Doomsday warnings – what should you do?

12 October 2018

“Asian stocks plunge after US bloodbath,” shouts the headline on Page A9 in today’s Straits Times (12 Oct 2018). Are you worried yet?

What typically happens after such shocking news is a slew of analyses by thousands of market strategists and financial journalists, all of them raring to tell you what really happened – and, more importantly, why.

One of the top reasons cited for this debacle in global stock and bond markets was the trade war that Trump started with China. It has only been around 9 months since Trump announced tariffs on imports. Surely investors were taken by surprise? Oh wait, but coming from the Trump himself, all this was the fault of the ‘loco’ Federal Reserve. After all, how could those ‘crazy people’ in charge of the monetary policy of the world’s largest superpower not have done something to prop the market up? Or maybe it’s because of bonds. Bond investors are now feeling uncomfortable with their losses, but instead of selling their bonds, they must be selling their stock holdings for some reason or another.

Grappling with explanations for why this or that happened is a common behavioural bias (narrative fallacy) inherent in human brains. We all have this need to come up with stories to make sense of disparate and random events. Sometimes, this follows a logical sequence: “Jack fell off his bicycle because he was cycling too fast and didn’t see that curb”. But it is far harder to find a logical reason for things that we don’t understand, like the stock market. So our mind tries to seek out patterns and stories.

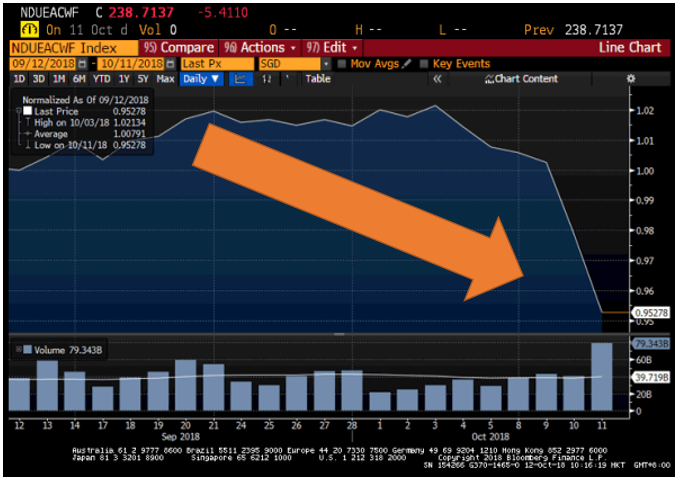

Looking at the recent sell-off with an extremely short 1-month view, you see only bad things, and might conclude that the market has no way to go but down (the diagram below shows the value of $1 invested in a global equity index over 1 month).

But if you look at the market over a longer period, say 10 years – which is a typical investor timeframe for achieving a financial goal – you will notice that corrections or sell-offs are merely small blips in the overall scheme of things. Isn’t this all a matter of perspective?

Given all the gloom-and-doom market predictions dominating headlines once again, it is not surprising that many people would feel a little anxious. Remember our earlier article on how bad news sells?

But if you did want to sell your stocks, what are the alternatives? The very strong ISM Services number reported during the first week of October, coupled with Fed Chairman Jerome Powell’s comments on the economy, set bond yields on an upward trajectory that hit levels not seen since 2011. (This means that bond prices fell, as yield and price are inversely related). The bond sell-off brought back comparisons with past “taper tantrums” and the effect they had on stock and bond prices. Bond investors are now feeling something they have not felt for a long time: losses.

We do not know how long the stock and bond weakness is going to last, although Bloomberg reported this morning that the “Stock Slump Shows Signs of Easing“, and the Financial Times ran the headline “Global rout in stocks abates in Asian trading” this afternoon.

What we can immediately answer, though, is the question of whether investors should go out and sell what they currently hold in their portfolio, or maybe shift their portfolio to ‘safer assets’. Remember that as humans, we are hard-wired to make mistakes with our money. It also serves you no purpose to keep switching around with your investments, and doing so is likely to make you worse off than just staying put and doing absolutely nothing.

However, if you really wanted to assess whether you are on the right path, then following these simple rules could help:

- If you are holding straight bonds or a bond portfolio with just a few names, you should consider changing to a more diversified approach. It is the same thing with stocks. There are many benefits to holding diversified portfolios (i.e. holding the thousands of securities listed in all the investable countries around the world). Too many investors have suffered serious financial consequences by not adhering to this simple rule.

