What Wine Can Teach Us About Investing

05 October 2018

As the Bordeaux En Primeur 2017 season came to a close, wine lovers around the world rejoiced that the vintage had not suffered as badly from the weather as was initially reported. In early April, severe frost had ravaged the wine growing region, with some estimates putting the crop destruction at 45%. Although the 2017 vintage could not compare with the previous excellent years of 2015 and 2016 (which benefited from superb weather conditions, the final verdict was still moderately good.

For those who enjoy it, savouring a fine wine is one of life’s greatest pleasures. However, what is often overlooked in the joy of drinking wine is the carefully-calibrated journey from grape to glass.

A great number of variables determine whether a wine turns out to be great, good, or mediocre. These include the quality of the grapes, the weather and the terroir – the soil, position of vineyard, irrigation, and farming practices. After each harvest, the grapes need to be sorted, crushed and pressed, fermented, aged and bottled. A lack of attention to detail at any point along this process can adversely affect the final outcome.

Similar levels of care are also critical to good investment outcomes. As with winemaking, investment management requires attention to detail: rigorous academic research to identify what drives investment returns and how to harness it within a portfolio, designing strategies to translate theory into practice, building diversified portfolios and implementing all of this in an efficient manner.

Just as winemakers cannot control the weather, investment managers cannot control the markets. Not every harvest will produce an excellent vintage. Even then, expert professionals can still maximise their chances of success by putting their greatest efforts into things they can influence to improve the vintage.

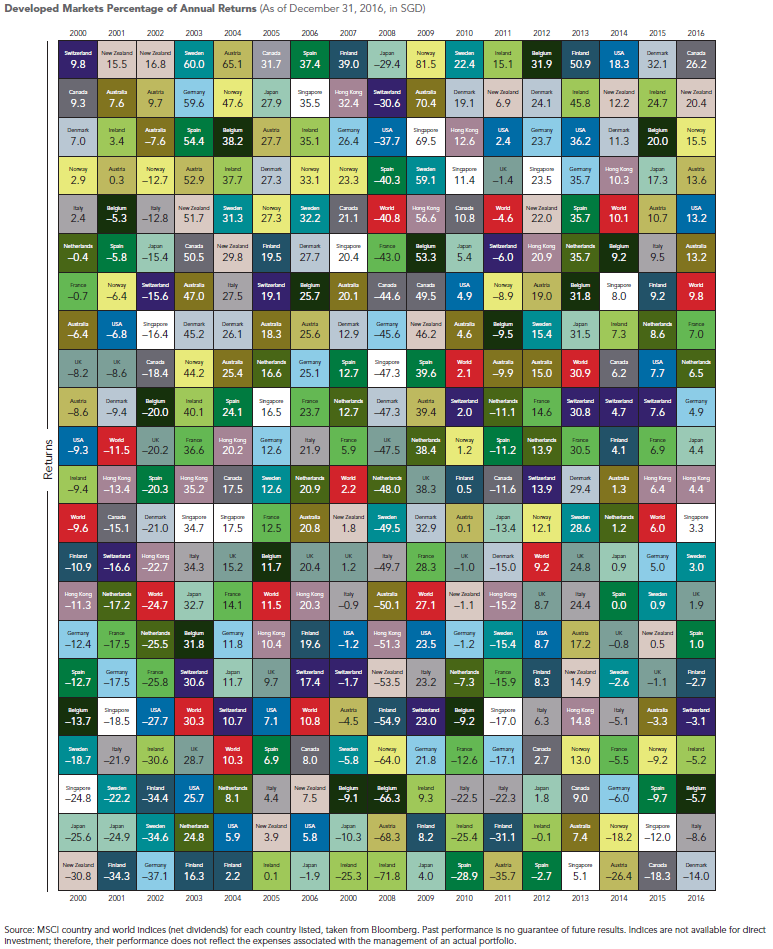

By extension, the skittles chart below shows the year-by-year performance of different countries’ stock markets – much like the performance of the different Chateau every year. In some years, all countries can achieve a positive return, while at other times, there will be both positive and negative performers. In really bad years, it will be negative all round. The chart also shows that not one country consistently comes out on top, nor is there any discernible pattern that will enable an investor to accurately predict which market will do well the following year.

So, what can winemakers, and investors, influence? For winemakers, they could take extra care to pick the grapes at the precise time that will deliver the desired balance of acidity and sweetness. For investment managers, they could precisely target the desired premiums while ensuring sufficient diversification to lessen idiosyncratic risk in the portfolio.

Winemaking is as much an art as a science. While fermentation comes naturally, the winemaker must still guide the process, using a variety of techniques to ensure the wine is as close as possible in style and flavour to what he is seeking to achieve. For the investment aficionados, I am sure you have read about many fantastic trading and investment models. However, for investing, real world inefficiencies mean that basing one’s approach purely on a theoretical model is unlikely to be successful. Trade-offs must continually be made between the expected benefits of buying particular securities and the expected costs of the transactions. Managing the effects of momentum and being mindful of tax considerations are among the other issues to be balanced.

Just as in viticulture, investment outcomes can also be affected by any number of external events – such as the imposition of capital controls in an emerging market, changes in regulation, a severe financial crisis, government intervention, or a major geopolitical event. Dealing with uncertainty and navigating the “unknown unknowns” are all part of the job. Investment managers must build into their processes a level of resilience, such as through diversification, so they have sufficient flexibility to work around unforeseen events.

For individual equity investors, this means not putting all your money into any one country or region but spreading it throughout the world. Investors who are unable to take the downside of a 100% equity portfolio need to diversify into other asset classes, such as fixed income, which can both temper volatility and reduce risk.

Unfortunately, the benefits of discipline and attention to detail are easy to overlook. Great ideas count, of course, and there is no shortage of excellent investment ideas or themes from the financial industry. But great ideas without proper and efficient implementation mean that even the best grapes in the world could go to waste!

Some excerpts from this article were taken from Outside the Flags 5 by Jim Parker, Dimensional Fund Advisors.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.