Back to School – Funding Your Children’s University Education

30 August 2017

Parents will know the feeling – we always want to provide the best for our children. One of the more important plans that parents will need to make in their lifetime is on how best to prepare for their children’s future university expenses.

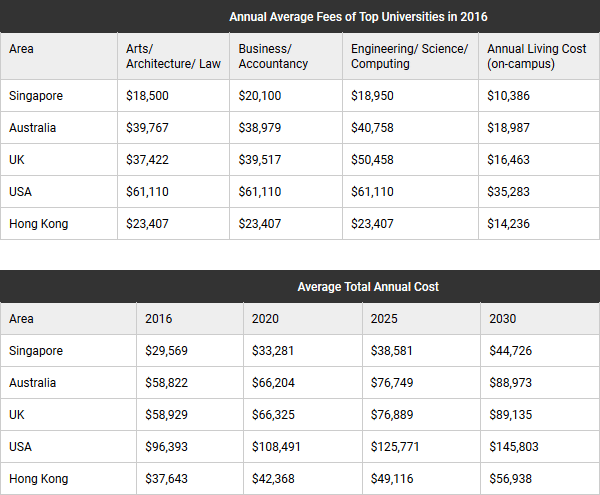

Recent data published by the National University of Singapore’s Office of Admissions showed that the annual cost of attending a university in 2016 averaged $29,569 for a Singaporean university, escalating to $96,393 for a Tier 1 university in the US. These figures are averages, meaning that actual costs will be higher at certain schools and lower at others. Additionally, these figures do not include the separate cost of books and supplies or the potential benefit of scholarships and other types of financial aid. As a result, actual education costs can vary considerably from family to family.

To further complicate planning, the effect of inflation makes a big difference when projecting so many years into the future. The table above shows the effect of 3% inflation on the annual costs. The difference in prices between now and 14 years later is significant! So, what can parents do to prepare for the costs of a university education? How can they plan for and make progress toward affording those costs?

Parents can invest in assets that are expected to grow their savings at a rate of return that outpaces inflation. By doing this, education expenses may ultimately be funded with fewer dollars as compared with just saving it in a bank account. Because these higher rates of return come with the risk of capital loss, this approach should make use of a robust risk management framework.

While inflation has averaged about 3% annually over the past 30 years, stocks, as measured by the MSCI World Index (a globally diversified equity index), have returned around 7.3% compounded annually during the same period. Therefore, the “real” (inflation-adjusted) growth rate for stocks has been around 4.3% per annum. Looked at another way, $10,000 of purchasing power invested at this rate for 14 years would result in around $18,000 of purchasing power later on. We can expect the real rate of return on stocks to grow the purchasing power of an investor’s savings over time. We can also expect that the longer the horizon, the greater the expected growth. By investing in stocks, and by starting to save many years before children reach university age, parents can expect to afford more expenses with fewer savings.

Do note that investing in stocks also comes with investment risks. It is very easy to forget the reason for investing in the first place when faced with big bouts of market volatility and reading all the negative headlines in the news. Tuning out short-term noise is often difficult to do, but historically, investors who have maintained a disciplined approach over time have been rewarded for doing so. Nonetheless, it can still be very hard, and here are some ways to help parents through the journey.

First, find and work with a trusted adviser. He or she should have a transparent investment approach that is consistent, based on sound investment principles, and can help investors identify an appropriate risk management strategy. Such an adviser must be there to hold your hand through any market crises and be on top of your portfolio strategy during such times. As such, one conversation you should be asking your adviser is what they will do when faced with a market meltdown. A good adviser will rehearse you through such worst case scenarios which will be invaluable in mitigating unpleasant (and often costly) surprises and ultimately contribute to better investment outcomes.

Secondly, working on a goals-based investing approach will help maintain one’s discipline in investing. Goals-based investing allows for investment instruments to be selected specifically to reduce uncertainty with respect to that goal. Plainly speaking, you can afford to take more risk (and seek better returns) when the time you need the money is a long time away. Conversely, as your goal line approaches, it may be prudent to then reduce your portfolio risk and thereby your uncertainty that you will not be able to adequately fund the university expenses when it is time to enroll your children.

Thirdly, diversification is also a key part of an overall risk management strategy for education planning. Nobel Laureate Merton Miller used to say, “Diversification is your buddy.” Combined with a long-term approach, broad diversification is essential for risk management. By diversifying an investment portfolio, investors can help reduce the impact of any one company or market segment negatively impacting their investment plan. Diversification also helps take the guesswork out of investing. Trying to pick the best performing investment every year is no better than a guessing game. We thus believe that by holding a broadly diversified portfolio, investors will be better positioned to capture returns wherever those returns occur.

It is a fact that there are no certainties in life. However, when it comes to saving for your children’s education, by just combining the above 3 strategies, you can reduce uncertainty by a large margin – and hence be able to fulfill your parental responsibility of providing for your children’s education.

Happy investing!

PS: Here’s just a quick word on using an insurance endowment policy, which is widely promoted by insurance agents to also help you save for your children’s education. It seems like a sure-thing – an almost guaranteed value at the time when you need the money, plus insurance cover to boot. However, the trade-off is that you will need to put in a higher amount of money, due to the lower risk instruments used to achieve the payout amount needed at maturity (the date when your child enrolls in university), as well as the high distribution cost of an insurance policy.

Also, you will be the one paying for the insurance cover, which is embedded in the policy premiums. There are definitely some merits to these plans for more risk-averse parents, provided they are also able to commit more money to getting the same outcome. In some cases, a combination of both an endowment plan and pure investment plan can also work together. It is thus best that you discuss these options with an adviser that is adept at both solutions to get an unbiased recommendation.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.