The Annual Investment Guessing Game

10 January 2018

An edited version of this article was published in the 6 January 2018 issue of TODAY.

In 1903, the president of the Michigan Savings Bank advised Henry Ford’s lawyer not to invest in the Ford Motor Co. “The horse is here to stay,” he said, “but the automobile is only a novelty—a fad.” Not too long ago, political sages predicted that Donald J. Trump couldn’t possibly win the Republican presidential nomination, let alone be elected President of the United States. We all know how those predictions turned out.

As we head into a brand new year, really smart people will be churning out new predictions of how the markets will perform. It is no coincidence that this is typically the time when investors review their investments and decide how they should be positioned for the future.

Forecasts and Outlooks – Who do we follow?

Most of us would mentally agree that predicting market performance is a practical impossibility. Yet some of us would still assiduously search for clues from experts – the more famous, the better, as though renown correlates with predictive accuracy. These forecasts are almost always followed by recommendations on how to capture the next big opportunity or avoid the next big market collapse. What should one do when faced with such a plethora of recommendations, some of which may be conflicting?

Views for 2018

Various institutions have already released a multitude of market outlooks and forecasts. Already, there are bearish views on how a China slowdown, high market valuations, North Korean nuclear attack and rising inflation will spell the end of the current bull market. On 2 Jan 2018, the Eurasia Group said, “If we had to pick one year for a big unexpected crisis—the geopolitical equivalent of the 2008 financial meltdown—it feels like 2018.” (Note that at the beginning of 2017, their annual forecast was that 2017 would be a period of geopolitical recession, given a volatile political risk environment that was as important to global markets as the economic recession of 2008.)

On the flip side, there are also bullish views on how Trump’s tax reform plan, global economic growth and consumer spending will continue to drive the bull market in 2018 and beyond. Yet other outlooks avoid taking a stand, and recommend buying property, gold or cryptocurrency instead.

Are you confused yet? It is hardly surprising that many people end up concluding that investing is complex and they need to find the ‘right expert’ to help them buy and sell at the correct times. That is perhaps why Steve Forbes of Forbes Magazine once said, “You make more money selling advice than following it.”

Are stocks too expensive?

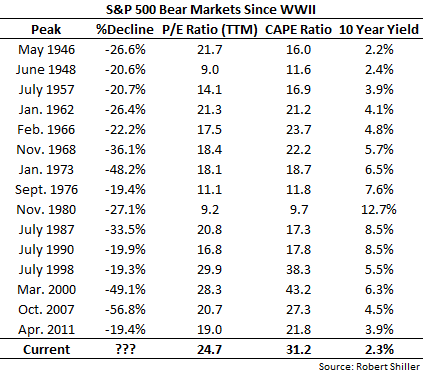

Consider the dire warnings bandied about by many investment professionals in the last 6 months: that stocks are “too expensive” and it would be better to hold cash, or wait for a better time to invest. The problem with such predictions is, firstly, we have to determine the threshold for stock valuations being too high. If we take US stock market data (the S&P500) and analyse past bear markets, the evidence shows no apparent correlation of high valuations with market declines. Using a simple P/E ratio and the increasingly popular Shiller cyclically adjusted P/E ratio (CAPE), we also see that there is no definitive number at which we can pinpoint a potential bear market. Bear markets happened when the P/E ratio was over 28 (high valuation) and when it was 9 (low valuation). So, when exactly should an investor sell out of stocks to hold cash?

The second problem with such predictions is that they actually force the investor to make two decisions. If the investor decides to heed the advice of selling stocks to hold cash, he or she must then decide when to buy back into the market. In Nobel Laureate William Sharpe’s 1975 study “Likely Gains from Market Timing”, he noted that investment practitioners required at least a 70% accuracy or more in their market timing calls in order to beat a dumb diversified buy-and-hold market portfolio. If someone manages to get a “Sell” call correct 70% of the time, and a “Buy” call correct also 70% of the time, they would have an overall accuracy rate of just 49%. That is, in fact, a 50/50 chance – just like flipping a coin! Once you deduct trading costs and taxes, you would be hard-pressed to break even from your efforts. An interesting study conducted by CXO Advisory Group compiled and graded a list of forecasts and predictions by well-known market timers. They found that the forecaster who came closest to the 70% yardstick only had 68% accuracy, and was thus unable to beat the buy-and-hold strategy.

Surely all such predictions and market forecasts should be backed up by verifiable research. Or is it? The majority of the analysis is likely to be based on forward estimates, which are ever changing according to the latest news and market sentiment.

