Understand That Economic Numbers and Market Returns Are Not Always Related

21 July 2017

The title of this post must have been quite eye-catching. But we felt that it would be appropriate to address this very important point. Yes, economic numbers definitely have some bearing on how the market performs – after all, GDP numbers, debt numbers, wage increases, consumer confidence, trade and fiscal policy all affect corporate earnings in some way, and in essence affect how investors value companies.

However, what appears related need not always be so. Bad economic numbers do not immediately mean bad stock market performance, and vice versa. We want investors to understand this important distinction: fundamental data tells us how the market should be acting, but everyday market movements – reflected in the prices of securities – tell us how the market is actually acting.

This leads us to one of the main tenets of Evidence Based Investing – the belief that markets are efficient.

Investors may find this hard to grasp, but it is very simple. They should accept that the price of securities at every second of every trading day is fair. Whether the price is irrational or not is not a discussion for the efficient market hypothesis.

The fact that the buyer and seller of the security have come to an agreement is a testament that both parties have found it reasonable enough for them to transact. Different investors would have different expectations and estimates on the future prospects of a company, so it is natural that there will be differing views on the expected return of the security. That is the beauty of the markets: all these differing views come together to transact in a open marketplace, and eventually settle on a fair price.

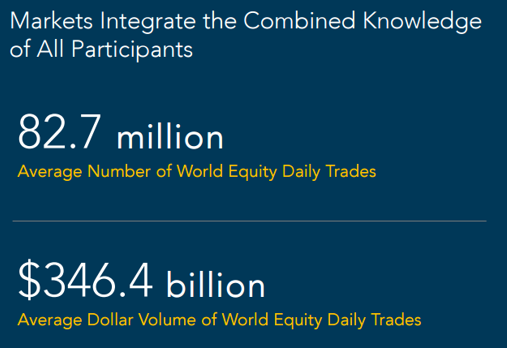

The chart below shows the average daily number of trades and the value of the daily trades for 2016. That is a staggering number of transactions. If someone believed in the conventional way of investing and thought that they had information that would allow them to get an edge over the rest, they should reconsider. It would mean that the investor had something very special that the other 82 million investors in the marketplace somehow did not have.

Source: Dimensional Fund Advisors

The other point of using economic data to create an investment strategy is that economic data is typically lagging, and subject to revisions. If we believe that markets are forward-looking, digest information quickly and are efficient, it is likely that market participants will be trying to price in good or bad economic data way in advance of the release. In essence, usually once the economic numbers have been published, this data is likely to have been priced into securities already.

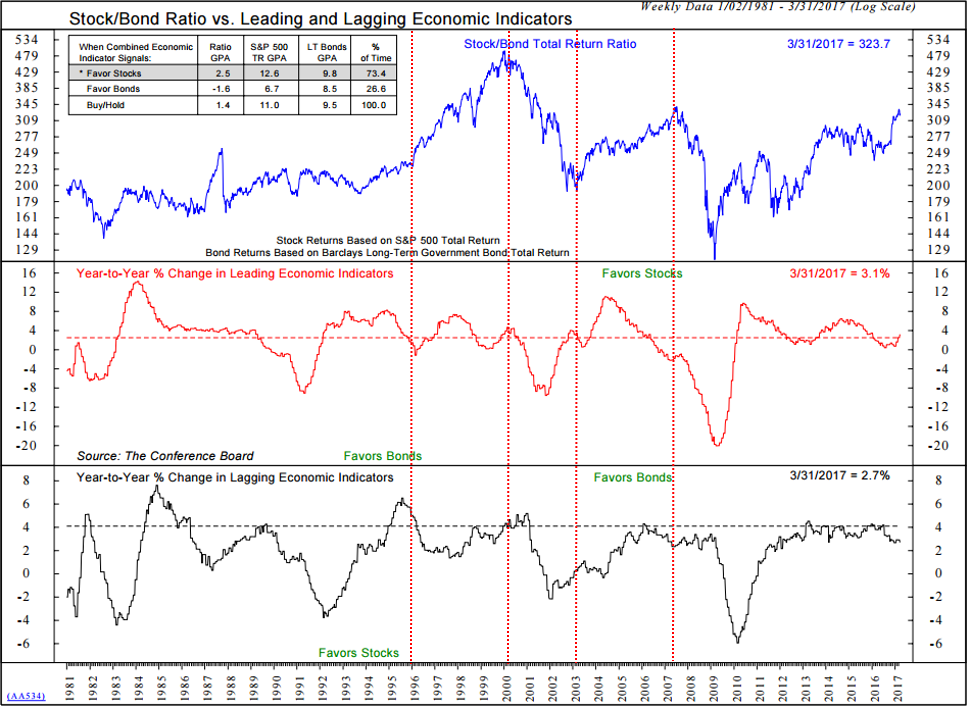

A simple look at the chart below on the performance of stocks vs bonds in correlation with leading/lagging economic releases shows this to be true in quite a number of instances. Typically, the market would already be on its upward or downward trajectory even before the economic numbers have highlighted anything.

Source: Ned Davis Research

This just brings us to our final point. In both good and bad times for the economy, investors (whose differing views are reflected in market prices) are constantly trying to estimate their expected returns in securities based on the data released. What happens at the end of the trading day is that the stock (and bond) markets will reflect that view.

When there is high uncertainty, and many people do not know what is happening, expect markets to be turbulent and volatile. The swinging prices just show that investors are trying to price in this event and typically would want to be compensated more for any risk they are taking in investing. Once uncertainty subsides and the data turns out to be more positive than initially thought, expect positive movements in the market. If the data turns out to be more poor, then expect a negative movement.

The key thing here is that it is very difficult to predict or forecast what would happen to prices the following day, so the best approach would be to be broadly diversified, and hold the most efficient portfolio (optimised for maximum return for every amount of risk you take).

So, the next time you read a report on possible economic gloom, rest assured that markets would have already anticipated this and reflected it in prices. As we highlighted in a previous article, markets go up nearly 70% of the time, so invest and be happy that you would always get a positive return in the long run.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.