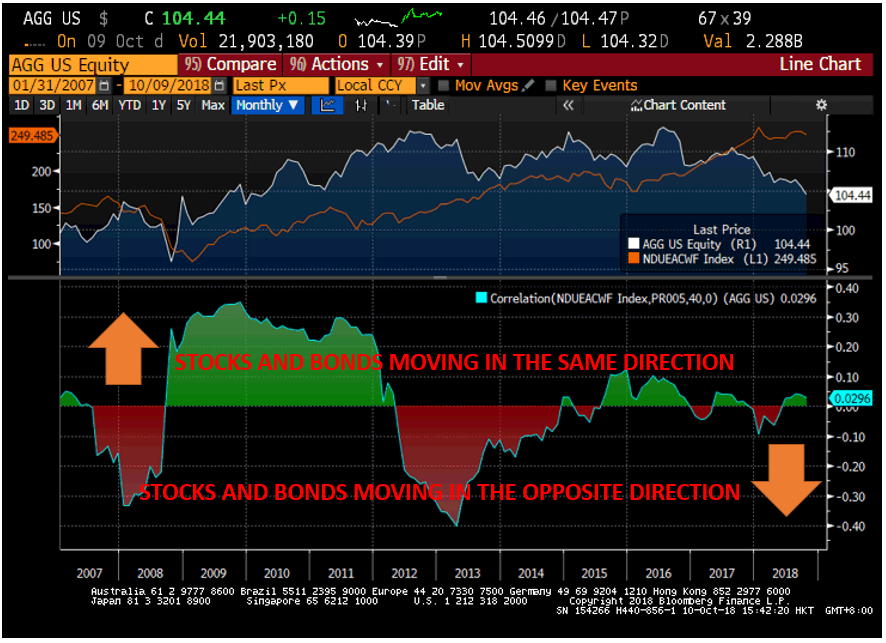

- Bad news about bonds or any other asset class shouldn’t keep you from holding them. If you have done your homework properly or been properly advised by an independent fiduciary adviser, you can be assured that the bonds in your portfolio are there to help buffer the volatility of the portfolio and help diversify risks away. The stocks in your portfolio help you generate a sufficient return to meet your long term needs and beat inflation (bonds don’t do that). If you are worried about why bonds and stocks suddenly sold off at the same time, the diagram below shows how bonds typically correlate to stocks. Although correlations do rise during market stress, bonds typically have a low average correlation to stocks, and the net effect is to help your portfolio ride through cycles.

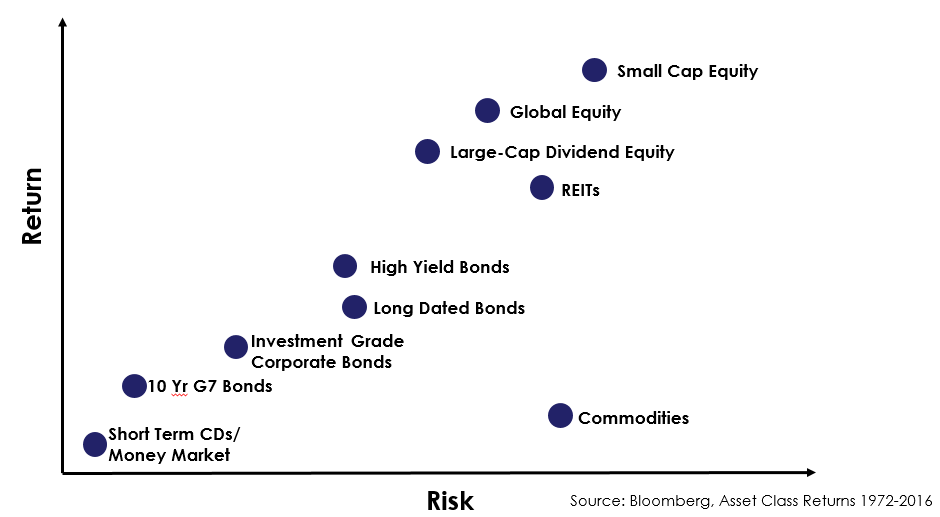

The allocation of stocks and bonds you hold depends on the investment solution that your adviser has matched to your goals. Investors who need short-term liquidity should stay away from investing in stocks or other risky assets like hedge funds or private equity. Their likely holdings would be short-term investment grade bonds or a representative money market vehicle. Investors with medium-term goals also need some bonds to reduce the equity risk in the portfolio.

Investors with very long-term time horizons (15 to 30 or more years) would likely hold high amounts of equity. What about alternative asset classes for them to hold, and can they reduce risk? Cash or ultra-safe investments would not provide sufficient returns to help them achieve their objectives. Property, while meant to provide a cash flow similar to fixed income, also suffers from market cycles and is comparatively very illiquid. And what about alternative investments like hedge funds or private equity? Their risk and return expectations are even more uncertain.

The chart below illustrates the risk-return trade-off of different asset classes and investments (you generally want to look for higher return as you take on more risk). Note that commodities (e.g. gold) provide very little return for the amount of risk that you have to take.

At the end of the day, we want to point out that reacting prematurely to ever-changing market conditions is unwise. You may think that you can time the market, but research shows that it is extremely hard to get right. Even if you had access to a perfect formula, its cost would be so high that your net returns would be below the market return.

However, if you have done a proper asset allocation and portfolio construction process with a fiduciary adviser, you do not need to worry. Just keep calm and carry on!

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.