So, what drives market returns?

What actually drives market returns and daily price fluctuations? Before anyone invests in a company or a business, most would want to know how much money that business was making, and whether the cash flow was positive or negative. Obviously, investors only want to invest in companies which have a positive cash flow, both now and in the future so that the expected return from investing in the company will be positive.

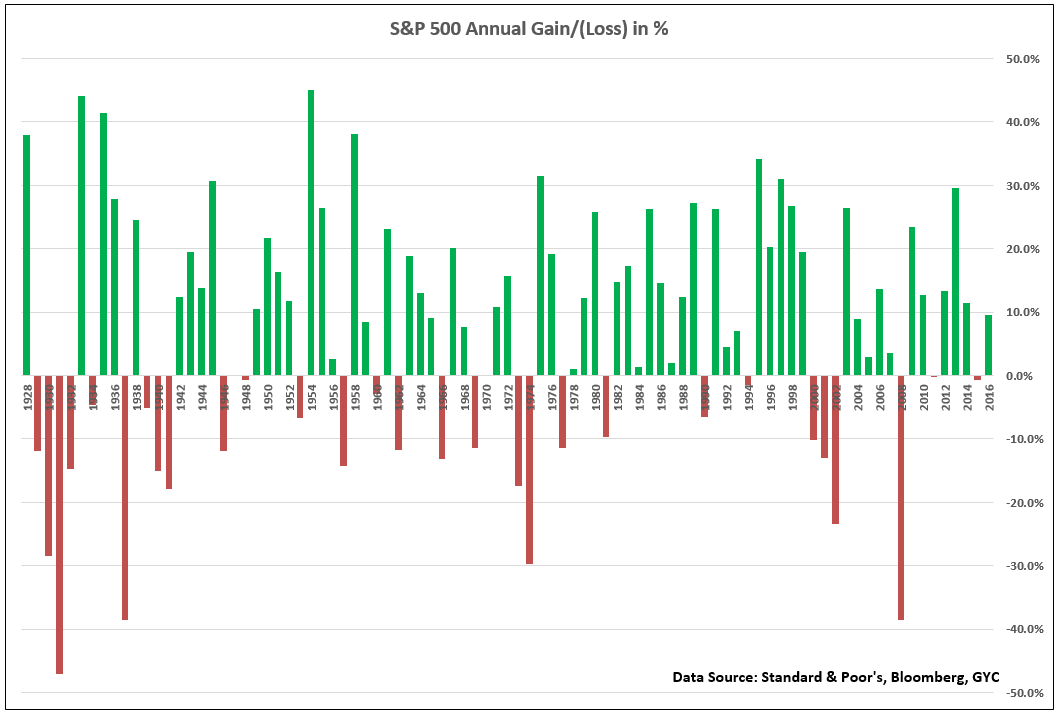

To prove that in aggregate, investors can expect a positive return for stocks, we look at the long term returns of stock markets via the S&P 500. Over the past 89 years since 1928, the chart below shows that 60 had positive returns and 29 had negative, giving the stock market a batting average of about 67%. New market highs have, historically, not always been followed by negative returns. Thus, regardless of where the market is currently at, the expected return is positive.

Why negative returns?

So, why then do so many people end up getting negative returns? Apart from market movements (which one cannot control), one of the main culprits is investor behaviour (which one can control). The relatively new field of behavioural finance has showed that humans are plagued with poor decision-making when it comes to investing, including not recognising bad advice. For example, humans tend to exhibit herd behaviour, driving prices to extremes whether up or down, and our brain tends to forget our long-term plans in order to chase short-term satisfaction.

Follow the evidence!

Ultimately, the evidence shows that investors are better served by sticking to a properly constructed plan and investing in a diversified portfolio with the correct asset allocation. Recognise that no one can predict market movements with sufficient consistency to beat a diversified buy and hold portfolio. Believing in this fact alone reduces stress levels and helps you avoid earning a lower return in the long run.

Ruchir Sharma, chief global strategist at Morgan Stanley, wrote in the New York Times on 30 Dec 2017 that leading economists have consistently missed big market turns and have not predicted a single US recession since a half-century ago. They have also missed many revivals, including the unusually broad global expansion of 2017. As such, by trying to time the markets just by following forecasts and outlooks, investors risk missing the majority of the time when the stock market generates positive returns. Follow the evidence, and stay the course.

May you have a happy and fruitful new year!

(This is part of a series of articles that we have been writing for Singaporean investors.)

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.