Which is a Better Long Term Investment: Property or Stocks?

13 November 2017

An edited version of this article was published in the 11 November 2017 issue of TODAY.

Judging from recent media reports, there has been a recent surge of interest in the Singapore property market again. Reports on how much money property investors have made from en-bloc collective sales have helped drive up sentiment. Local property and bank stocks have been pushed up, with the rise in prices attributed to the improving outlook in the property sector, with some help, no doubt, from a recent Morgan Stanley report which predicted a 10% increase in property prices.

It is very difficult to forecast in the short term where prices of assets (including property) are heading, with a 50 per cent probability of getting it right. In a May 2007 Money Magazine interview with Yale’s Robert Shiller (a 2013 Nobel Laureate for Economics), he made a prescient statement that highlighted how US real estate had already enjoyed a big run up in prices, and the way that people continued to pursue it reminded him of previous asset bubbles. He noted that part of this was due to what sociologists refer to as collective consciousness, which gets reinforced by stories about how well the housing market is doing, regardless of rationality. At that time, the collective thinking was that houses were just like stocks – if you owned one anywhere, it would continue going up in price and was the easiest way to get rich. It seems that this type of thinking is pervasive amongst Singaporeans, due to our love affair with property.

The more interesting fact pointed out by Shiller was that the return on US residential real estate over 100 years from 1890 to 1990 was around 0 per cent, after adjusting for inflation. Yes, you read right – ZERO per cent! Only in the shorter 20-year period of 1987 to 2007 was the return 3 per cent per year, after adjusting for inflation. Shiller countered the popular view held by most property investors that property had a 10 per cent per annum return by saying that if homes really went up 10 per cent annually, nobody would be able to afford a house in the long run.

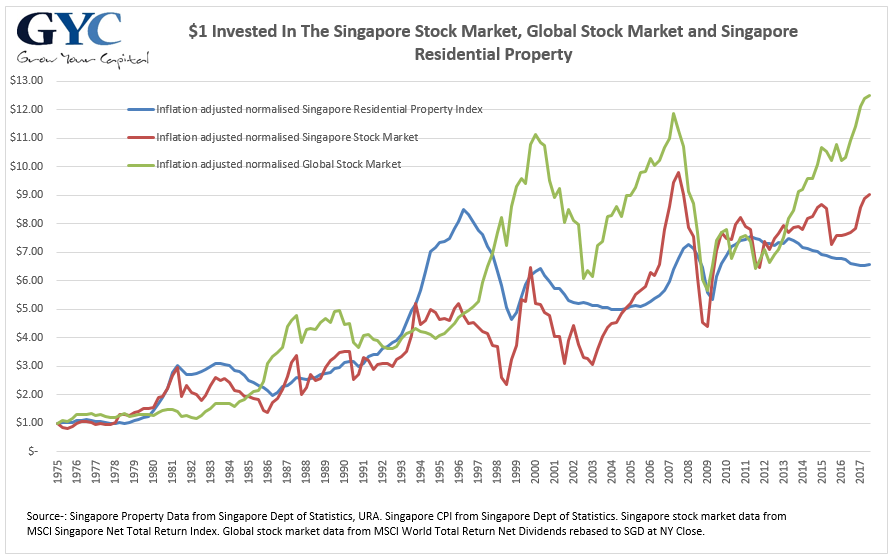

Although Singapore does not have a 100-year track record of property prices, we can look at the last 42 years to see how the returns compare with stocks.

