t job hop for the sake of a higher salary. In a recession, cost-cutting and downsizing in companies typically strike high-paying PMET positions more than others (PMET is the acronym for Professionals, Managers, Executives and Technicians). The less you’re getting paid (for the value you are giving to your company), the less likely you’ll be fired.

- Don’t buy big ticket items. If a recession is on the horizon, it would be a terrible time to buy that flashy expensive car. (Yes, even if it sparks joy.) Not only would you have problems paying off the loan if you do get fired, but you might also have to sell that car shortly after its purchase – and at a much lower value than you just got it for. In any case, automobiles are one of the worst assets to buy, especially in Singapore.

- Save more (#1). Keeping a higher-liquidity buffer in a deposit account will give you easier access to your money in a crisis. This will definitely come in handy if your job is affected. Having this liquid buffer can also help you pay for your living and whatever immediate expenses that may arise. For example, if you need $4,000 a month for living and lifestyle needs and you have about $100,000 in bank deposits, you know that you can survive for up to 2 years while searching for a new job. This also saves you from feeling pressured to sell off your investments at the worst possible time.

- Save more (#2). Having that liquid buffer available would also be very valuable during a crisis when prices of assets are down. When the recession does hit, it would be a good time to pick up stocks at depressed prices (stocks on fire-sale!) to add to your investment portfolio, and this can significantly enhance your long-term returns.

Remember, no one can predict the future. There is no schedule that states a recession is due. If you didn’t know, Australia has not suffered a recession for the last 25 years. We also don’t know how stocks and bonds would specifically react even if a recession does come, so taking any action now in advance of the event could prove unwise.

We hope that the above pointers will be useful to help you prepare for any recession in a prudent way, giving you a bit more control over what happens and mitigating any financial damage that could occur.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.