The Market Works In Cycles

25 February 2017

Many investors or potential investors we meet assume that once they put their money to work, they are guaranteed a return. Unfortunately, that is not how investing works. You get a return on your capital for taking a risk on owning shares of companies, or lending them money to generate economic advantages.

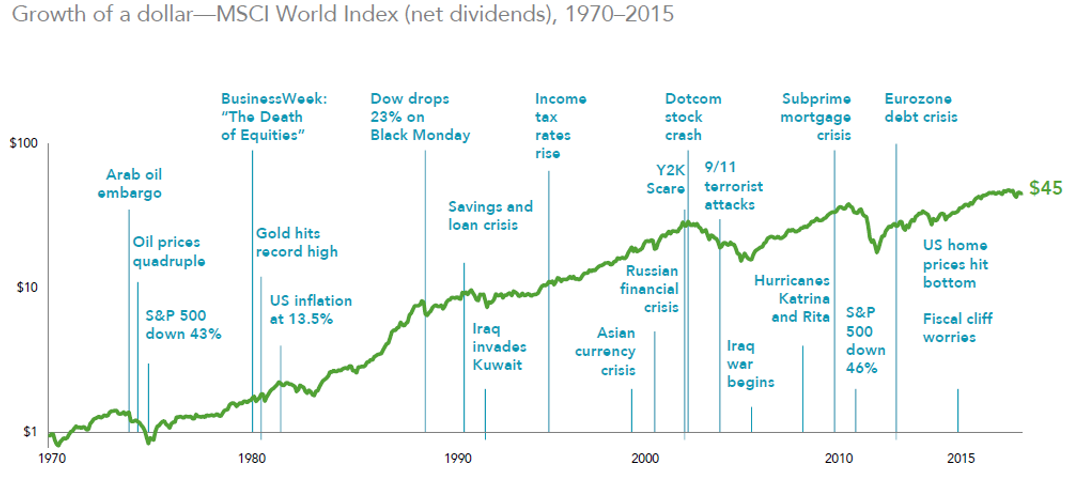

The market, being liquid and traded daily with millions of shares changing hands and affecting the price, also gets affected by investor sentiment and the economic cycle. As the global economy goes into recession, as the world gets hit with political problems, war and conflicts, commodity problems, the stock market prices in these risks accordingly. The chart below shows how investing a dollar into global equities in the 1970s would have turned out – it grew by 45 times. This is despite the world undergoing various turmoil over the years, from the Oil Crisis to Black Monday, the Gulf War, Dotcom Bubble, 9/11, the Mortgage Bubble, and the European crisis. The market has suffered serious sell-offs but has always recovered and subsequently gone higher.

Source: Dimensional Fund Advisors

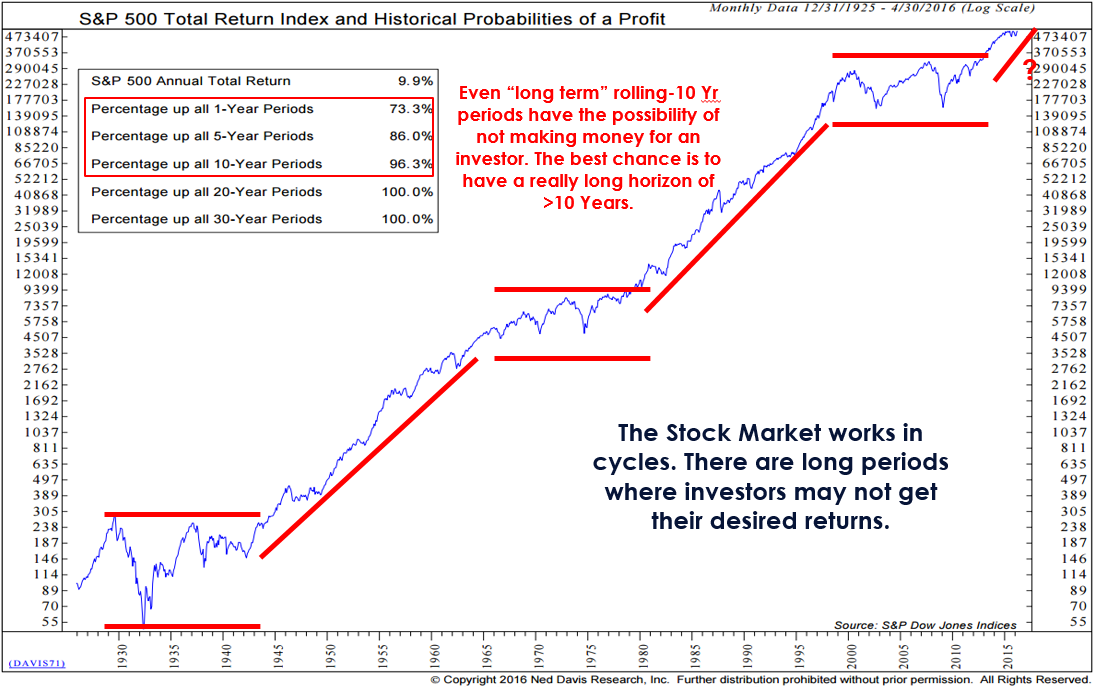

Analysing an even longer term chart on the stock market – in this instance, the US S&P 500 index, which has a long history – we can see that there have been many periods in the past where the market has gone sideways for many years. During these periods, it is very likely that investors would have gotten a 0% or even a negative return over 10-15 years! That is a very long time to leave money idle, with the most recent period being the 2000-2013 secular bear market.

Source: Ned Davis Research, Inc.

When you measure rolling periods, we can see that even when holding stocks for 10 years, despite a high probability of a positive return there is still a 3.7% chance that you would not make any money. It happened in the 1940’s and has just happened in the 2000’s. It is unfortunate that we had just lived through such a period. However, investors should be comforted that statistically, time is on their side if they stick to their gameplan and hold out for 20 or even 30 years – as the probability of a positive return for holding through such a long time is 100%.

It is very likely that investors during such painful times would have questioned whether the stock market had been broken and most likely would have lost faith and sold out at a loss. However, because the returns of the market are seemingly “random” with no one able to predict when there will be a strong upturn, it is much better to buy, and hold and only review your investments when your circumstances change. There is no benefit in checking the prices of securities every day, hour or minute and it will be better to relax without stress, with the knowledge and belief that markets have worked, and will still continue to work to your benefit.

#

If you have found this article useful and would like to schedule a complimentary session with one of our advisers, you can click the button below or email us at customercare@gyc.com.sg.

IMPORTANT NOTES: All rights reserved. The above article or post is strictly for information purposes and should not be construed as an offer or solicitation to deal in any product offered by GYC Financial Advisory. The above information or any portion thereof should not be reproduced, published, or used in any manner without the prior written consent of GYC. You may forward or share the link to the article or post to other persons using the share buttons above. Any projections, simulations or other forward-looking statements regarding future events or performance of the financial markets are not necessarily indicative of, and may differ from, actual events or results. Neither is past performance necessarily indicative of future performance. All forms of trading and investments carry risks, including losing your investment capital. You may wish to seek advice from a financial adviser before making a commitment to invest in any investment product. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product is suitable for you. Accordingly, neither GYC nor any of our directors, employees or Representatives can accept any liability whatsoever for any loss, whether direct or indirect, or consequential loss, that may arise from the use of information or opinions provided.