Using Singapore inflation and residential property data from SingStat stretching back to 1975, we found that one Singapore dollar invested in residential property for nearly 42 years would have yielded a return of 6.58 times ($6.58) after inflation. That didn’t seem too bad, but how did this compare with investing in stocks? We replicated the same time period analysis on the stock markets and found that investing in the local stock market would have yielded a return of 9.04 times ($9.04), and 12.53 times ($12.53) if invested in the global stock market over the same period and after adjusting for inflation. The equivalent annualised returns are shown in the table below.

| Asset Class | Compounded Annual Growth Rate (1975 to 3Q2017) |

Growth of $100,000 invested from 1975 to 3Q2017 | |

| Before Inflation | After Inflation | ||

| Singapore Residential Property | 6.8% p.a. | 4.6% p.a. | $1,546,067 |

| Singapore Stocks | 7.6% p.a. | 5.4% p.a. | $2,123,926 |

| Global Stocks | 8.4% p.a. | 6.2% p.a. | $2,942,343 |

Note: Singapore property and CPI data from Singapore Department of Statistics. Singapore stock market data from MSCI Singapore Total Return Index. Global stock market data from MSCI World Total Return Index. All data rebased to SGD.

The results must be surprising, given how most people seemed to think that property investing was a sure-fire thing, and that stocks were a poorer investment. And yet the differential in returns on a compounded basis would have huge implications on one’s retirement funding. So, why do people still have this thinking?

For one, most property investors buy a residential property using a loan. With the effect of leverage, the absolute return when selling the property at the right time can look like a large amount. Most of the time, a down payment of only a fifth to a quarter of the price of the property is placed – essentially a leverage of about 4 to 5 times. There is thus no surprise that any positive returns would seem abnormally big. It must be borne in mind that leveraging for stock investors (i.e. buying stocks on margin) is comparatively rare, otherwise the effect on stock returns could likewise be astounding. But many people forget about the costs associated with buying and holding a physical property, i.e. mortgage interest costs (for leveraging), stamp duty, brokerage, insurance, renovation, maintenance and sinking fund fees, property tax and agent fees, all of which would erode the returns on your property investment. Of course, some of these could be offset by rental income, but one would then have to contend with a higher property tax, legal fees, periodic upgrading and furnishing costs.

Many investors forget that leverage is a double-edged sword, for it also amplifies the losses when the price of the property falls. Having worked with a property developer from the late 80’s until the early 2000’s, I have encountered house owners and property investors who made money during the boom years as well as those who sadly lost money when the Asian financial crisis caused a collapse in Singapore property prices. But the more indelible memories to me were the very sad tales of families ruined when negative equity became a common phrase during the Asian financial crisis. Many of these were not reckless property punters, but hard-working individuals who had simply over-extended themselves on their property loans, believing in the myth that one can’t really lose real money on property.

In his 2014 shareholder’s letter, Warren Buffett wrote a story about his purchase of a farm in 1986 and a building in New York in 1994, and compared it with investing in stocks. He highlighted that the major difference in the purchases was that stocks provided investors with minute-to-minute valuations on their holdings, whilst he had yet to see a regular quote for his farm or building. He opined that property investors had the uncanny ability to sit quietly on their assets for decades, but become frantic stock traders when exposed to the noise from the stock market, economy, interest rates and commentators in the media.

So, what is our view of the Singapore property market? Although we decry forecasting, the truth is that nobody knows for sure whether it is ready for a bull run or heading towards the end of its cycle. Property should be treated just like any other asset class, with prudent asset allocation being applied in accordance with one’s risk and liquidity profile. In essence, you should not over-allocate your capital to it (including leverage), and must be aware of its peculiar risks and illiquidity. We need to guard against letting our emotions get the better of us when it comes to investing – be it in the stock market, property market or any other seemingly-exciting investment. Do not be easily swayed by stories of individuals who have made it big from property investments, as there are also many who have been severely burnt by it and are just too embarrassed to share their sad stories. Look at the facts and ask the difficult questions about any investment, be it property or otherwise.

Finally, quoting from Shiller who, when asked if people should think about their home as an asset, advised, “Avoid concentration of risks. You need a house, but I would avoid a second one – or at least avoid an outsized house.” These are perhaps wise words to heed from a Nobel Laureate who spent a lifetime studying the stock and property markets, including the causes of asset bubbles.

(This is part of a series of articles that we have been writing for Singaporean investors.)

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.