Do smart people invest better?

09 April 2018

An edited version of this article was published in the 7 April 2018 issue of TODAY.

Bloomberg and the Wall Street Journal recently reported how Harvard University’s endowment fund was hit with a staggering US$1.1 billion write down on its natural resources holdings. Yet Harvard’s money managers are likely ranked among the best and brightest in the investment business. In 2017, the Boston Globe reported that Harvard’s seven top-paid endowment managers earned a combined US$58 million in 2015, during a period when Harvard’s investment performance lagged behind the rest of the Ivy League endowments.

How can this be? Conventional wisdom says that if you are smarter, you should be able to spot better investment opportunities and thus invest better. Perhaps it was just bad luck or was it something else?

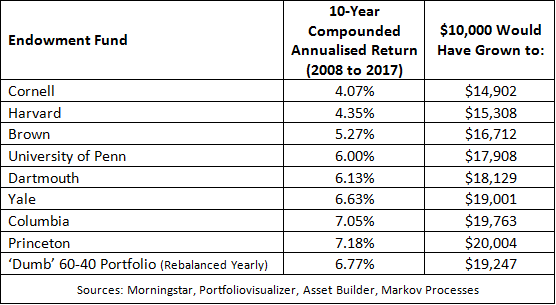

In the latest update on returns from endowments from financial research firm Markov Processes International, Harvard continued to maintain close to the bottom spot amongst its peers (see chart below). On a closer look, most large endowment funds actually fail to beat the benchmark return of a “dumb” and passive 60-40 index portfolio (consisting of a diversified basket of 60% of the US stock market and 40% of the US bond market, with about 12,000 holdings).

According to Professor Gilbert, a finance professor at the University of Washington, the mistake that smart investment managers make stems from the belief that their skill and intelligence would allow them to sidestep risks and mistakes that others would typically avoid.

Shane Frederick, from the Sloan School of Management, MIT, found out that smart people (high IQ scores) had the tendency to make more mistakes when problem-solving by taking mental short-cuts as that requires less mental effort. He also found out that smart people were also more willing to gamble (i.e. take more risk) even with poor odds.

Behavioural finance and psychology experiments also point to a cognitive bias called the blind-spot bias. Everyone is prone to this irrationality – where we are better at recognising biased reasoning in others but not ourselves.

Psychologists West and Meserve from James Madison University and Stanovich of the University of Toronto have found that the blind spot bias is greater the smarter an individual is. As a result, most smart individuals are able to see why others have made poor investment choices yet are unable to see their own mistakes. They are more likely to ignore the advice of peers or experts and fail to recognise when they need help.

As an illustration of this point, Eleanor Laise did a study on the investment performance of the Mensa investment club (Mensa is a non-profit organization open only to people with IQ scores in the top 2% of the population). For the 15-year period from 1986 to 2001, the Mensa investment club managed to get an average return of 2.5% annually versus the 15.3% annual return of the S&P 500 index. In other words, the investment returns of a select group with IQs at the top 2% of the population did 84% worse than the index.

The point is not to say that all smart people are bad investors, as there are obviously smart people who have done really well. But everyone, smart or not, needs to be more aware that self-perceived smartness, especially if derived from past successes in their careers, need not always equate to success in investing.

We should thus not be so awed by the large armies of highly-paid professional investment managers and analysts employed by large financial institutions, as many of them could likewise be unaware of their blind spot bias.

Elaborating on the reports of the Ivy League’s endowment performance, author and financial columnist Andrew Hallam conducted a fun experiment and wrote about it on the AssetBuilder website. He asked two girls aged 7 and 8 years old to pick 20 exchange traded funds (ETFs) from 5 main asset categories to construct a portfolio, of which not all were ‘winning’ funds. He then back-tested their portfolios to see if they could beat the endowments.

The results were unsurprising. A simple diversified portfolio was able to beat the complex investment strategies employed by all these super smart pros. The portfolios that the children chose did not constantly switch the asset allocation nor constituent funds.

So, the good news is that if children are able to beat some of the most intelligent investors on the planet with simple, proven methods, you can too! The mechanics can be as simple as just investing in a globally-diversified portfolio of index funds with an asset allocation that is most suited to one’s personal risk tolerance and then rebalancing yearly. The more difficult part is actually managing one’s emotions and instinctive behaviors during volatile and uncertain markets, so that one doesn’t fall prey to buying and selling at the wrong times.

Whilst you may not beat all the pros each and every single year, the odds of outperforming many of them over the long term, e.g. 10 years, is good. Remember Warren Buffet’s $1 million bet against a basket of hedge funds? The bet ended after 10-years in 2017 with his chosen S&P 500 index gaining an average of 7.1% per annum against the 2.2% per annum returns of the hedge funds selected by Protégé Partners.

Bloomberg’s report on Harvard ended with a suggestion from a group of alumni from the class of 1969 who had a simple suggestion for Harvard’s endowment chief: invest in index funds. That way, Harvard would have gotten better investment returns, plus saved a whole lot of money from paying salaries to their top notch investment teams.

(This is part of a series of articles that we have been writing for Singaporean investors.)

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.