How Many Sweets Are in this Bowl?

07 November 2017

A while ago, we ran a contest asking people to guess the number of sweets in a bowl. We said that the exercise had something to do with the stock market, and here’s our explanation for it!

This little experiment is related to how our stock market gets its price every day, based on the seminal work of Sir Francis Galton, an English mathematician from the Victorian era. His work was expanded on in the late 90s by Nobel laureate William Sharpe and finance professor Jack Treynor. The original paper, “Vox Populi” (or Wisdom of the Crowds) published in 1907 can be found here.

Galton conducted an experiment with people guessing the weight of a cow at a county fair. He theorized that the aggregated answer from a group of people would be more accurate than the majority of individual answers. What he found was that the median answer (or the middlemost guess) came the closest to the cow’s actual weight. So, what does the weight of a cow have to do with the stock market?

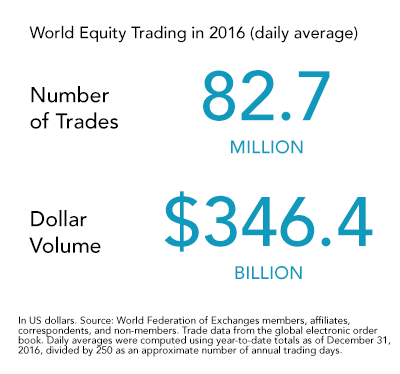

Every day, millions of participants come together to trade in the stock market (the number of trades and volume is shown above). In 2016, there was an average of 82.7 million trades a day, totalling an average dollar volume of $346.4 million. Some investors want to buy stocks, whilst others want to sell them. Some investors bid at very low prices, whilst others ask for very high prices. But whatever happens, the price of stocks eventually settles at a median price by a buyer and a seller who have agreed to transact at that value. That is how stock prices are set. This process repeats itself day after day. So, what are the takeaways from this?

- We have to trust that market prices are fair. You may think stocks are very expensive, but the fact that there are people buying at the current price or bidding higher means that there are investors out there who feel it is still cheap. Who is right and who is wrong? No matter what analysts and market gurus say, there are enough people out there who hold an opposite view and who thus make sure the market price is always fair.

- Individually, we are unable to make accurate predictions. As shown in the experiment, out of hundreds of participants, only one or a few will get it correct. It is the same with the stock market. Some investors will predict a low number while others predict a high number, but these predictions are very hard to get right. Trying to guess which stock or sector will do well, and which will not, will only increase your probability of a poor investment outcome.

Coming back to our contest, out of over 150 guesses, the lowest guess was 168 and the highest 6,478. The majority of guesses ranged wildly between 300 and 1500, with quite a few guessing over 2000. However, the median guess of 876 came close to the actual number of 898 sweets, in line with Galton’s theory that the median guess from a crowd will be more accurate than the majority of individual guesses.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.